Bitcoin miners are operating out of respiratory room.

Within the wake of the $19 billion market collapse, carriers have begun transferring giant quantities of Bitcoin to exchanges, a traditional signal of mounting promoting stress.

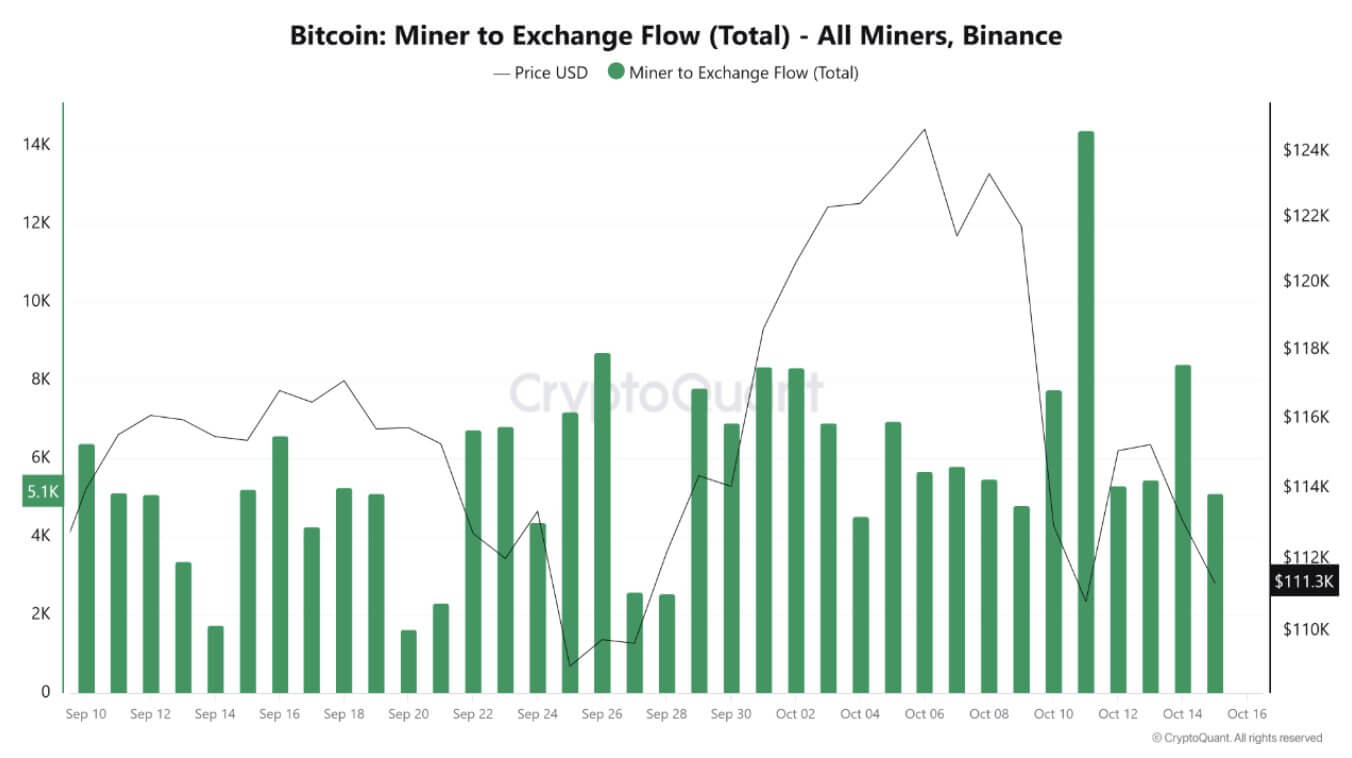

In response to CryptoQuant knowledge, between October ninth and October fifteenth, mining wallets transferred 51,000 BTC (equal to over $5.6 billion) to Binance alone. The utmost every day switch was over 14,000 BTC on October eleventh, the biggest miner deposit since July 2024.

promote reserves

Such spikes not often happen in isolation. These sometimes seem when miners want liquidity to cowl rising prices or hedge towards value fluctuations.

Analysts view these actions as on-chain bearish alerts, indicating that miners are rising from a long-term accumulation section and getting ready to promote.

Blockchain researcher ArabChain defined that giant transfers from miner wallets often point out preparation for direct liquidation or collateralized borrowing.

In response to researchers,

“Generally, miners may even deposit cash for use as collateral for spinoff contracts or financing functions. In some circumstances, these deposits are merely technical reallocations, i.e., transfers between wallets related to mining entities and buying and selling platforms for regulatory or operational causes.”

This alteration in habits marks a tipping level for the trade. For a lot of this yr, miners have been constantly accumulating web price and benefiting from post-halving shortage to drive up costs.

Nonetheless, it’s now experiencing the other response, with shrinking revenue margins and intensifying community difficulties leading to decrease margins.

More durable race to every block

Bitcoin mining issue, which measures how troublesome it’s to seek out new blocks, peaked at greater than 150 trillion in September after seven consecutive constructive changes.

In response to Cloverpool knowledge, the newest epoch ending on block 919,296 ended up easing by 2.73%, offering momentary reduction after months of relentless upward stress.

Issue changes happen roughly each two weeks, recalibrating puzzles to carry blocks nearer to Bitcoin’s 10-minute aim.

A rise in issue signifies that extra machines are competing for rewards. A lower signifies {that a} weaker miner has powered down. Nonetheless, even the slight lower didn’t enhance profitability.

Hashprice, the return per terahash of computing energy, has fallen to about $45, the bottom since April, in accordance with the Hashrate Index.

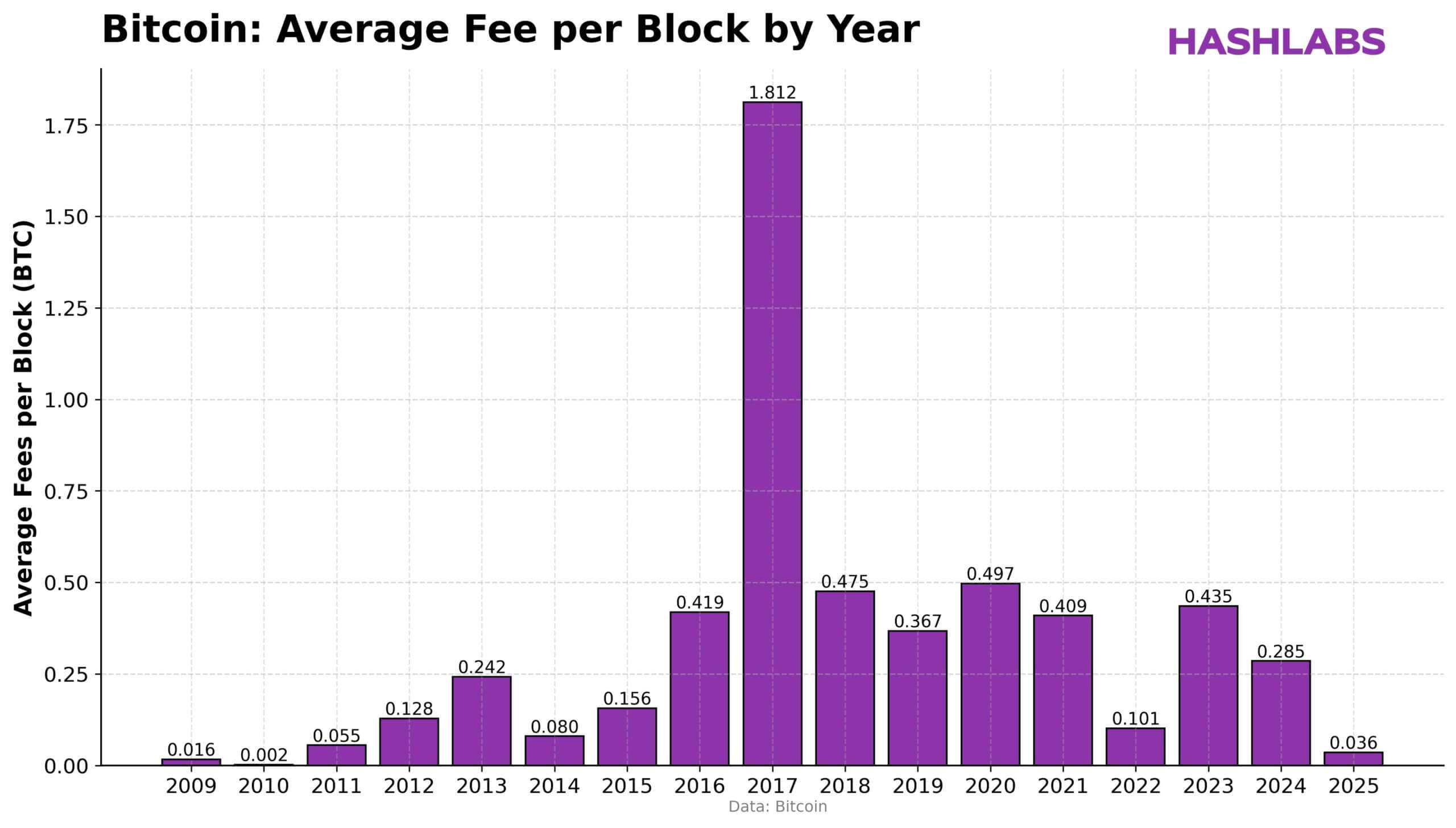

However, transaction charges, which ought to offset the decline in charges, have really risen. To this point in 2025, the common payment per block is 0.036 BTC, the bottom since 2010.

Bitcoin mining analyst Jaran Melelund stated:

“It’s paradoxical that so many Bitcoin miners fully ignore transaction charges. Nobody appears to even discuss transaction charges…In simply 10 years, these charges might be virtually the one supply of revenue.”

Since April’s Bitcoin halving decreased the block reward to three.125 BTC, miners are actually competing in a zero-sum setting the place everybody pays much less for each further terahash of energy.

Many small companies, particularly these working older and fewer environment friendly rigs, are already underwater.

AI gives a lifeline

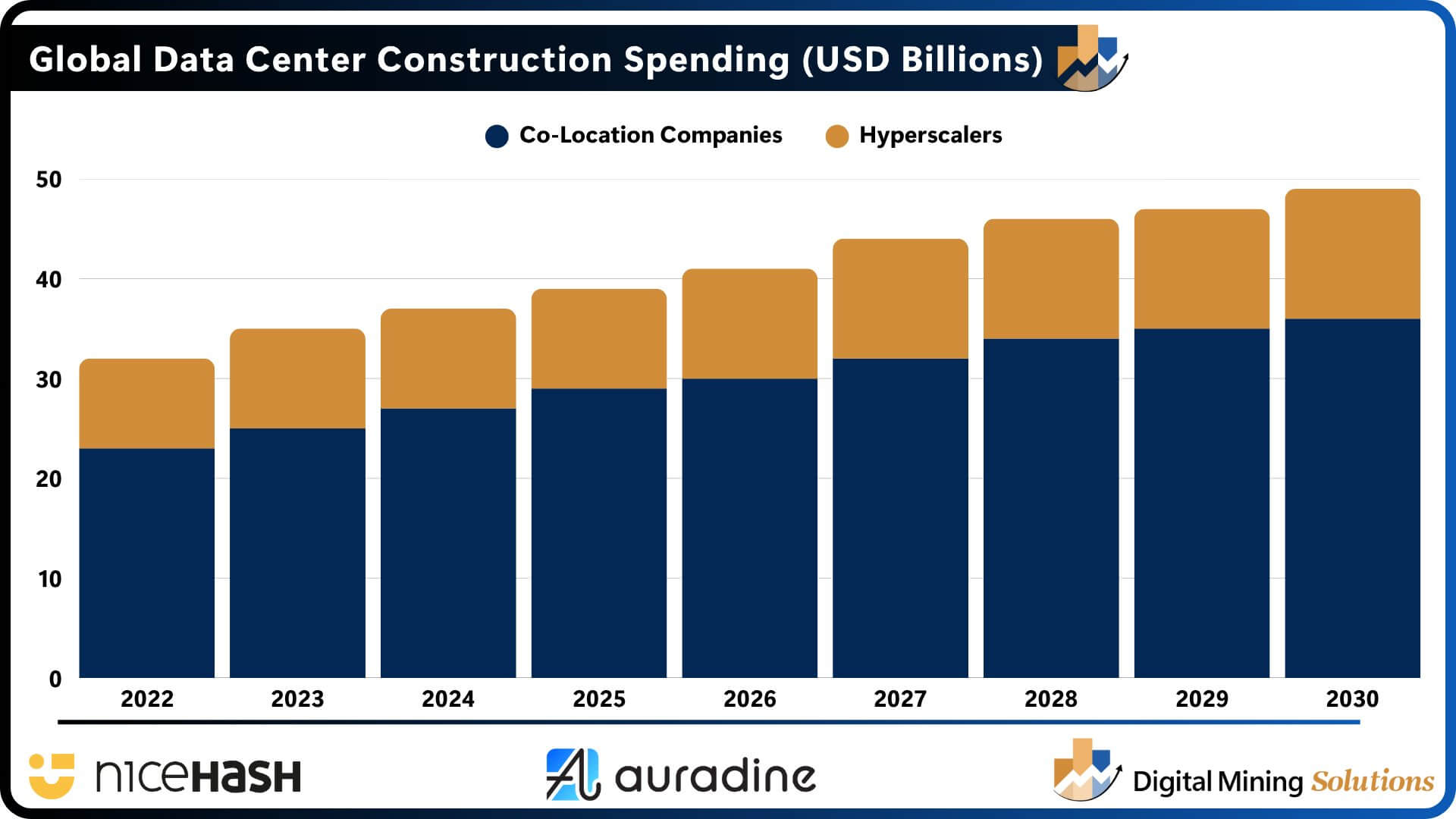

Going through razor-thin margins, main mining firms are discovering profitable options in AI and excessive efficiency computing (HPC) internet hosting.

Over the previous yr, firms like Core Scientific have been reconfiguring giant knowledge heart footprints which are already optimized for energy, cooling, and fiber connectivity to accommodate compute-intensive AI workloads.

Hashlabs reported {that a} 1 megawatt (MW) mining website working an environment friendly rig at roughly 20 Joules per Terahash (J/TH) may generate roughly $896,000 in annual Bitcoin income at a BTC value of $100,000.

Nonetheless, renting the identical MW to AI shoppers for compute-intensive workloads can generate as much as $1.46 million in steady contract-based income per yr.

Nico Smid, founding father of Digital Mining Options stated:

“The rise of AI and excessive efficiency computing (HPC) is remodeling the world’s computing panorama, and Bitcoin miners are feeling the consequences firsthand. What started as parallel industries now compete for a similar vital assets: energy, infrastructure, expertise, and capital.”

This shift doesn’t imply miners will abandon Bitcoin. As an alternative, they’re diversifying the identical infrastructure that when secured blockchain into the broader computing economic system.

In reality, miners can stay solvent by way of internet hosting contracts whereas ready for the subsequent cryptocurrency upcycle.

What it means for Bitcoin

Within the brief time period, it’s clear that miner gross sales are including stress to an already fragile market.

Traditionally, continued inflows from minor wallets have preceded intervals of consolidation or capitulation. However the long-term story may have even greater implications.

Bitcoin’s safety mannequin, which depends on constant hashpower incentives, may face structural adjustments if mining amenities proceed to remodel into hybrid AI and crypto knowledge facilities.

As profitability from pure block rewards declines, Bitcoin’s hashrate might turn into more and more depending on firms whose major enterprise is now not solely mining.

talked about on this article