Mid-sized Bitcoin miners are closing the hole with trade leaders in realized hashrate after the 2024 halving.

abstract

- After the halving in 2024, mid-tier miners have quickly expanded and are closing in on prime gamers.

- Public miners doubled their realized hashrate to 326 EH/s, the primary report improve in a yr.

- Debt within the mining sector has soared to $12.7 billion, pushed by heavy funding in rigs and AI ventures.

After years of infrastructure development, Cipher Mining, Bitdeer, and HIVE Digital have expanded quickly, bringing them nearer to prime gamers comparable to MARA Holdings, CleanSpark, and Cango.

This transformation will make the enjoying subject extra stage within the mining sector. “Their rise highlights how middle-class public miners, as soon as far behind, are quickly increasing manufacturing because the 2024 halving,” Miner Magazine wrote in its newest Miner Weekly E-newsletter.

You might also like: Crypto VC funding: Coinbase acquires Echo for $375 million, Pave Financial institution raises $39 million

Prime Bitcoin miners double their hashrate

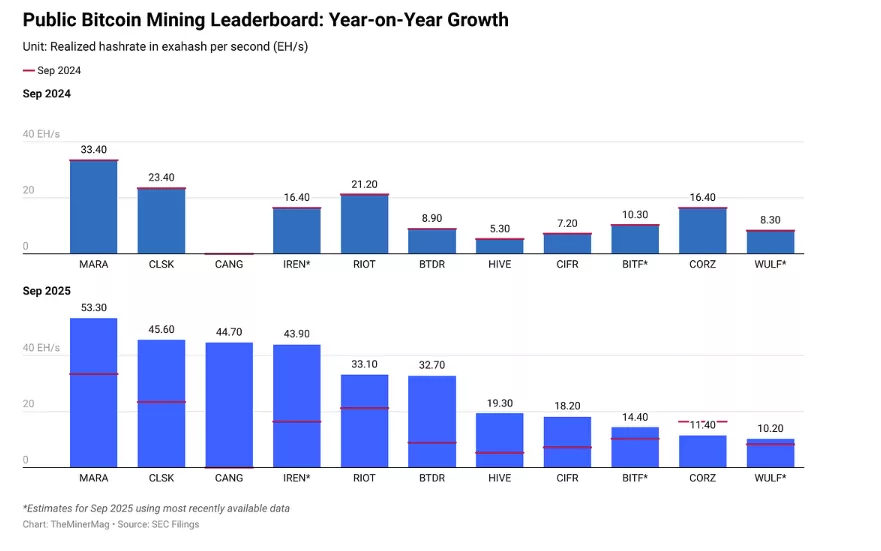

MARA, CleanSpark, and Cango retained their standing because the three largest public miners. Rivals comparable to IREN, Cipher, Bitdeer, and HIVE Digital recorded vital year-over-year will increase in realized hashrate.

Prime public miners reached a realized hash price of 326 exahashes per second (EH/s) in September, greater than double the extent recorded the earlier yr. These at present account for almost a 3rd of Bitcoin’s (BTC) whole community hash price.

Public Bitcoin Mining Leaderboard: Supply: The Miner Magazine

Hashrate measures the computational energy of miners, which helps safe the Bitcoin blockchain. The achieved hashrate tracks the precise on-chain efficiency, i.e. the speed at which legitimate blocks are efficiently mined.

For publicly traded miners, realized hashrate gives a extra correct indicator of operational effectivity and income potential. This indicator has grow to be an vital indicator forward of the third quarter earnings season.

You might also like: James Wynn enters XRP with vital funding

Mining debt soars to $12.7 billion

Bitcoin miners are reaching report debt ranges and increasing into new mining rigs, synthetic intelligence infrastructure, and different capital-intensive ventures. Whole debt throughout the sector jumped to $12.7 billion from $2.1 billion simply 12 months in the past.

VanEck’s analysis notes that miners might want to proceed investing in next-generation {hardware} to keep up their share of Bitcoin’s whole hashrate and sustain with rivals.

Some mining firms are turning to AI and high-performance computing workloads to diversify their income streams. This transformation was made in response to the lower in margin and block reward to three.125 BTC as a result of Bitcoin halving in 2024.

The rise in debt signifies aggressive enlargement plans throughout the trade. Mining firms face strain to increase rapidly or danger shedding market share to better-capitalized rivals.

learn extra: Cryptocurrency’s $1 trillion blind spot requires a brand new framework | Opinion