Ethereum stays range-bound following the current market rally, however stays above the most important institutional demand zone. The market is getting into a interval of consolidation between structural help and resistance, suggesting that the subsequent decisive transfer is more likely to be pushed by a liquidity shift out of this vary.

technical evaluation

Written by Shayan

each day chart

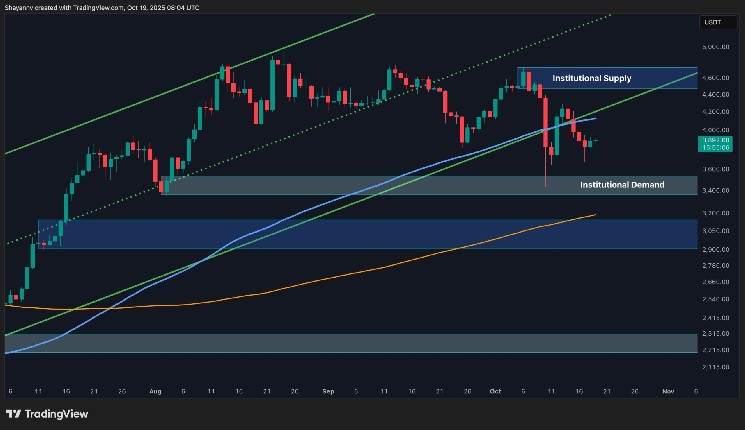

On the each day time-frame, Ethereum continues to commerce between two main zones. An institutional provide zone round $460 to $470 and an institutional demand zone round $340 to $350. After shedding the channel’s decrease trendline help earlier this month, the asset is now retesting it from beneath and confirming that it’s resistance.

This construction means that Ethereum is at present in an intermediate equilibrium stage the place neither patrons nor sellers have clear management. The 100-day transferring common, which beforehand offered dynamic help, has now changed into a resistance zone close to $4.1 million to $4.2 million, whereas the 200-day transferring common close to $3.1 million stays the final structural line of protection.

Ethereum’s macro pattern stays intact so long as the value stays above institutional demand of $3.4 million. Nevertheless, if this stage can’t be sustained, the market could possibly be uncovered to a deeper retracement in the direction of the $3.0,000-$29,000 liquidity cluster the place the 200-day transferring common and former cumulative base converge.

4 hour chart

The 4-hour construction reveals a descending wedge sample that fashioned after a pointy rejection from the $4.2,000 breakdown zone. This repeated rejection on the confluence of the downtrend line and uptrend line displays the continued tug of battle between short-term patrons and sellers.

On the identical time, the decrease sure of the wedge is carefully aligned with the broader institutional demand zone, suggesting that Ethereum is approaching a degree of compression the place elevated volatility is imminent.

If the value breaks above the downtrend line and closes above the $4,000-4.1,000 resistance, a reversal could possibly be confirmed with a goal of $4.4,000-4.6,000. Conversely, a break beneath $3.7,000 might set off a deeper decline in the direction of $3.4,000, the identical zone that helps the broader bullish construction. Till affirmation is acquired, Ethereum will stay vary sure, swinging between structural provide and demand.

sentiment evaluation

Written by Shayan

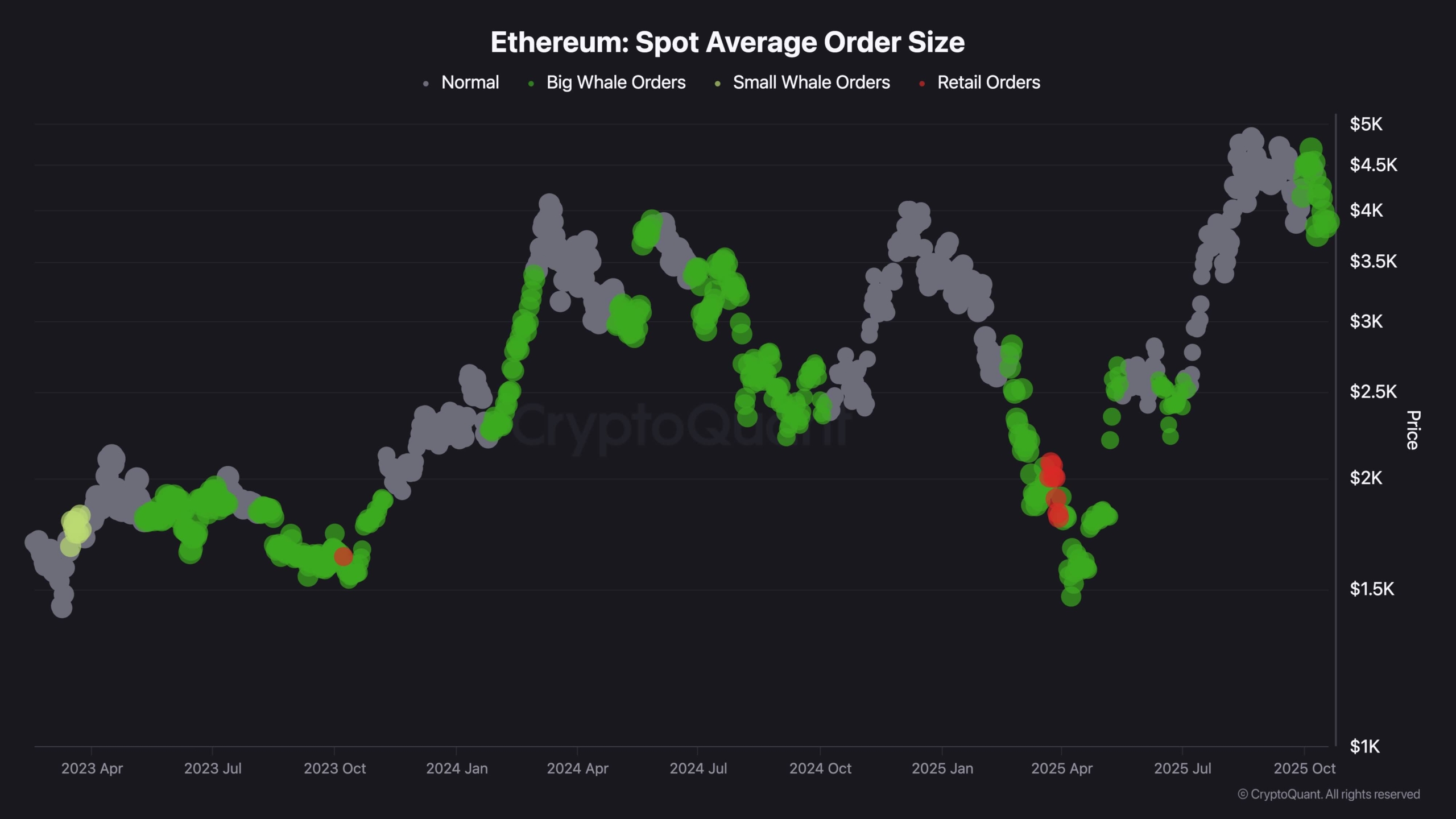

Latest on-chain information reveals that Ethereum’s market construction is tightening once more. Since mid-October, two necessary tendencies have emerged concurrently. Whereas overseas trade reserves are declining quickly, the common measurement of spot orders is more and more dominated by giant whale trades.

Since October fifteenth, the value of ETH has remained comparatively secure at slightly below the $4,000 stage, however the underlying market composition has modified considerably. Whale-sized spot orders (inexperienced clusters) have expanded, indicating new exercise by deep-pocketed members, whereas the quantity of Ethereum held on exchanges (in USD phrases) has fallen to one among its lowest ranges in 2025.

This mix of shrinking overseas trade reserves and growing whale spot exercise has traditionally signaled strategic accumulation by institutional and high-net-worth buyers. With liquidity thinning throughout exchanges, even a modest inflow of recent demand can amplify worth reactions, as decreased sell-side availability magnifies volatility upwards.

Ethereum now seems to be getting into a brand new part of tight provide, reflecting a quiet however robust interval of accumulation within the second half of 2020. Throughout that cycle, there have been constant spot purchases and forex outflows that preceded one among ETH’s strongest multi-month rallies. As soon as the macro atmosphere stabilizes and ETF-related inflows return, the present structural tightening might present the inspiration for Ethereum’s subsequent massive upcycle.