Growler Mining, the Argo blockchain’s greatest lender, is taking management of the struggling cryptocurrency miner by way of a debt-for-equity swap that leaves present shareholders with a tiny stake within the firm.

The reorganization, filed below UK Corporations Regulation, will see Growler convert roughly $7.5 million in secured loans and supply new funding in change for 87.5% of Argo’s recapitalized shares.

Bondholders of Argo’s $40 million unsecured notes will obtain a mixed 10%, whereas present shareholders will solely personal 2.5%. The deal is a part of a court-supervised restructuring plan referred to as “Undertaking Triumph” aimed toward stopping chapter and maintaining the mining firm listed on the Nasdaq.

“Until the plan firm (Argo) undertakes a steadiness sheet restructuring, the plan firm will be unable to acquire the funding it wants and can turn out to be bancrupt on each a money move and steadiness sheet foundation,” Argo stated.

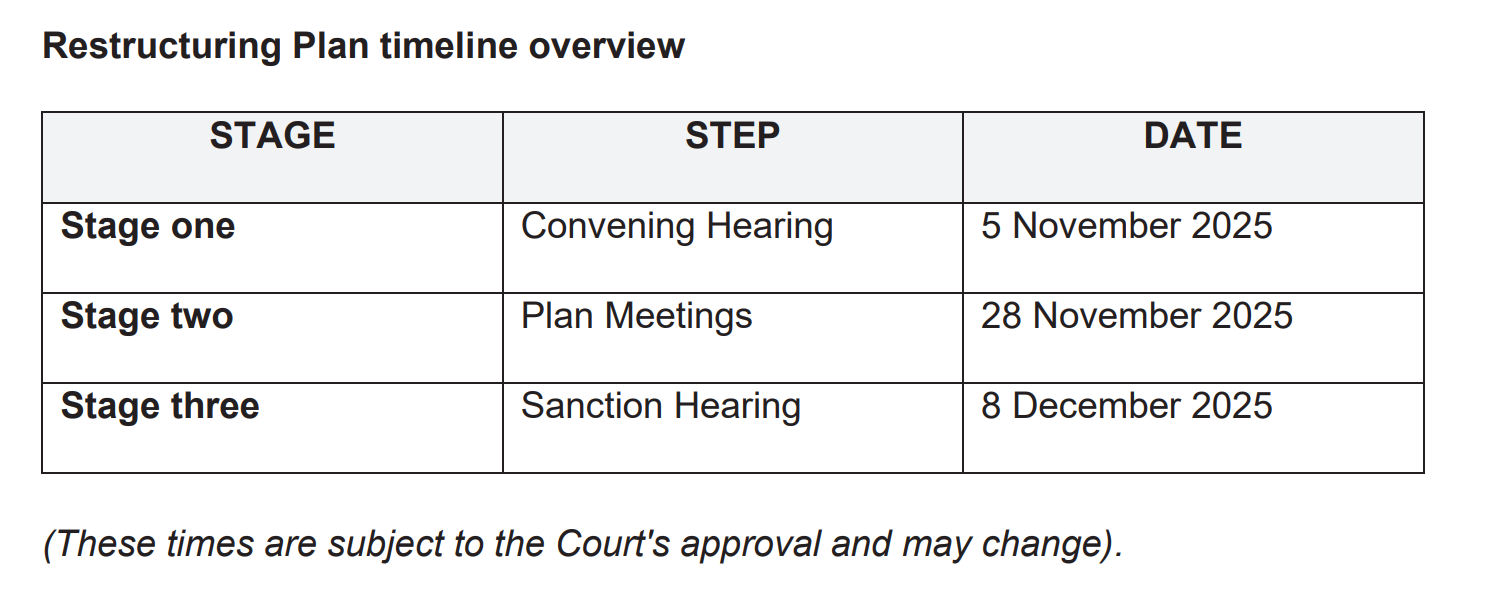

Overview of Argo’s restructuring plan timeline. sauce. Argo

Associated: Bitcoin miner Argo repays $35 million in Galaxy aid mortgage

Argo to be delisted from LSE

Argo can even be delisted from the London Inventory Alternate, ending its six-year existence as one of many UK’s few listed crypto firms. Offered the corporate meets compliance circumstances, together with a deliberate reverse inventory break up by January 2026, its shares will proceed to commerce on the Nasdaq.

The corporate will stay included and headquartered in London, however its capital markets focus will shift fully to the USA. In 2018, Argo grew to become the primary crypto firm to listing on the London Inventory Alternate, elevating roughly $32 million at a valuation of $61 million.

Argo’s Bitcoin (BTC) manufacturing has plummeted over the previous two years, from almost six cash per day in 2022 to simply two cash per day in 2024, as growing older equipment and excessive power prices weighed on profitability, in response to the submitting.

The mining firm bought its Helios facility in Texas to Galaxy Digital and concentrated its operations at its Baycomo web site in Canada and its U.S. internet hosting facilities in Tennessee and Washington.

Associated: Argo Blockchain cuts debt in half to $75 million in 2022

The top of Argo’s period as a UK public firm

The Growler acquisition features a plan to inject new capital generally known as “exit capital” and switch possession of Growler USCo, a subsidiary with new mining belongings, to Argo in change for brand new inventory. The transfer will give lenders operational management and a method to replace Argo’s fleet, which is able to turn out to be out of date in 2026.

If authorised by the Excessive Courtroom of England and Wales, the restructuring would eradicate most of Argo’s money owed, save its Nasdaq itemizing and hand management of the corporate to its collectors. For buyers, that is nearly full extinction and the top of Argo’s period as one of many pioneers of public market cryptocurrencies within the UK.

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom