desk of contents

BNB’s Development Trajectory in 2025 Historic Efficiency and Cycle Resilience BNB Cryptocurrency Trilemma Balancing as a Strategic Portfolio Asset Strategic Highlights of the BNB Ecosystem BNB’s Place within the Development of Web3 FAQ

BNB, native token BNB chainconfirmed vital progress all through 2025 with constant community exercise and utility enlargement. Every day lively addresses on the chain peaked at 3.4 million on October 13, reflecting 300% year-over-year person progress.

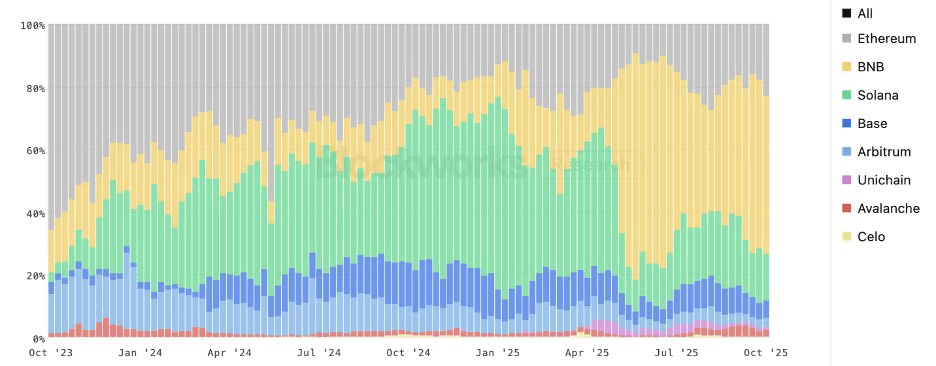

DEX buying and selling quantity reaches roughly $19 billion per day, capturing roughly 61 p.c of the market share amongst main chains, and lively stablecoin pockets addresses attain roughly 20 million, confirming widespread adoption throughout DeFi, AI, memes, real-world property, and shopper functions.

These numbers spotlight BNB’s function in offering customers with publicity to numerous Web3 sectors, with historic native holding yields of 15-20% derived from the mixing throughout the asset issuing and distribution tiers. Because the yr progressed, BNB’s deflationary mechanism additional solidified its financial construction, burning over 64 million tokens value over $72 billion at October costs. This mix of indicators prepares us to analyze the event of BNB in extra element.

BNB progress trajectory in 2025

The 2025 BNB Chain enlargement was constructed on a multi-layered roadmap aimed toward rising throughput and performance. The community focused over 20,000 transactions per second with sub-150ms block finality, incorporating a local zero-knowledge privateness module for safe funds.

As a mid-year initiative, Binance The Alpha program induced a surge in DEX exercise, with buying and selling quantity at one level exceeding 70 p.c of all on-chain spot buying and selling. The improve, with an eye fixed towards 2026, promised near-instant affirmation, Nasdaq-level capability, and upgradable digital machines for parallel execution, together with privateness options and simplified person controls. These enhancements place the BNB Chain as a modular stack for asset issuance, discovery, and settlement, with BNB serving because the central utility token.

DEX Spot Quantity by Chain (Blockworks Analysis – October 22, 2025)

Stablecoins and funds fashioned one other pillar of progress, with BNB Chain rating among the many prime networks for transaction quantity and person engagement in these areas. Integration with tokenized treasuries from companions similar to Ondo Finance and franklin templetontogether with Circle’s USDC deployment and cross-chain bridging, has deepened liquidity. Piloting real-world property linked to exchanges, similar to Kraken’s xStocks and tokenized funds, has prolonged BNB’s utility to mainstream situations.

The chain hosts 1000’s of initiatives throughout DeFi, gaming, social tokens, and NFTs, with BNB serving as the primary unit of participation. This tied demand to rising ecosystems, fused parts of CeFi and DeFi, and supported long-term worth aligned to utilization slightly than cycles.

Vital adjustments have occurred in entry to the US market, which was beforehand restricted however is now evolving because of regulatory developments. BNB Digital Asset Belief (DAT) and ETF pipeline and itemizing on platforms similar to: robin hood Coinbase has enabled fiat-based publicity for members. full forgiveness Binance founder CZ eliminated potential limitations and prompt alternatives for developer onboarding and company integration in funds, custody, and infrastructure. This positioned North America as a possible progress engine and accelerated adoption in underserved areas.

Product diversification additional expands the scope of traders’ entry to BNB’s story. Regional DATs similar to Nasdaq-listed BNB Community Firm provided amplified returns, whereas ETFs within the approval course of provided the efficiency of intraday liquidity mirroring tokens. Yield funds like Hush International responded to the order by proscribing direct holdings of the token however permitting investments linked to BNB.

With KYC/AML compliance, unbiased audits, and standardized disclosures, these devices have lowered friction and expanded the person base throughout liquidity and yield preferences. Current examples embrace that of CMB Worldwide. $3.8 billion Cash market funds tokenized on the BNB chain by way of CMBMINT and CMBIMINT. It integrates with protocols similar to Venus for collateralized lending.

Previous efficiency and cycle resilience

BNB demonstrated resilience throughout market cycles and outperformed its friends. layer 1 Token topic to DAT. From 2017 to October 2025, it achieved an annualized worth improve of ~113%, outperforming ETH, BTC, and SOL when it comes to structural good points. This decoupling from broad market beta allowed BNB to take care of its power in the course of the financial downturns of 2018 and 2022, permitting it to regain highs via utility and provide self-discipline. This consistency outcomes from on-chain financial exercise, platform consolidation, and deflationary combustion, making it appropriate for long-term structured merchandise that generate charges and yield.

BNB Outperformance and Decoupling (CoinMarketCap – October 7, 2025)

BNB as a strategic portfolio asset

BNB appealed to new entrants by going past crypto natives to enhance risk-adjusted returns with a diversified portfolio. Our simulations present that allocating 2 to five p.c to BNB will increase the Sharpe ratio for a mixture of shares, bonds, and commodities from 0.95 to 1.25, permitting you to achieve Web3 publicity whereas enhancing diversification. Independence from crypto beta, pushed by twin CeFi-DeFi engines, displays actual utilization and progress slightly than macro liquidity.

The present scenario has created a chance for asset managers, particularly these with institutional holdings like Utilized DNA’s $27 million BNB and CEA Industries’ 480,000 tokens for monetary methods, to consolidate BNB in its place.

Balancing the crypto trilemma

BNB has addressed the crypto asset trilemma (financial throughput, safety, and liquidity) via Proof-of-Staked-Authority consensus and multi-venue entry. Channel person exercise via transactions and deployments whereas sustaining strong validation and low-friction alternate.

Not like networks that commerce one dimension for one more, BNB maintained steadiness and transformed its holdings into lively participation via Launchpools, airdrops, and governance. Historic incentives have outpaced friends, with annual will increase of 15-20% to encourage diversification and retention. This one-token engagement spans lending, buying and selling, and gaming, strengthening the ecosystem.

Strategic highlights of the BNB ecosystem

BNB’s ecosystem served as a extremely environment friendly platform for issuance and buying and selling of Web3 property, integrating centralized and decentralized parts. Incentives inspired long-term holding via applications that supplied rewards and entry, whereas deflationary fashions matched use and worth.

Enterprise members like YZi Labs have supported initiatives from proof of idea to world buying and selling, establishing prime token pairs and driving progress throughout the BNB chain and exchanges. This full-cycle hub coated incubation, deployment, liquidity and participation.

The Launchpool mechanism causes lockups, generates a peak annual worth improve of 15-20%, and outperforms SOL (6.5%) and ETH (4.5%) by leveraging native integration. Characterised as Web3’s “know-how platform,” BNB combines Binance’s visitors with strong infrastructure and utilities like Alpha, distinguishing it from BTC’s store-of-value function and ETH’s DeFi focus.

BNB’s place within the development of Web3

BNB encapsulates entry, utility, and safety of provide, providing holders the total spectrum of Web3, from blue-chip chips to rising tokens. Whereas ETH focuses on DeFi infrastructure and BTC on worth storage, BNB operates as an environment friendly buying and selling engine for the worldwide Web3 financial system. Its on-chain progress, incentives, and compression mechanisms place it as an necessary allocation software for traders navigating this area.

supply:

- BNB: The Core Engine Behind the World Financial system (YZi Labs): https://www.yzilabs.com/weblog/bnb-the-core-engine-behind-the-global-web3-economy

- Franklin Templeton Integration (BNB Chain Weblog): https://www.bnbchain.org/en/weblog/franklin-templetons-benji-technology-platform-onboards-bnb-chain-unlocking-the-next-era-of-tokenized-finance

- DEX: Spot quantity by blockchain: https://blockworks.com/analytics/dex-volume/dex-blockchain-12748