Ethereum developer Federico Carone mentioned the rising affect of firms corresponding to Paradigm on the community could possibly be a “tail danger” to the Ethereum ecosystem.

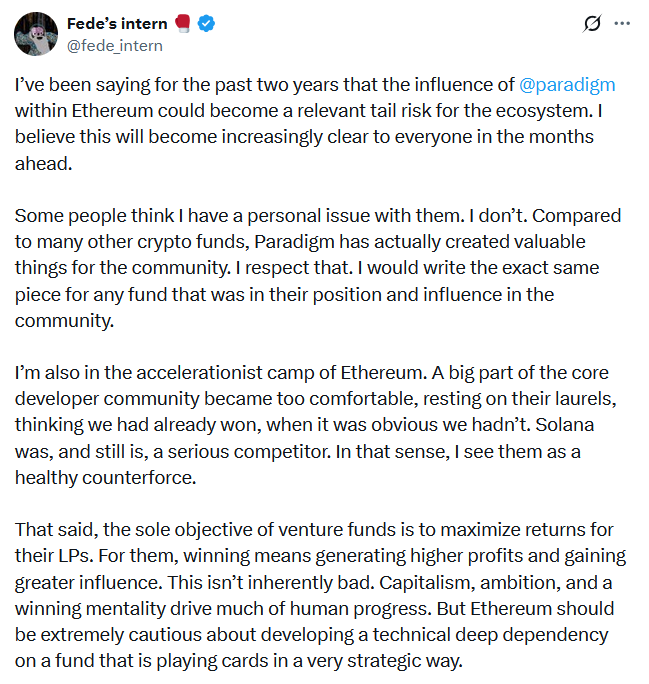

A core Ethereum developer at Firm X, who’s known as a “Fede intern,” argued in a publish on Sunday that whereas Paradigm has “created one thing of worth for the group,” he’s involved concerning the rising affect of enterprise funds whose finish targets are revenue and affect.

“I’ve been saying for the previous two years that the @paradigm influence inside Ethereum could possibly be a related tail danger to the ecosystem, and I consider this can change into more and more clear to everybody within the coming months.”

sauce: Federico Carone

Carone added that whereas Paradigm’s hiring of main Ethereum researchers and funding of open supply libraries “vital to Ethereum” could seem good on the floor, it would not sit nicely with those that assume Ethereum ought to characterize a “philosophical and political” motion that’s “greater than any firm.”

Paradigm has made a sequence of Ethereum performs through the years, together with Reth, an Ethereum improvement software program based mostly on the Rust language.

One notable current initiative is partnering with fintech large Stripe to incubate Tempo, a competing layer-1 blockchain.

Tempo remains to be in improvement and will probably be L1 targeted on stablecoins and funds, with Stripe primarily controlling the community. Its ethos is in stark distinction to Ethereum’s decentralized and open-source nature, provided that it’s a corporate-controlled chain.

Finally, Carone’s issues middle across the totally different goals of decentralized and centralized organizations, and the hazards of permitting funds of any type, not simply Paradigm, to have an excessive amount of affect over the Ethereum ecosystem.

“We’ve to be very cautious that Ethereum is technically deeply depending on funds working their playing cards in a really strategic approach.”

“When firms achieve an excessive amount of visibility and affect over open supply tasks, priorities begin to drift away from the long-term imaginative and prescient of the group and towards company incentives. That’s when misalignment begins.”

Cointelegraph reached out to Paradigm for remark, however didn’t obtain a response as of press time.

Carone requires stability in a follow-up publish. sauce: Federico CaroIt’s

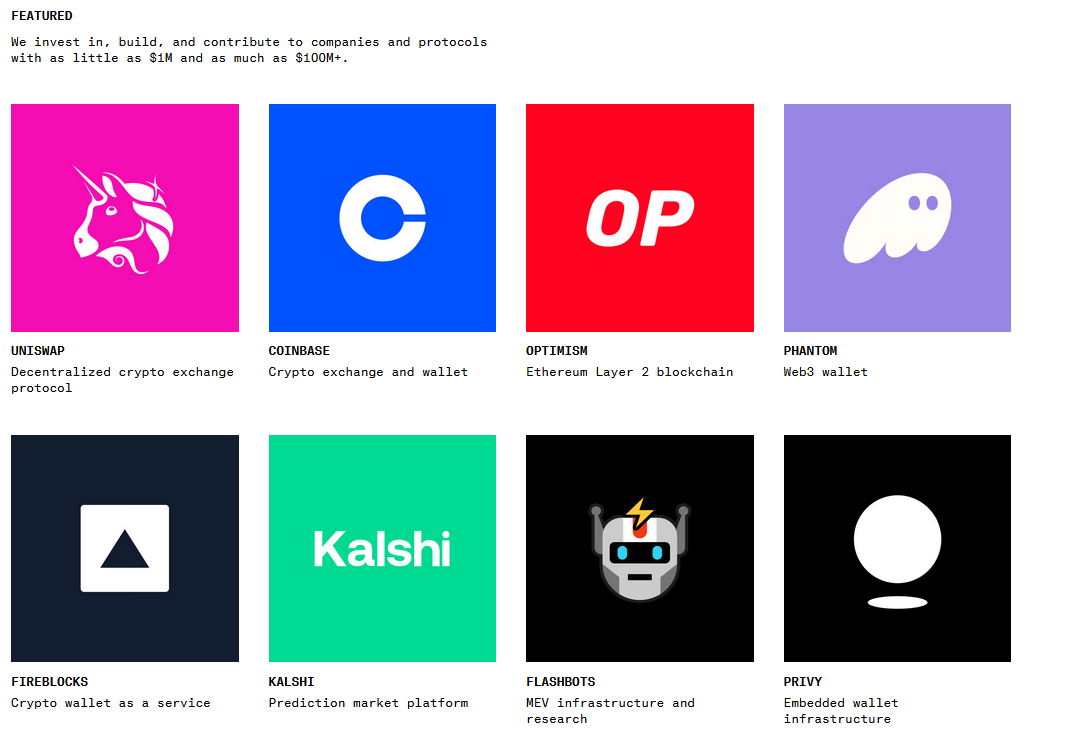

paradigm crypto enterprise

Paradigm is a cryptocurrency and AI funding firm based in 2018 by Matt Hwang, previously of VC large Sequoia, and Coinbase co-founder Fred Asum.

The corporate invests broadly throughout markets, overlaying every thing from DeFi and NFTs to blockchain safety, infrastructure, and startups.

A part of Paradigm’s funding portfolio. sauce: paradigm

In Tempo’s preliminary announcement in September, Paradigm outlined its aim as advancing crypto know-how and adoption by means of a “mixture of investing, constructing, and analysis.”

“This helps us perceive friction factors and alternatives and brings us nearer to the boundaries of what’s doable,” the announcement reads.

Apart from purely financial play, We’ve made a number of strikes that exhibit our agency perception within the crypto group. From submitting court docket briefs in help of Twister Money co-founder Roman Storm to hiring acclaimed blockchain detective ZachXBT as an advisor to fund analysis and assist defend VC companies.