Cash flowed into U.S. spot Bitcoin and Ether exchange-traded funds (ETFs) on Tuesday after Federal Reserve Chairman Jerome Powell hinted at the potential of additional rate of interest cuts earlier than the tip of the 12 months.

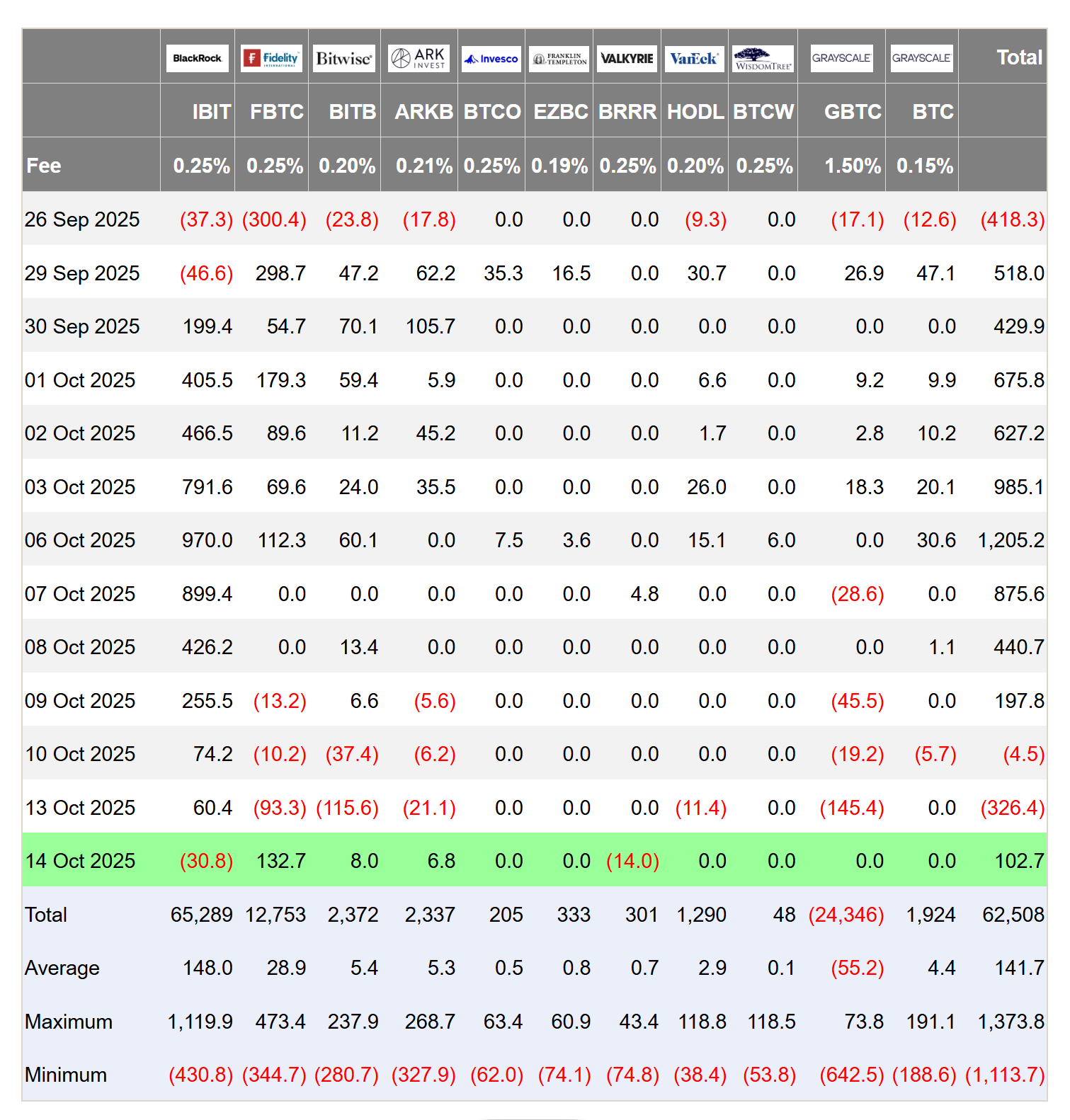

The Spot Bitcoin (BTC) ETF had internet inflows of $102.58 million, rebounding from the day before today’s outflows of $326 million, in accordance with knowledge from SoSoValue. Constancy’s Smart Origin Bitcoin Fund (FBTC) led the positive aspects with inflows of $132.67 million, whereas BlackRock’s iShares Bitcoin Belief (IBIT) recorded modest outflows of $30.79 million.

The whole internet belongings of all Spot Bitcoin ETFs reached $153.55 billion, accounting for six.82% of Bitcoin market capitalization, and the cumulative influx quantity reached $62.55 billion.

The Ether (ETH) ETF additionally mirrored the turnaround, recording internet inflows of $236.22 million following Monday’s important outflows of $428 million. Constancy’s Ethereum Fund (FETH) topped the record with $154.62 million, adopted by Grayscale’s Ethereum Fund (ETH) and Bitwise Ethereum ETF (ETHW) with $34.78 million and $13.27 million, respectively.

Spot Bitcoin ETF turns optimistic. sauce: father’s aspect

Associated: US spot Bitcoin and Ether ETF drops $755 million as crypto market crashes

Powell hints at additional charge cuts

Federal Reserve Chairman Jerome Powell signaled Tuesday that the U.S. central financial institution is nearing the tip of its steadiness sheet discount program and making ready for attainable rate of interest cuts because the labor market weakens.

Talking on the Nationwide Affiliation for Enterprise Economics convention, Powell mentioned reserves had been “barely above the extent” in step with ample liquidity and mentioned the Fed might quickly finish its “quantitative tightening” course of.

Vincent Liu, chief funding officer at Taiwan-based Cronos Analysis, informed Cointelegraph: “The speed reduce in October will drive the market away, and cryptocurrencies and ETFs will see an inflow of liquidity and exercise.”

“We count on digital belongings to really feel the upside as capital seeks effectivity in a softer rate of interest atmosphere,” he added.

Associated: Bitcoin ETF maintains ‘all-time’ momentum with $2.71 billion in weekly inflows

Crypto merchandise stay resilient regardless of latest crash

As Cointelegraph reported, CoinShares mentioned crypto funding merchandise confirmed sturdy resilience amid final week’s market turmoil, recording $3.17 billion in inflows regardless of an enormous flash crash brought on by renewed US-China tariffs.

CoinShares introduced on Monday that outflows had been solely $159 million, though final Friday’s panic induced $20 billion of positions to be liquidated throughout exchanges. Attributable to this resilience, complete inflows in 2025 will attain $48.7 billion, already exceeding final 12 months’s complete inflows.

“The easing of US-China tariff tensions and the renewed decline in commerce mirrored within the energy of gold are stimulating new demand for digital belongings,” Liu mentioned.

journal: EU’s privacy-destroying chat management invoice postponed, however the combat is not over