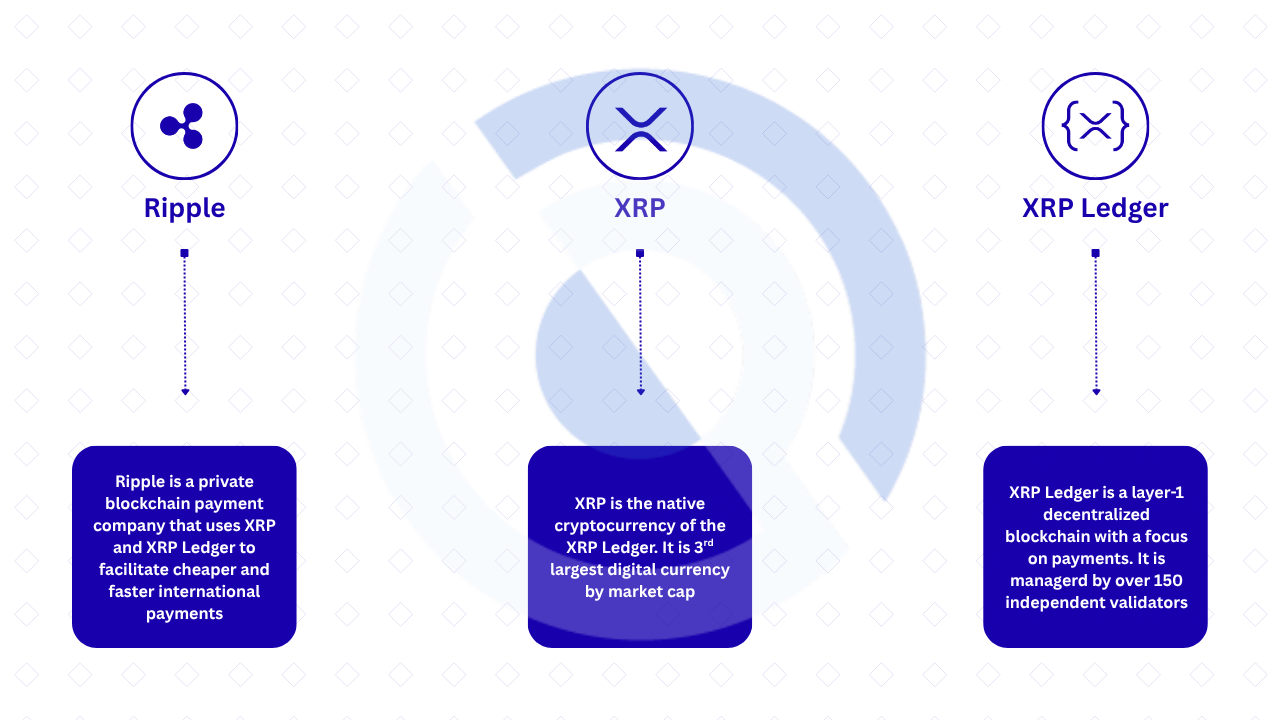

Most individuals have a tendency to think about XRP, or the third largest cryptocurrency, as Ripple. Though Ripple, XRP and the XRP Ledger are tied collectively underneath an ecosystem, they’re utterly various things meant to play totally different roles.

“Let me be clear: Ripple is totally different than XRP.” Ripple’s present CEO Brad Garlinghouse made this very assertion in 2022, establishing the distinction.

In a nutshell, the easiest way to consider that is to have a look at Ripple as an organization, XRP as a coin, and the XRP Ledger as a blockchain. Nonetheless, not many individuals appear to know this as they’ve been exchanging one another for over 10 years.

This confusion stems from the early levels of the undertaking, when the branding was deliberately in depth. Let’s speak extra about it.

Why is there confusion?

The early branding and historic mislabeling of Ripple, XRP, and the XRP Ledger are two main components that contributed to this confusion that also exists at this time.

Ripple, XRP and XRP Ledger are sometimes used interchangeably

The XRP Ledger was first introduced in 2012 because the Ripple Consensus Ledger. On the time, the community, protocol, and even the native cryptocurrency XRP had been all branded “Ripple.” Many continued this unified branding and referred to the ledger and XRP as Ripple.

The state of affairs grew to become even worse after non-public corporations had been established. The corporate was initially referred to as NewCoin however was later rebranded to Ripple.

Though Ripple claims to be a separate ledger, the perceived connection between the corporate and the coin has led individuals to make use of phrases equivalent to “Ripple blockchain” and “Ripple coin” when referring to XRP.

Historical past of misrepresentation in media and exchanges

Cryptocurrency exchanges and media contributed to the false place of traders mislabeling Ripple, XRP, and the XRP Ledger.

The media over-connected XRP and Ripple, with some individuals routinely writing headlines equivalent to “Ripple value exceeded $3 at this time” as a substitute of “XRP value exceeded $3 at this time.” In Might 2021, Brad Garlinghouse corrected this after CNBC listed “Ripple” on the high of its cryptocurrency rankings and referred to as the bounce in XRP value a “Ripple rally.”

“Thanks (Joe Kernen) and (Andrew Ross Sorkin) for speaking about Ripple’s traction, the distinction between Ripple and XRP, and the necessity for regulatory readability. Concerning your second level…I’ve corrected your graphic,” Garlinghouse wrote.

Kraken, Binance, and plenty of different crypto exchanges had been additionally responsible of misrepresenting XRP and Ripple. In 2022, former FOX enterprise journalist Eleanor Tellet labeled XRPL the “Ripple Community” and criticized Kraken for itemizing XRP underneath the “Ripple” header.

Now that we all know what triggered the confusion, allow us to clarify how XRP, Ripple, and the XRP Ledger are totally different from one another.

What’s Ripple?

Ripple is a non-public blockchain firm that can oversee use case growth and adoption of the XRP Ledger. Though Ripple holds the vast majority of its XRP provide in escrow, the corporate stays structurally impartial from XRP or the XRP Ledger.

Overview of Ripple Labs

Ripple Labs was began as NewCoin in September 2012 by Chris Larsen, Jed McCaleb, David Schwartz, and Arthur Britto.

Shortly after its founding, the corporate was rebranded between 2012 and 2015 as OpenCoin, then Ripple Labs, after which shortened to Ripple.

The founders based Ripple to offer a greater various to the normal banking system. Utilizing the XRP and XRPL networks, now you can settle cross-border funds in 3-5 seconds with near-zero price charges. Due to this fact, Ripple is principally the first consumer on the community that goals to introduce use circumstances for the XRP Ledger.

As an incentive to do that, Ripple was given 80% (or 80 billion) of the whole provide of XRP to fund cost options, present liquidity, and supply a seed market by means of partnerships, all with the purpose of selling the XRPL community.

RippleNet and cost options

RippleNet is Ripple’s various to conventional cost networks like SWIFT. RippleNet itself will not be a blockchain. Relatively, it leverages the XRP Ledger and XRP cash to offer quicker and cheaper transactions throughout borders.

As of October 2025, greater than 300 monetary establishments are reported to be collaborating in RippleNet, together with SBI Holdings, Financial institution of Japan, American Categorical, Normal Chartered, Santander within the UK and Spain, and Commonwealth Financial institution of Australia.

The community processed a whopping $1.3 trillion per quarter in Q2 2025 alone.

Apart from RippleNet, the corporate additionally presents different merchandise equivalent to on-demand liquidity (ODL), Ripple CBDC platform, and RLUSD stablecoin.

Ripple’s organizational partnerships

Ripple has many partnerships with the world’s largest monetary establishments, banks, custodians, and fintech suppliers to make the most of its providers.

As talked about earlier, SBI Holdings, Normal Chartered, and 300 different establishments are presently utilizing Ripplenet to settle cross-border funds.

In September 2025, Ripple partnered with Securitize to combine the just lately debuted greenback stablecoin RLUSD into the latter’s tokenization platform, permitting traders in BlackRock and VanEck’s tokenized cash market funds to redeem their holdings into RLUSD on demand.

Central banks equivalent to Georgia and Colombia additionally chosen Ripple as a know-how associate to supervise their 2023 CBDC pilots.

Ripple’s function in selling the unfold of XRP

Ripple has been instrumental within the institutional adoption of XRP and the XRP Ledger. Most of its providers are backed by cash and networks.

For instance, ODL makes use of XRP as a real-time bridge asset for worldwide funds. This is without doubt one of the main use circumstances for the XRP token.

The ODL service permits any associate who must convert their native forex to XRP to ship XRP over the community and immediately convert it to the vacation spot fiat forex (e.g. USD to XRP to GBP).

The corporate can also be dabbling in different areas equivalent to tokenization and institutional DeFi, all of that are offering additional traction for the XRPL community.

What’s XRP?

XRP refers back to the precise cryptocurrency that powers the XRP Ledger. It’s the base forex of the XRPL community, simply as ETH is the forex of Ethereum.

XRP as a digital asset

XRP was created particularly for quick, low-cost international monetary transactions. There are as much as 100 billion cash, all of which had been created (pre-mined) on the launch of the XRP Ledger. So, you could be questioning, how is provide managed?

Recall that roughly 80 billion XRP was allotted to Ripple to fund XRPL’s progress. Ripple has locked the vast majority of these cash into time-locked escrow to create predictability of provide available in the market.

Each month, 1 billion XRP is launched from escrow, however generally not all cash make it to market. Unused tokens will likely be locked in escrow for a later date.

In response to knowledge from CoinMarketCap, there’s presently solely about 59.8 billion XRP in circulation.

Utilization instance

XRP instantly addresses the most important issues in worldwide cost methods. It’s now utilized by many establishments to course of cross-border funds shortly and cost-effectively, which is a giant drawback with conventional methods like SWIFT.

The third largest cryptocurrency has made it straightforward for monetary establishments to entry liquidity in seconds by means of Ripple’s ODL. Beforehand, if banks needed to course of worldwide funds, they first needed to pre-fund their Nostro and Vostro accounts in varied foreign currency to boost liquidity.

ODL removes this want through the use of XRP as a bridge forex. On this case, the cash is first transformed to XRP, transferred in seconds, after which transformed to the recipient’s native forex.

Like different cryptocurrencies, XRP can also be used for cash transfers. That is because of the distinctive properties of blockchain that allow quicker and cheaper funds in comparison with conventional suppliers equivalent to Western Union.

XRP pace and value benefits

XRP transactions are processed inside 3-5 seconds and value a minimal of 0.00001 XRP. That is equal to $0.0000297 at present costs. However, transfers by way of conventional methods equivalent to SWIFT can take as much as 3-5 enterprise days. Even Bitcoin transactions can take as much as 10 instances or extra to settle.

XRP’s pace and value benefits are primarily because of the XRP Ledger’s distinctive consensus mechanism that depends solely on an inventory of trusted validators to shortly affirm transactions. We are going to talk about this intimately later within the article.

Comparability of XRP and different cryptocurrencies

XRP is just like BTC, ETH, stablecoins, and different digital belongings in that it’s backed by a blockchain. Nonetheless, the aim is what units it aside.

Simply as BTC was created to allow peer-to-peer transactions with out a government, XRP’s main goal is to facilitate cross-border funds for monetary establishments shortly and at low price.

XRP has totally different pricing from stablecoins equivalent to USDT and USDC. Whereas the value of XRP is primarily pushed by provide and demand within the public market, stablecoins are pegged to an underlying asset or forex and due to this fact have a secure worth.

This is a fast have a look at how XRP compares to BTC and ETH when it comes to transaction goal, pace, and consensus mechanism.

What’s XRP Ledger?

The XRP Ledger is extra just like the engine that powers the XRP ecosystem. Each RippleNet and XRP are based mostly on the XRP Ledger. It was created by the identical founder as Ripple, however operates independently from Ripple.

XRP ledger fundamentals

The XRPL community is a decentralized, public, layer 1 blockchain. Which means that no single entity, even Ripple, can absolutely management the community. Anybody can select to turn out to be a validator on the community from anyplace on the earth.

XRPL is open supply. Meaning anybody can examine, modify, and construct on it. Construct good contracts and decentralized purposes (dApps) on the community.

The XRP Ledger additionally now helps Ethereum Digital Machine (EVM) by way of a sidechain launched in June 2025. This implies any Ethereum dApps can run on XRPL by way of a layer 2 blockchain. Within the first week alone, over 1,400 good contracts had been deployed on the sidechain.

consensus mechanism

As talked about earlier, the XRP Ledger makes use of a proprietary consensus mechanism referred to as the XRP Ledger Consensus Protocol. Because of this transactions on the community full inside 3-5 seconds, and why you possibly can’t mine XRP like BTC or stake XRP within the conventional sense like ETH or SOL.

The protocol is predicated on a Byzantine fault-tolerant consensus mechanism, which ensures that XRPL continues to function accurately even when a validator fails or behaves maliciously.

There are roughly 150 validator nodes on the XRPL community, operated by Ripple and establishments equivalent to universities, exchanges, and impartial operators. Each validator on the community has an inventory of different validators that it may well belief to not behave maliciously. That is referred to as the Distinctive Node Checklist (UNL).

As soon as a transaction is made, a validator collects it and shares it with UNL. It should solely be validated if at the very least 80% of the validators’ UNL approve it. Apparently, this complete course of takes place inside 3-5 seconds.

Good contracts and tokenization options

With the just lately launched XRP EVM sidechain, anybody can now deploy Ethereum-compatible good contracts and dApps to the XRP Ledger.

Aside from that, XRPL can natively assist light-weight good contract programmability on the protocol degree by means of what are referred to as “hooks.”

Presently, XRPL doesn’t natively assist Turing-complete good contracts, so all of the heavyweight dApps seen on Ethereum, equivalent to Uniswap and Aave, can’t be constructed instantly on high of XRPL, however may be constructed by means of sidechains.

However, tokenization may be very potential with XRPL. Supported natively on the ledger, there isn’t a must deploy customized good contracts.

Environmental and effectivity advantages

Bitcoin’s Proof-of-Work consensus mechanism has lengthy been the topic of criticism as a result of mining new cash is energy-intensive. The XRP Ledger averted this drawback by selecting to make use of federated consensus, which doesn’t require mining.

It’s no exaggeration to say that XRPL is extra environmentally pleasant and scalable than Bitcoin. This ledger processes as much as 1,500 transactions per second with near-zero charges.

How Ripple, XRP, and XRP Ledger work collectively

By now, it must be clear what the distinction is between Ripple and XRP, and the way every works collectively throughout the community. Ripple is selling the adoption of XRPL by leveraging XRP and blockchain in its merchandise. XRP serves as the bottom forex on the XRPL community, powering all transactions.

Ripple makes use of XRP and XRPL in cost options

RippleNet is an instance of how Ripple makes use of the XRP and XRPL networks in its cost options. RippleNet leverages the XRP Ledger to allow real-time messaging, clearing, and settlement of cross-border monetary transactions, a lot quicker and cheaper than conventional alternate options.

Ripple additionally makes use of XRP as a bridge forex in its on-demand liquidity service, which eliminates the necessity for banks to pre-fund accounts in several native currencies simply to facilitate worldwide funds.

Impartial builders constructing XRPL past Ripple

Ripple will not be the one developer transport merchandise on XRPL. There are additionally different purposes launched on the community by impartial builders. Listed here are some examples:

1.xrp.Cafe

xrp.cafe is each an NFT market and a launch pad for the XRPL ecosystem, permitting anybody to purchase, promote, and mint NFTs on the XRP Ledger. The developer additionally created “First Ledger,” a Telegram-based buying and selling bot for XRPL.

2. Zaman Pockets

Xaman is main the self-custodial crypto pockets for the XRPL ecosystem. It was particularly designed to assist customers handle their digital belongings on the XRP Ledger.

3. Sologenic

Sologenic is an XRP Ledger-based platform that goals to bridge conventional monetary markets to cryptocurrencies. The platform permits customers to commerce tokenized shares and ETFs utilizing XRP.

4. Apex protocol

Vertex Protocol is a decentralized alternate for buying and selling on-chain tokens. Initially launched on Arbitrum, it was later deployed to the XRP Ledger by way of a sidechain.

Authorized and regulatory implications

There was some impression on the partnership and fraudulent show between XRP, Ripple, and the XRP Ledger.

Ripple’s important contributions to the community, together with a whopping 80 billion XRP acquired from its founders, stay a degree of rivalry for a lot of crypto commentators relating to the declare that the XRP ledger is “decentralized.”

Some argue {that a} single entity, particularly a business firm like Ripple, with such a big allocation would have an excessive amount of affect over the XRP market.

On the regulatory aspect, the alternate of XRP and Ripple has given rise to false reviews that patrons are buying the Ripple firm reasonably than the XRP coin. This shaped a part of the U.S. Securities and Trade Fee’s (SEC) claims in opposition to Ripple in a virtually five-year authorized battle.

The SEC argued that Ripple was providing unregistered securities by promoting XRP, arguing that XRP was a safety as a result of its worth was tied to the corporate’s efforts.

Widespread misconceptions about Ripple and XRP

The shared historical past between XRP, Ripple, and the XRP Ledger has led to sure misconceptions. Let’s get the details straight.

Ripple doesn’t personal the XRP ledger

Ripple and XRP Ledger might have been created by the identical founder, however they function independently of one another. Even when Ripple ceased to exist at this time, the community would proceed to function because it at all times has.

The reason being that the community is managed by a community of impartial validators. Ripple additionally operates validator nodes, however they’ve the identical rights and management as different individuals.

XRP isn’t just a “Ripple coin”

It’s fallacious to name XRP a Ripple coin as a result of Ripple doesn’t difficulty XRP. The corporate doesn’t personal the digital forex itself.

XRP was issued natively to the XRP Ledger to pay transaction charges and as a “bridge forex” to facilitate fast and low-cost funds throughout borders.

XRP Ledger is managed by impartial validators

Many thought that Ripple would preserve XRPL solely and its validators would act as company nodes. Nonetheless, as talked about earlier than, Ripple is simply a participant within the community and has no particular privileges.

The community is maintained by a decentralized community of over 150 validators operated by impartial organizations equivalent to universities (equivalent to MIT), cryptocurrency exchanges, and neighborhood members.

XRP Ledger use circumstances past Ripple

The XRP Ledger can present extra than simply Ripple and its providers. Blockchain has many native options that allow different use circumstances.

Micropayments and cross-border remittances

Ripple’s capability to supply quicker and cheaper cross-border funds with its providers will not be its personal privilege.

In reality, that performance is an inherent technical property of the XRPL community. This implies anybody, anyplace can resolve to make use of XRPL to construct a equally environment friendly platform for micropayments and cross-border transactions.

Central financial institution digital forex (CBDC) pilot

The XRP Ledger can be used to difficulty and handle central financial institution digital currencies.

Ripple itself has additionally confirmed this by launching its personal non-public community based mostly on XRPL. There, the central financial institution has full management and sovereignty to discover and pilot CBDC tasks.

NFTs and tokenization in XRPL

In the event you keep in mind, we talked about earlier that the XRP Ledger natively helps asset tokenization. That is a giant use case. You possibly can simply leverage the community to mint, commerce, and write quite a lot of tokenized belongings, together with non-fungible tokens and real-world belongings.

The way forward for Ripple, XRP and the XRP Ledger

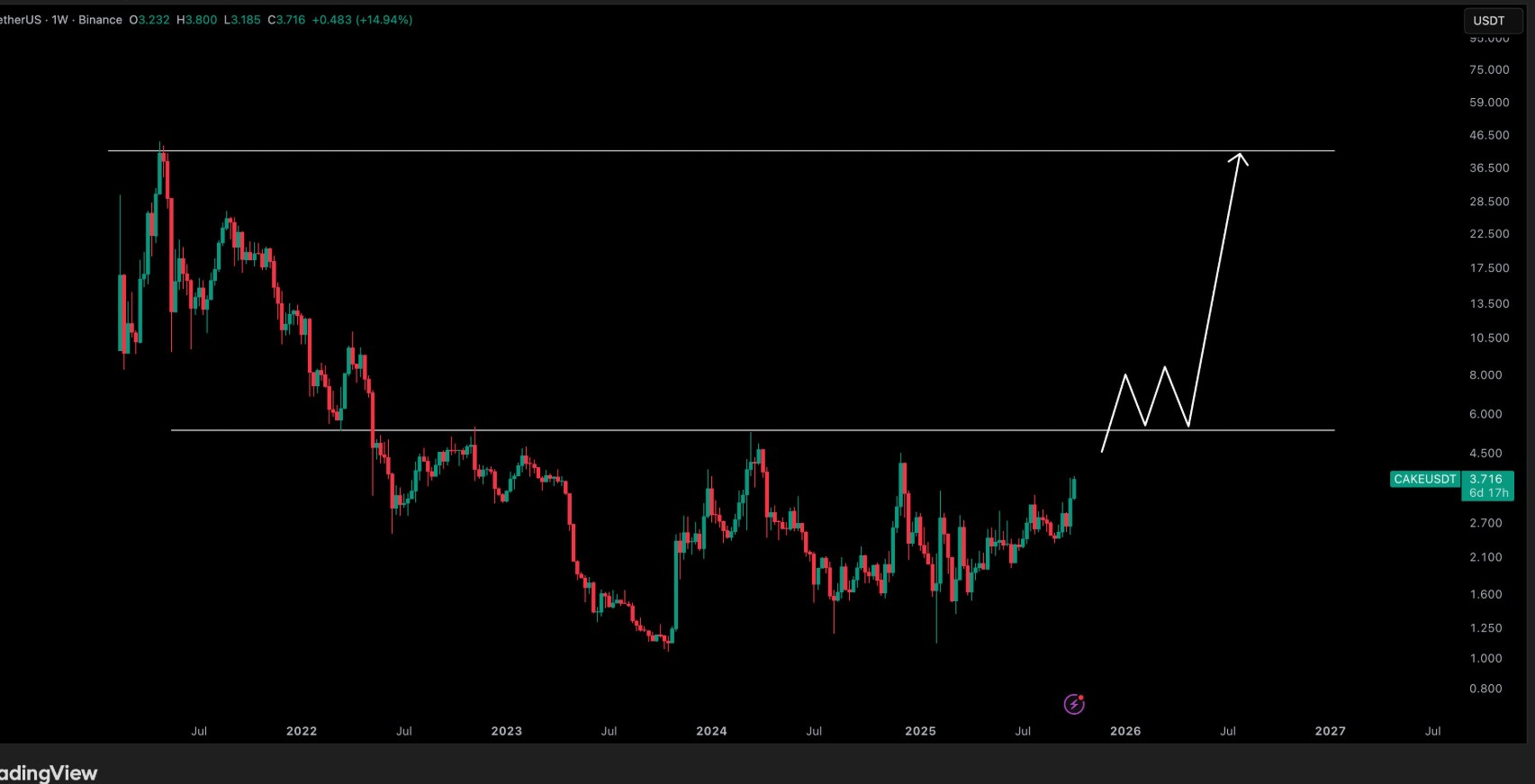

The decision of the long-running authorized battle between Ripple and the SEC is a serious victory for the way forward for Ripple, XRP, and the whole community.

When the SEC sued Ripple in 2020, we noticed the way it affected the value of Ripple and XRP. Nonetheless, when each events lastly filed for dismissal of the lawsuit in August 2025, the outlook grew to become bullish, and XRP’s value mirrored that.

With that uncertainty eliminated, progress is anticipated throughout key sectors.

Prospects for institutional adoptions

Following the information that Ripple has ended its lawsuit with the SEC, the corporate was in a position to rent extra institutional companions, together with BNY Mellon. Maybe it supplies a glimpse into the potential of additional institutional implementation sooner or later.

Authorized readability and regulation in 2025

There’s now some readability that XRP doesn’t qualify as a safety, paving the best way for XRP spot ETFs and institutional traders, which is wholesome for the value of XRP. We count on to see extra ETF launches and XRP digital asset treasury corporations sooner or later.

XRPL enlargement and developer ecosystem

All issues thought of, it is not laborious to see the XRPL ecosystem increasing from right here, particularly with the launch of the EVM sidechain that bridges Ethereum and the XRP Ledger. We are able to count on an inflow of liquidity into the XRPL ecosystem.