Nobody has a crystal ball, but when Bitcoin continues to behave in line with previous cycles, it is most likely already peaked.

Bitcoin hit an all-time excessive on October 6, however was unable to increase its features because the post-halving clock approached the height zone seen in earlier cycles.

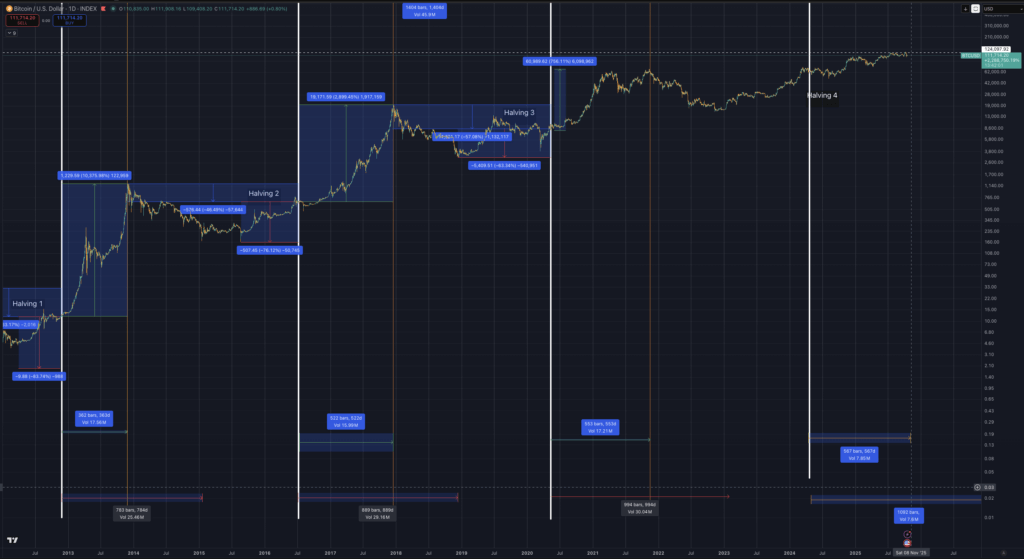

The 2024 halving will happen on April twentieth, with earlier peaks reached roughly 526 days after the 2016 halving and 546 days after the 2020 halving.

At this tempo, the present cycle peaks from roughly mid-October to late November.

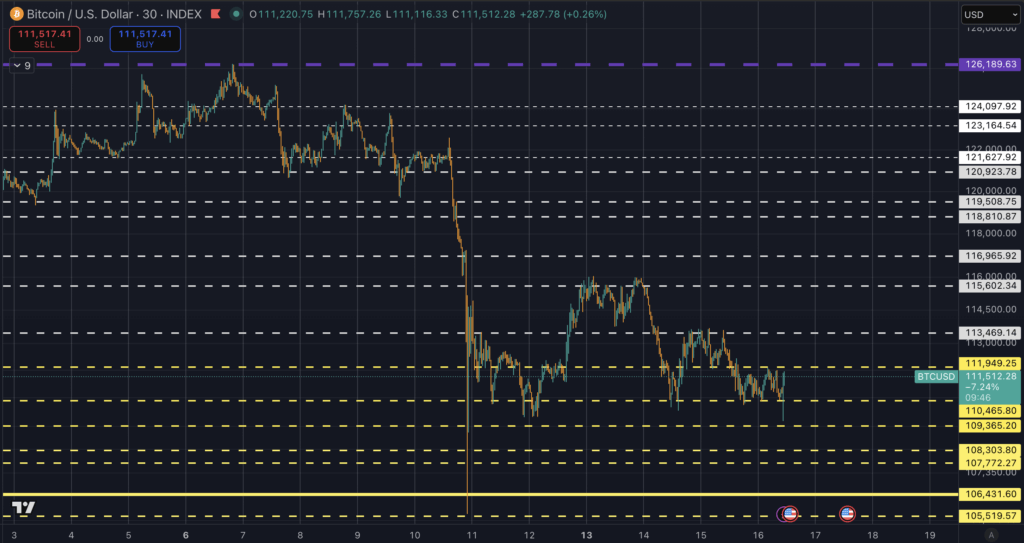

The inventory’s worth round $126,200 on October sixth has not been recovered, and spot buying and selling has moved between $105,000 and $114,000, with main help close to $108,000.

The timing case now intersects with clear macro shocks.

Since hitting document highs, the White Home has introduced new tariffs on Chinese language imports, together with imposing tariffs of as much as 100% on some merchandise. The headline despatched shockwaves by means of cryptocurrencies, as futures contracts deleveraged round $19 billion in liquidations inside 24 hours.

Spinoff positioning has modified as nicely, with elevated demand for draw back safety following a wipeout. Funding stress on the standard facet flickered as Reuters reported an uncommon spike in using the Federal Reserve’s standing repo facility, an indication that short-term greenback funding is tightening in the identical window.

Flowtape will stay because the interim arbitrator. The US Spot Bitcoin Change Traded Fund has been performing as a marginal purchaser on this cycle. Farside Traders integrates and publishes day by day creations and redemptions, which makes it simple to learn whether or not money is coming into or exiting the wrapper.

Context for weekly capital flows is supplied by CoinShares, which tracks a broader vary of digital asset merchandise. Broad internet inflows over a number of periods would go away the door open for late-cycle marginal highs.

The unstable adverse growth will strengthen the view that October sixth marked the highest of the cycle.

A situation framework helps translate these inputs into costs and instances.

Bitcoin’s historic bear market lasted about 12 to 18 months, with a peak-to-trough drop of about 57% in 2018 and 76% in 2014, a sample demonstrated by NYDIG.

Because the present market construction contains spot ETFs and deeper derivatives markets, a lighter vary of 35-55% is an affordable benchmark for draw back danger administration. Making use of it to $126,272 produces a trough zone of roughly $82,000 to $57,000.

That schedule would roughly match the tempo of the halving referenced above, with costs hitting a low someplace in late 2026 to early 2027.

If the timing, macros, and stream are all leaning in the identical course, the chance that the highest is already there’s excessive. The halved clock is delayed inside regular limits.

The tariff shock created uncertainty in the actual economic system and a visual danger premium in derivatives. Tight greenback liquidity has led to a surge in using repo services.

Bitcoin worth has did not maintain above its early October excessive and is at present buying and selling beneath its preliminary help. The burden of proof is on demand, however ETF tapes are the cleanest on a regular basis instrument.

Whereas some argue that the standard Bitcoin cycle ended with the launch of ETFs, new demand has by no means ended previous cycle patterns. Are we actually going to do it now?

Up to now, every Bitcoin cycle has seen diminishing returns. If $126,000 is certainly the height of this cycle, you’ll have made an 82% revenue.

The primary decline (cycle 1→2) decreased returns by as much as 57%.

The subsequent drop (cycle 2→3) confirmed an extra lower of roughly 84%.

If this fee of decay had continued proportionately (roughly 70-80% lower per cycle), the anticipated return would have been roughly 50-70% as an alternative of 82%.

Due to this fact, the potential 82% achieve already reveals a small decay in comparison with the exponential decay sample implied in earlier cycles.

The relative returns for this cycle are above development, which can counsel that though it is a prime, the cycle is maturing however nonetheless resilient.

Though historic returns present a transparent decay curve, the potential 82% rise on this cycle barely breaks the anticipated downward slope, suggesting both the onset of a extra gradual decay part or structural adjustments (e.g., ETF demand, institutional capital) that reasonable the long-term development of diminishing returns.

Within the reverse case, a selected sequence is required.

5 to 10 consecutive days of widespread internet additions throughout the ETF advanced would point out sustained demand for money.

Choices skew must pivot in direction of greater than a short lived pullback, a change that third-party dashboards comparable to Laevitas are displaying.

The spot ought to then clear and maintain above $126,272 with growing quantity.

This path may see a slight new excessive within the $135,000 to $155,000 space earlier than circulation resumes, a sample that was repeated in our previous cycle commentary.

If this case doesn’t develop by the tip of the standard 518-580 day interval, time itself will turn into a headwind.

Miner provides one other ahead queue. After the halving, income per unit of hash has been compressed, and the spring surge has eased payment shares, tightening money stream for older fleets. Financial circumstances and fleet turnover dynamics are adopted by the hashrate index.

If costs decline whereas power prices stay robust, miners could periodically promote to cowl working prices and repair obligations. This provide tends to undergo from skinny orders after shocks. On-chain ranking bands comparable to MVRV and MVRV-Z might help body late-cycle danger, however shouldn’t be used alone as absolutely the thresholds fluctuate from cycle to cycle.

Macro has its personal scoreboard.

The greenback’s efficiency interacts with danger urge for food, and the Reuters Foreign money Wrap gives an replace on its relative power. Rate of interest expectations are tracked by CME FedWatch and might help interpret whether or not tariff shocks and subsequent inflationary pressures are altering the course of coverage.

If easing expectations decline whereas repo services proceed to rise, liquidity in speculative property could proceed to be constrained.

Readers can monitor the framework utilizing the desk beneath.

Leverage profile requires persistence. As an alternative of chasing upside, merchants added draw back hedges after the tariff shock. That is in keeping with the market focusing extra on capital preservation than momentum.

If ETF inflows do not resume quickly, sellers can hedge in opposition to the flows from put purchases, limiting the market’s rally. The tape requires day by day consideration because the construction can change quickly as soon as influx resumes.

None of this reductions the structural bid for Bitcoin created by the ETF wrapper or the long-term results of mounted provide. This maps out a late-cycle setup that’s at present driving macro stress. The halving timer is nearing the tip of its historic interval.

The excessive worth on October sixth is the highest worth. The distribution case stays simpler to learn till the stream adjustments the steadiness.

talked about on this article