Bitcoin entered November as its strongest month of beneficial properties in historical past, with a mean acquire of 42.51% since 2013. So, if historical past is something to go by, Bitcoin may prime $160,000 this month.

Nevertheless, one cryptocurrency analyst identified that a number of macroeconomic components are additionally at play.

“I feel seasonal charts are essential, however they must be mixed with many different components,” stated Markus Thielen, crypto analyst at 10x Analysis.

Wanting forward, there are expectations that the US Federal Reserve will additional decrease rates of interest, and the US and China are engaged on a commerce deal. Each developments might be advantageous for Bitcoin. However the authorities shutdown and U.S. tariffs have added to the financial uncertainty.

This is a breakdown of a number of the key developments to look at within the coming weeks.

Easing commerce tensions between the US and China

Thursday’s assembly between U.S. President Donald Trump and Chinese language President Xi Jinping is seen as a constructive step towards ending U.S.-China commerce tensions.

President Trump praised his assembly with the Chinese language president in South Korea as “wonderful.” The talks additionally included an settlement by President Trump to cut back tariffs on China, resume U.S. purchases of soybeans and elevate restrictions on uncommon earth exports for one 12 months in change for a crackdown on China’s fentanyl commerce.

Month-to-month Bitcoin returns since 2013. supply: coin glass

President Trump advised reporters he anticipated a commerce take care of China to be reached “quickly.”

President Trump’s menace of tariffs in opposition to China has been blamed for the latest cryptocurrency crash, the place $19 billion was liquidated in simply 24 hours on October eleventh. Since then, the cryptocurrency market has struggled to get better.

However Dennis Wilder, a Georgetown College professor and senior fellow on the China Initiative, advised CBC Information that whereas the talks have been a “mini-pause” within the commerce struggle, it is not over.

US Federal Reserve lowers rates of interest, ends quantitative tightening

It was simply days in the past that Fed officers voted for an additional quarter-point fee lower, bringing the important thing lending fee to its lowest stage in three years.

The date for the subsequent Fed assembly is about for December 10, 2025. Merchants are pricing in a 63% probability of a fee lower, in accordance with information from CME’s FedWatch, a device that measures expectations for rate of interest modifications from the Federal Reserve.

Federal Reserve Chairman Jerome Powell shocked markets on Wednesday by saying the transfer was “not a foregone conclusion.”

The Fed’s rate of interest cuts are seen as bullish for Bitcoin, as decrease borrowing prices have traditionally motivated traders to commerce riskier property akin to cryptocurrencies.

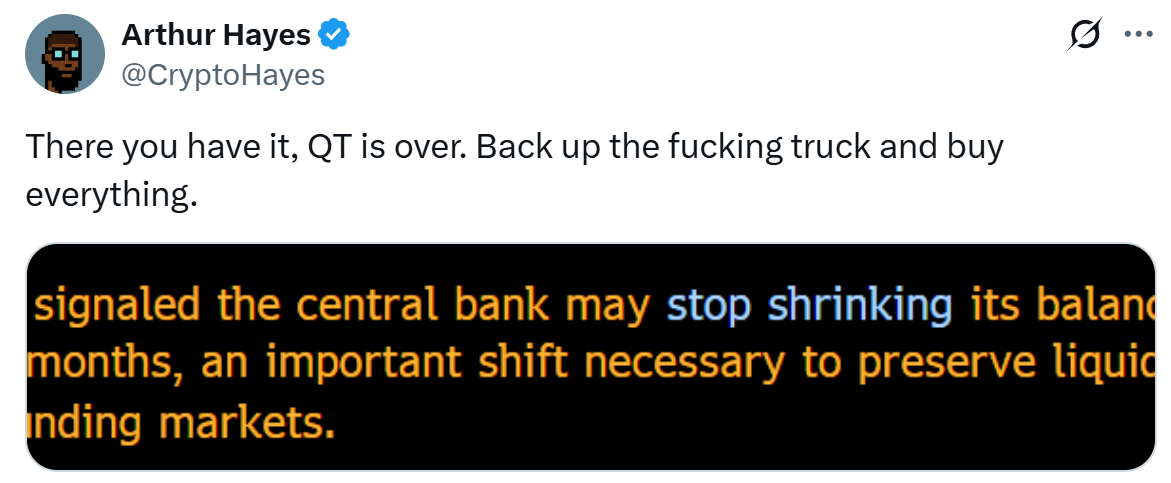

Added to that is the Fed’s latest determination to finish its quantitative tightening (QT) program on December 1st. QT is the method of shrinking a central financial institution’s stability sheet. QT’s purpose is to chill an overheating economic system and stop inflation from rising quickly.

sauce: Arthur Hayes

The other of this, quantitative easing, is seen nearly as good for cryptocurrencies as a result of it entails central banks injecting more money into the economic system, with a few of that cash flowing into various property.

US authorities shutdown drags on

The U.S. authorities shutdown will quickly enter its fifth week, approaching the longest in U.S. historical past, as Republicans and Democrats stay deadlocked over authorities spending plans.

Associated: Bitcoin’s 4-year cycle is not over, subsequent recession predicts 70% drop: VC

On Thursday, President Trump referred to as on Republicans to abolish the “Senate filibuster” rule, which permits a minority of senators to dam majority motion, claiming it was the reason for the federal government shutdown.

“The selection is obvious: Activate the ‘nuclear choice,’ eradicate the filibuster, and make America nice once more!” Trump wrote on Fact Social.

The top of the shutdown, together with necessary developments within the Cryptocurrency Market Construction Act, also referred to as the CLARITY Act, is seen as a crucial step for the SEC to present the ultimate inexperienced mild to some crypto ETFs.

journal: Bitcoin blinking ‘uncommon’ prime sign, Hayes suggests $1 million BTC: Hodler’s Digest, October 19-25