The October 10 crash that noticed Bitcoin (BTC) hit $102,000 has been largely overshadowed by the worth correction per week later, however the liquidation chart exhibits a basic setup that may compress brief curiosity out there ought to KingCoin rise above the $111,000 mark once more.

Bitcoin fell under $108,000 throughout U.S. pre-market buying and selling on Tuesday, however has now consolidated round $107,700 after dropping 3.7% in value over the previous 24 hours. Merchants are attempting to determine what to do about combined alerts, which have despatched funding charges plummeting and into territory the place brief bets are beginning to pay out lengthy bets.

Analysts say a cumulative $14 billion price of short-term leveraged bets are poised to be liquidated if Bitcoin’s bearish pattern reverses and the coin rises to a document excessive of $124,000.

Quick squeeze is imminent if BTC revisits $110,000 choice

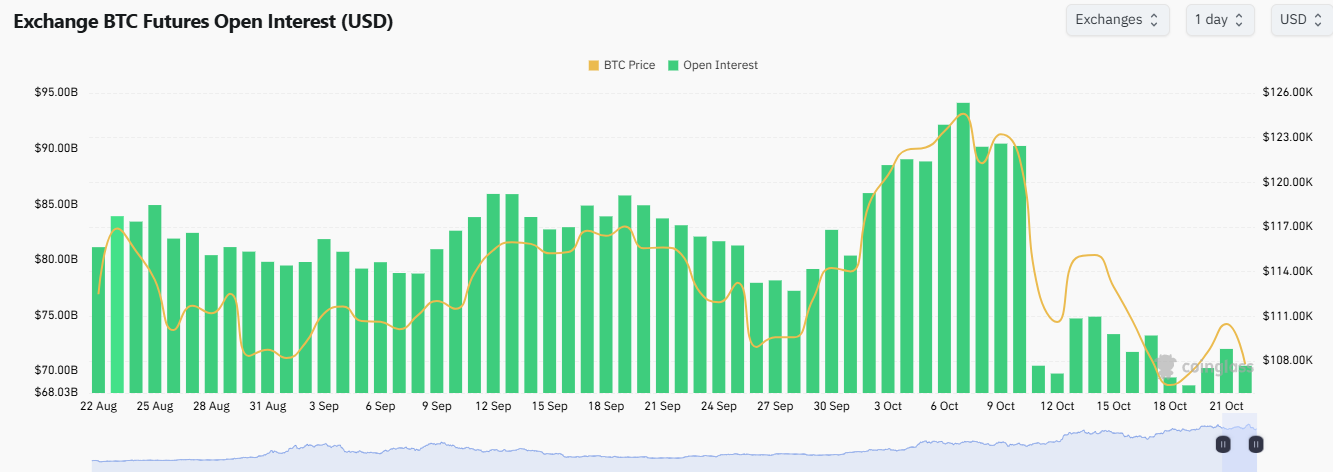

Perpetual futures information exhibits that funding charges have turned damaging, indicating that brief positions are beginning to pay out lengthy holders once more. In keeping with information from Coinglass, open BTC futures curiosity has fallen by about $20 billion since October 9, when BTC hit an all-time excessive.

Destructive funding charges and declining short-term rates of interest point out imbalances that may amplify sudden value reversals. Merchants are actually centered on whether or not Bitcoin can regain the $111,000 degree, which analysts consider will set off the subsequent crash.

BTC futures open rate of interest. Supply: Coin Glass

Different analysts are evaluating the present state of affairs to January 2021, when King Coin soared from $30,000 to over $40,000 inside a number of days, catching bearish merchants off guard. A squeeze additionally occurred in the USA within the spring of 2024, with President Donald Trump’s victory sparking a week-long rally that noticed Bitcoin rise above $100,000 for the primary time in historical past and thousands and thousands of {dollars} in leveraged brief gross sales liquidated.

On-chain analytics agency CryptoQuant’s Bitcoin Composite Market Index (BCMI), which aggregates a number of market well being indicators, has retreated to the 0.5 impartial zone, the midpoint between overvaluation and undervaluation in Bitcoin’s market cycle.

In earlier cycles seen in 2020 and early 2024, a retest of the 0.45 to 0.5 vary signaled the tip of a correction part and preceded a brand new growth leg. As Wumingyu defined, this can be a cooling-off interval throughout which speculative exercise decreases and long-term worth indicators are reset.

At present, Bitcoin’s MVRV is round 1.8, effectively under the historic overvaluation degree of over 3.0, whereas the SOPR is near 1.02, indicating a great stability between revenue taking and accumulation.

“All components level to a structural mid-cycle correction slightly than a macro high,” Wu Mingyu stated in his evaluation. “If BCMI recovers from 0.5 to 0.6, momentum might resume in direction of new native highs. Nevertheless, a break under 0.45 might lead to a chronic consolidation.”

The market is in disbelief and does not know what to do

Dirkforst, a market watcher and member of CryptoQuant, believes that the asset could also be coming into the so-called “stage of mistrust”, a psychological stage the place the worth begins to rise once more, however investor confidence is low because of damaging value corrections.

Bitcoin funding charges have hovered round -0.004% for six of the previous seven days because of sustained bearish positions taken by the market. The extended interval of damaging funds signifies that merchants are nonetheless leaning brief despite the fact that the worth has stabilized above $107,000.

That stated, foreign money flows present that about 18,000 BTC has flown out of exchanges and about 16,000 BTC has flowed in over the previous few days. Average web outflows recommend that accumulation is modest, which additionally means the market isn’t assured in regards to the destiny of BTC costs.

Bitcoin bulls struggled to maintain the worth above $111,000 within the face of a bearish rally that moved the worth to a brand new resistance degree. The $107,000 help zone wants to carry. It is because if the worth continues to fall under that degree, the size of promoting stress will shift to the east, probably prolonging the consolidation part.