October was a month of ups and downs. Bitcoin Regardless of seasonal guarantees of “uptober” income, merchants and traders didn’t.

Traditionally October has been time. Bitcoin Holders have recorded inexperienced months in 10 of the previous 12 years, averaging returns of greater than 20%. Based on knowledge from Coinglass, Bitcoin is presently buying and selling at a comparatively modest worth of +1.14% for the month.

Bitcoin soared above $123,000 in early October, however plummeted to $107,000 by mid-month, a 13% correction that erased weeks of positive aspects in a matter of days. Since then, the bull market has slowly returned to its present stage of round $115,000.

Presently buying and selling at $115,542, Bitcoin has managed to stay above this vital threshold regardless of risky worth actions all through October. The query now going through merchants is whether or not Uptober will dwell as much as its title and end with Bitcoin within the inexperienced.

Conventional markets are firing on all cylinders, with the S&P 500 hitting a brand new all-time excessive of over 6,900 factors on Tuesday. Traders are pricing in a attainable quarter-point fee reduce when the Federal Reserve broadcasts its determination on Wednesday, which might carry rates of interest right down to a spread of three.75% to 4.00%, sometimes bullish territory for threat belongings like cryptocurrencies.

The rally was additionally fueled by Treasury Secretary Scott Bessent’s trace at a framework for resolving the U.S.-China commerce dispute forward of subsequent week’s assembly between President Donald Trump and President Xi Jinping. This mix of dovish financial coverage and geopolitical threat mitigation has pushed the risk-on sentiment that crypto markets sometimes monitor.

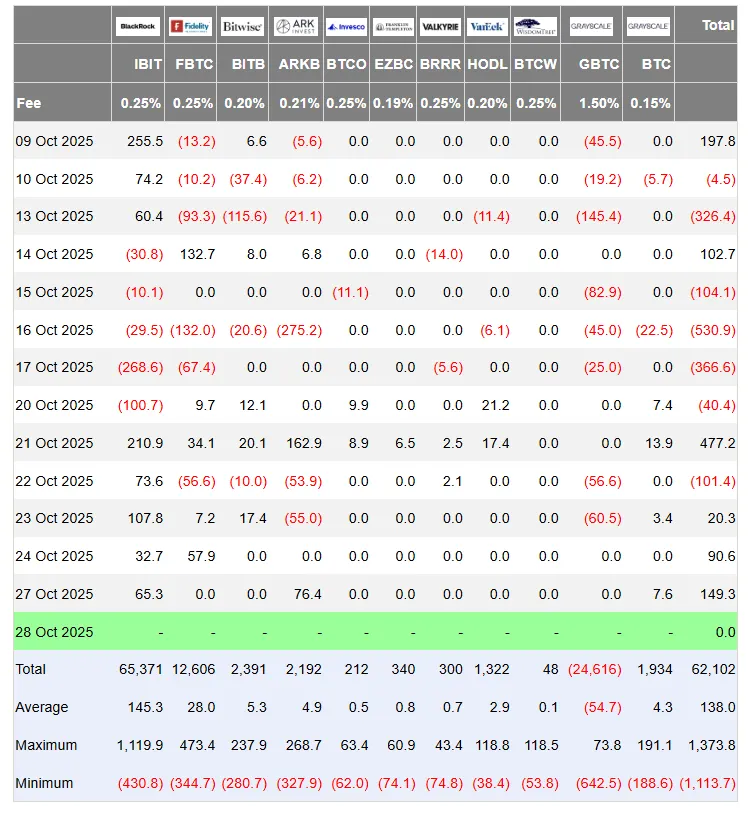

Maybe most telling about Bitcoin’s near-term outlook, the Spot Bitcoin ETF recorded its third consecutive day of inflows, elevating $149 million as of yesterday.

Bitcoin ETFs are experiencing inflows. Picture: Far Facet Investor

When institutional cash flows into Bitcoin by means of regulated merchandise, it often alerts confidence from bigger gamers, the sort of demand that helps worth stability.

Bitcoin technical breakdown: Bulls construct energy

So, will Bitcoin finish the month in inexperienced or pink?

As a result of quick timeframe of the forecast, we used a 4-hour candlestick setup for our evaluation.

The short-term chart reveals a bullish construction, suggesting that Bitcoin is extra prone to maintain and prolong its rally above $114,200 than beneath. At the very least in the meanwhile, worth seems to have damaged by means of the resistance line that signaled a correction (dotted pink line on the chart beneath) and rebounded within the ascending channel (dotted inexperienced line on the chart).

Bitcoin worth knowledge. Picture: Tradingview

The typical directional index (ADX) is 32.14 and is marked as “Sturdy” on the chart. This indicator measures the energy of a development on a scale of 0 to 100, no matter route. A studying above 25 confirms a longtime development, whereas a studying above 30 suggests robust momentum. When ADX continues to rise above 25, it often signifies that the development has legs and is prone to persist relatively than reverse quickly.

The Relative Power Index (RSI) of 69.05 tells an attention-grabbing story. The RSI measures momentum by evaluating the magnitude of latest positive aspects to latest losses, and readings above 70 point out overbought situations the place revenue taking is frequent. Bitcoin is approaching that zone at 69, however not fairly there. Subsequently, there’s room to run for the subsequent three days earlier than Bitcoin subsequent hits overbought territory and triggers an adjustment in algorithmic buying and selling settings.

Exponential shifting averages (EMAs) inform merchants the place worth help and resistance are by taking the typical worth of an asset over the quick, medium, and long run. Within the case of Bitcoin, the 50-period EMA (common worth of the previous 50 4-hour buying and selling classes) is beneath the 200-period EMA, producing a “quick” sign on the 4-hour timeframe.

This configuration, generally known as a “loss of life cross” when it happens, often signifies a bearish market construction as a result of it means short-term costs are on common decrease than long-term costs. Nevertheless, the present worth motion is buying and selling properly above each shifting averages, with the EMA 50 indicating an upward transfer indicating a attainable golden cross (above the EMA 200 can be a bullish setup).

The squeeze momentum indicator flashes on a “bullish impulse” with a “lengthy” sign. Developed by dealer John Carter, this indicator identifies when volatility is compressed (like a spring being squeezed) earlier than an explosive transfer. When the squeeze “fires” with bullish momentum, it alerts the tip of the compression part and the start of a directional transfer. A “bullish impulse” standing signifies that not solely has the squeeze been triggered, however momentum is accelerating upward. Merchants sometimes interpret this as a probable setup for continued income, particularly when mixed with different confirmatory indicators akin to rising ADX.

Lastly, Ichimoku cloud evaluation reveals that Bitcoin is buying and selling above the cloud (worth is stronger than the earlier buying and selling session) and future clouds are predicted to be bullish. For merchants new to this Japanese charting method, consider the cloud as a dynamic help/resistance zone. When costs are buying and selling above a bullish cloud with increasing momentum, it often signifies a continuation of the development relatively than a reversal.

Lastly, if Bitcoin respects the present worth help, even the bottom worth can be $622 above the opening worth registered on October 1st. That is solely 0.5% above the goal, however nonetheless above 0.

prone to be inexperienced

Can Bitcoin finish October above $114,200? Technical proof means that it’s attainable. If this development continues, this Uptober might change into a short-body Doge. Costs fluctuate wildly within the center, however roughly begin the place it began. In different phrases, it could find yourself being a small revenue, however nonetheless a constructive one.

With BTC presently buying and selling 1.2% above that stage and exhibiting robust development affirmation throughout a number of indicators, the trail of least resistance seems to be in the direction of a sideways-to-highs relatively than a breakdown beneath the month-to-month open.

The fast help zone is roughly $114,000 to $114,500, in step with the month-to-month open and up to date consolidation space. For Bitcoin to finish October within the pink, it will want to interrupt by means of this help zone and stay beneath it for the remaining days of the month, however this state of affairs is unlikely given the present ADX numbers, bullish momentum indicators, and supportive macro backdrop.

Sentiment stays broadly bullish in the mean time, with Myriad merchantsA prediction market developed by Dastan, Decrypt’s dad or mum firm, costs Bitcoin as having a 70% likelihood of constant its rise in the direction of $120,000 after which dropping to $100,000. These odds now look fairly totally different from six days in the past, when merchants had been predicting a 56% likelihood of Bitcoin falling to $100,000.

Nevertheless, merchants ought to at all times bear in mind that Wednesday’s Fed coverage announcement represents a binary threat occasion. Markets are pricing in a 25 foundation level (bp) fee reduce, however hawkish feedback on the longer term path of rates of interest might trigger short-term volatility. The important thing query shall be whether or not Bitcoin can maintain help above $114,000 within the occasion of a Fed-related disruption.

Primary ranges to notice:

- Prompt help from $114,000 to $114,500 (month-to-month open zone);

- Sturdy help at $112,000 (latest stable lows),

- Rapid resistance at $116,000 (latest rejection level),

- Sturdy resistance between $118,000 and $120,000 (psychological barrier and quantity hole)

Disclaimer

The views and opinions expressed by the authors are for informational functions solely and don’t represent monetary, funding, or different recommendation.

mark