The Financial institution for Worldwide Settlements (BIS) has warned of the dangers of stablecoin yield merchandise. The group warned that the addition of yield blurs the strains between fee instruments and investments.

The Financial institution for Worldwide Settlements (BIS) has issued a warning concerning the growth of stablecoin yield merchandise. The group notes present traits in stablecoin adoption, however warns towards revenue-based apps and merchandise.

As a cryptopolitan reportedBIS has been important of stablecoins up to now, whereas taking a typically destructive stance in the direction of cryptocurrencies.

“These practices can blur the road between fee devices and funding merchandise. These can compete with financial institution deposits, however are sometimes provided with out comparable prudential oversight, deposit insurance coverage or transparency, exposing customers to gaps and losses in client safety. ” BIS warned in a latest evaluation.

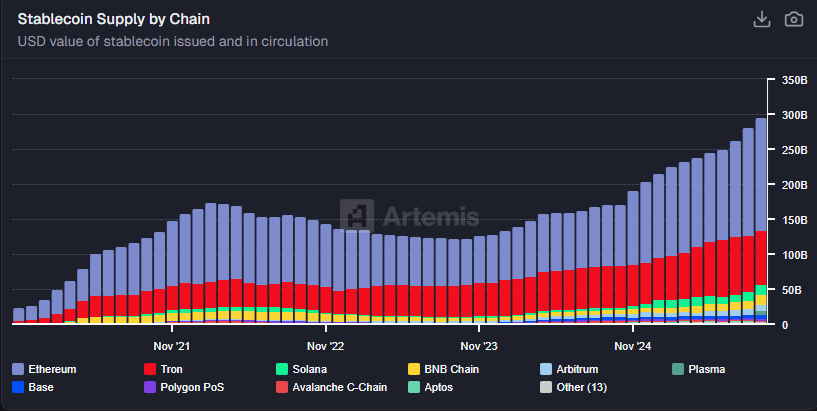

The stablecoin rapidly expanded to a complete provide of 305.9 billion tokens, break up into normal fee belongings and specialised tokens linked to yield-based merchandise. Stablecoins are saved in 42.1 million addresses 4% Prior to now month.

BIS warns of conflicts of curiosity in stablecoins and lending providers

BIS has warned that the recognition of stablecoins may create conflicts of curiosity with conventional banks. Moreover, high-yield or lending apps can create conflicts of curiosity. Regardless of the present framework backing stablecoins, the house remains to be unregulated by way of yield.

BIS additionally referred to as for extra regulation for decentralized crypto asset service suppliers (CASPs) that provide yield. There are presently no particular restrictions on decentralized yield and lending protocols, and no protections for retail customers.

One supply of the dispute is that some stablecoins have comparatively excessive financial savings charges, considerably exceeding financial institution deposit charges for U.S. prospects. Nevertheless, BIS warned that these yield-bearing merchandise are fully unregulated and don’t have any security mechanisms for depositors.

“Excessive-yield merchandise that mimic financial savings accounts can expose customers to potential losses and opposed contractual outcomes, reminiscent of being handled as unsecured collectors, if the middleman fails. ” I defined about BIS in a latest article. report.

Some stablecoin protocols leverage yield from US Treasury payments, both immediately or via tokenized merchandise like BUIDL. Not like banks, protocols share extra of their income with customers. There are exceptions like USDT, which primarily holds curiosity on Treasury payments.

Unbelievable yields depend upon the protocol, not the stablecoin

Stablecoins are accepted by a number of protocols and the ultimate yield varies relying on their decentralized app. Even regulated stablecoins like USDC are finally saved in high-yield vaults or protocols.

Whereas stablecoins expanded their complete provide, additionally they gained further incentives from airdrop farming, rising income alternatives. The overall stablecoin provide is over 305 billion tokens. |Supply: Artemis

At present, a lot of the liquidity is held in Aave, Morpho, Maple Finance, and Sky Protocol. Nevertheless, there’s a lengthy tail of low-yield merchandise with APYs larger than 100% and even reaching 1,000%. Most merchants nonetheless keep away from these protocols as a result of the yields are unrealistic and unsustainable.

Extra generally, yields for fashionable protocols vary from 4% to 7%. Even these presents are engaging in comparison with financial institution deposits.

Yields from stablecoins usually have further incentives reminiscent of airdrop farming. Over the previous yr, extra customers have chosen to farm new tokens as a substitute of buying and selling dangerous and risky crypto belongings.