October of this 12 months was a tough month for the crypto market, with Bitcoin hitting a brand new all-time excessive of $126,295 at the start of the month, solely to hit its lowest since July at $102,329 only a few days later. Now that “Uptober” is coming to an finish, everyone seems to be taking note of what November has in retailer for the foremost cryptocurrencies.

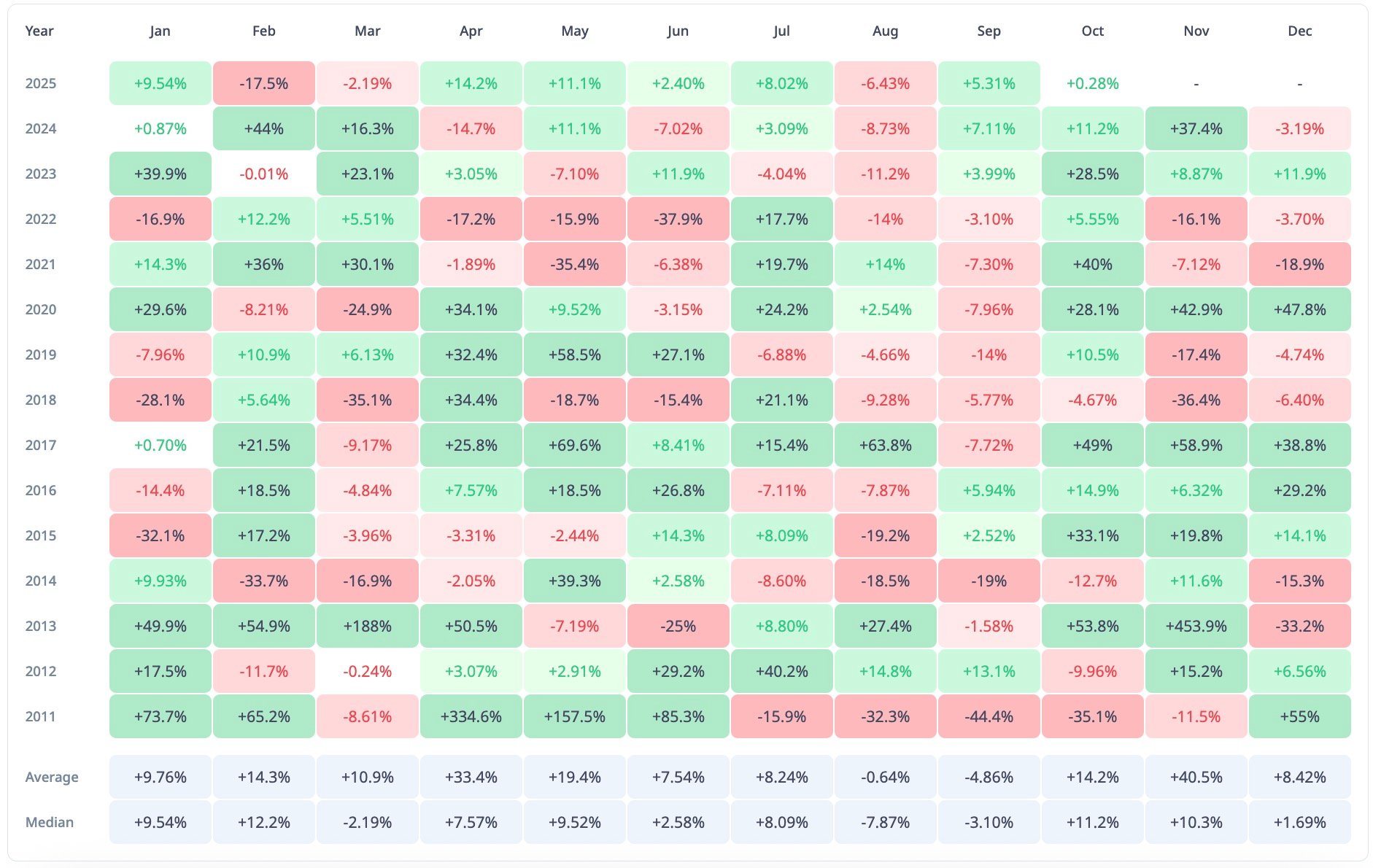

CryptoRank’s heatmap of month-to-month returns is filled with crimson and inexperienced spots, however November stands out, with features of over 40% on common all year long.

In truth, Bitcoin’s efficiency in November is without doubt one of the most secure development durations in Bitcoin’s historical past. Again in 2013, the coin rose a whopping 453.9%, setting a precedent that will affect subsequent cycles.

Bitcoin rose 42.9% in November 2020 and practically 59% in 2017. This sample has solely damaged a number of occasions, with far fewer reds than greens in November, making the statistical slope fairly bullish.

“Santa Rally” in November

The setting for 2025 can also be distinctive. Bitcoin is now in November after spending most of this 12 months popping out of a correction and consolidation, and buyers are already whispering cautiously about the opportunity of a repeat of the historic Santa Rally.

With a median historic improve of 40.5% and a median of practically 10%, even a conservative studying of worth historical past appears to favor the bulls.

Worth historical past would not assure outcomes, particularly in a chaotic setting like cryptocurrencies, but when the identical month retains exhibiting the inexperienced mild all through the cycle, it is greater than only a coincidence.

If Bitcoin follows its seasonal rhythm, November 2025 would be the begin of the 12 months, and this might be one other memorable 12 months for cryptocurrencies.