Consumers who picked up gold bars at Costco (NASDAQ:COST) in 2023 are actually reaping strong earnings as the dear metallic continues to hit new all-time highs.

When the corporate first began promoting one-ounce gold bars in mid-2023, every priced at about $1,900, they bought out virtually immediately.

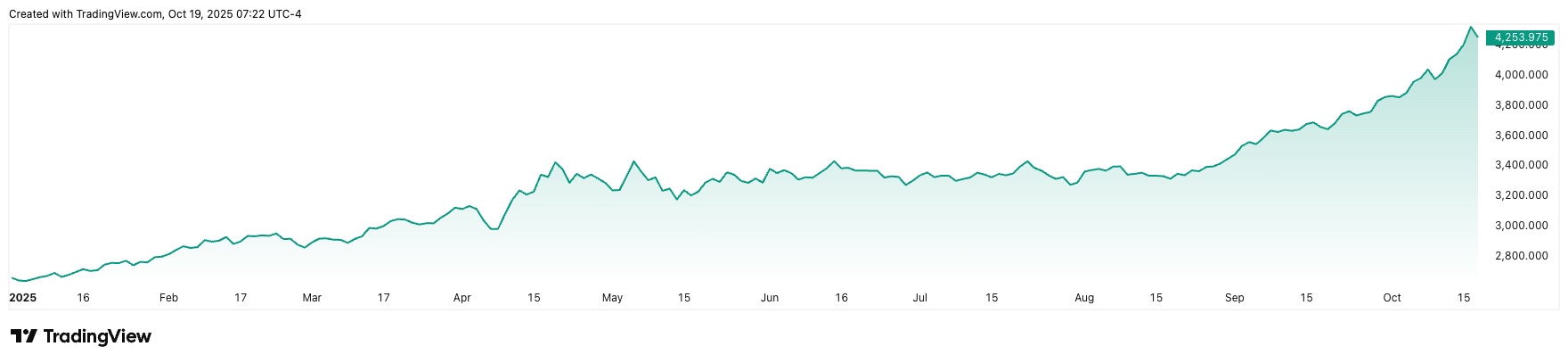

These identical bars are actually value about $4,253, that means early patrons greater than doubled their cash in lower than two years.

That is a return of about 124%, far outpacing the general inventory market efficiency over the identical interval. The yellow metallic has additionally risen greater than 60% year-to-date.

Rising urge for food for gold

On the identical time, Costco’s gold gross sales have since skyrocketed to almost $200 million monthly, indicating a rising urge for food for proudly owning bodily gold.

Nevertheless, affordability has decreased considerably. To this finish, the next insights might be shared: wall avenue engine Present analysis exhibits that it takes the common American employee about 116 hours of labor to purchase one ounce of gold, the very best degree in a minimum of a century.

This determine has doubled in simply 18 months, highlighting how gold costs are outpacing wage development.

Gold’s share of world investable property has additionally risen, rising from 4% to six% up to now two years, its highest degree since 1986.

In the course of the 1980 gold bubble, that proportion reached 22%, when entry to funding markets was rather more restricted.

The current momentum particularly has been fueled by buyers dashing into safe-haven property amid issues a couple of potential financial downturn attributable to components akin to tariffs, inflationary pressures and a cooling labor market.

Featured picture through Shutterstock