Decentralized trade (DEX) buying and selling exercise surged to new highs in October, demonstrating the worldwide cryptocurrency market’s continued shift in direction of on-chain finance.

In line with information from DeFiLlama, perpetual DEX buying and selling quantity exceeded $1.36 trillion final month, the best stage ever. This quantity surpassed August’s peak of $759 billion and have become a brand new benchmark for on-chain buying and selling exercise.

Hyperliquid takes the lead as on-chain perpetual good points momentum

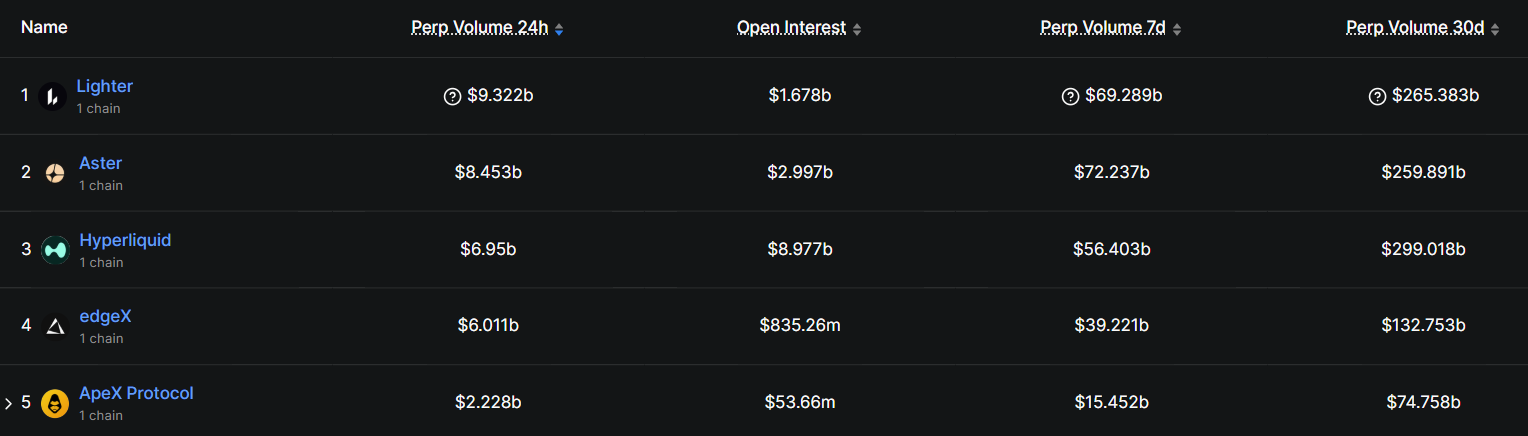

The fast enhance in buying and selling quantity confirms the rising confidence of buyers in on-chain platforms. Hyperliquid, the layer 1 blockchain that has dominated the persistent DEX panorama, accounted for roughly $299 billion of the October complete.

This was adopted by Lighter, an Ethereum-based DEX, which processed roughly $265.4 billion, and Binance-linked Aster, which processed roughly $259.9 billion.

Prime 5 Perps DEX Platforms. Supply: Defilama

The efficiency of latest gamers reminiscent of Lighter and Aster reveals that merchants are steadily migrating away from centralized exchanges (CEX). They’re as a substitute turning to decentralized venues that provide better transparency, decrease charges, and direct management of their belongings.

The truth is, the spot quantity share from DEX to CEX has doubled from lower than 10% final yr to greater than 20% in 2025.

Notably, Hyperliquid is each a driver and beneficiary of that momentum.

Business analysts consider that this on-chain increase is because of a number of intertwined elements. The rise of platforms providing improved interfaces and incentives reminiscent of airdrops and factors applications has attracted retail merchants in droves.

However this pattern additionally displays deeper structural modifications. Following repeated centralized trade scandals and elevated regulatory scrutiny, many merchants now consider that DEXs are a safer place to take care of custody and supply early entry to new tokens.

Nonetheless, October’s file numbers weren’t purely pure.

This spike in buying and selling quantity coincided with roughly $20 billion in compelled liquidations throughout leveraged positions at the start of the month. The wave was sparked after President Donald Trump stated the USA might increase tariffs in response to new restrictions on China’s uncommon earth exports.

The feedback brought about a big decline in threat belongings, sending crypto costs decrease and triggering a wave of file buying and selling exercise throughout platforms.

The truth is, CoinShares later reported that the ensuing market turmoil had generated file weekly buying and selling quantity of over $53 billion in regulated crypto funding merchandise reminiscent of ETFs.

The put up DEX buying and selling quantity surges above $1 trillion as buyers shift away from CEX appeared first on BeInCrypto.