After years of relentless shopping for, Michael Saylor’s digital asset treasury agency Technique has quietly slowed its accumulation of Bitcoin.

In current weeks, the corporate’s BTC purchases have fallen to only a few hundred cash, in keeping with firm filings, marking a pointy slowdown for the corporate, which is the biggest holder of the flagship cryptocurrency.

Through the firm’s third-quarter earnings name, Thaler stated the financial slowdown was because of the firm being at an “inflection level.”

Based on him:

“MNAV, our multiple-to-net asset worth, is trending downward and can proceed to say no over time because the Bitcoin asset class matures and volatility decreases.”

However this lull might be short-term, as the corporate’s new funding route is now in movement.

This features a 10% euro-denominated perpetual most well-liked inventory listed in Luxembourg and a US floating fee subject that has simply regained its $100 par worth.

Collectively, these merchandise may restart flows into Technique’s Bitcoin reserves and check whether or not yield-seeking buyers will as soon as once more fund Saylor’s $70 billion wager on digital shortage.

Internationalize your technique with STRE

Technique’s newest quarter highlighted each pauses and prospects. The corporate reported a web revenue of $2.8 billion, primarily from unrealized beneficial properties on its Bitcoin holdings, however solely a small variety of cash had been added.

Business analysts blamed the financial slowdown on a decline in demand for the corporate’s widespread inventory and 4 publicly traded most well-liked shares, which have lengthy been the corporate’s important supply of funding.

Bitcoin analyst James Verify stated:

“The corporate is struggling to take care of costs above par, and day by day buying and selling volumes are so low that nobody can measurement them up. Demand is lukewarm.”

Nonetheless, as firms increase internationally, issues can change.

On November 3, Technique launched Collection A Perpetual Stream Most well-liked (STRE). It is a euro-denominated safety with an annual dividend of 10%, paid quarterly in money.

Dividends are cumulative and improve by 100 foundation factors for every interval missed, as much as a most of 18%. It added that proceeds from this financing will probably be used for “common company functions, together with the acquisition of Bitcoin.”

Notably, the financial context is encouraging experimentation.

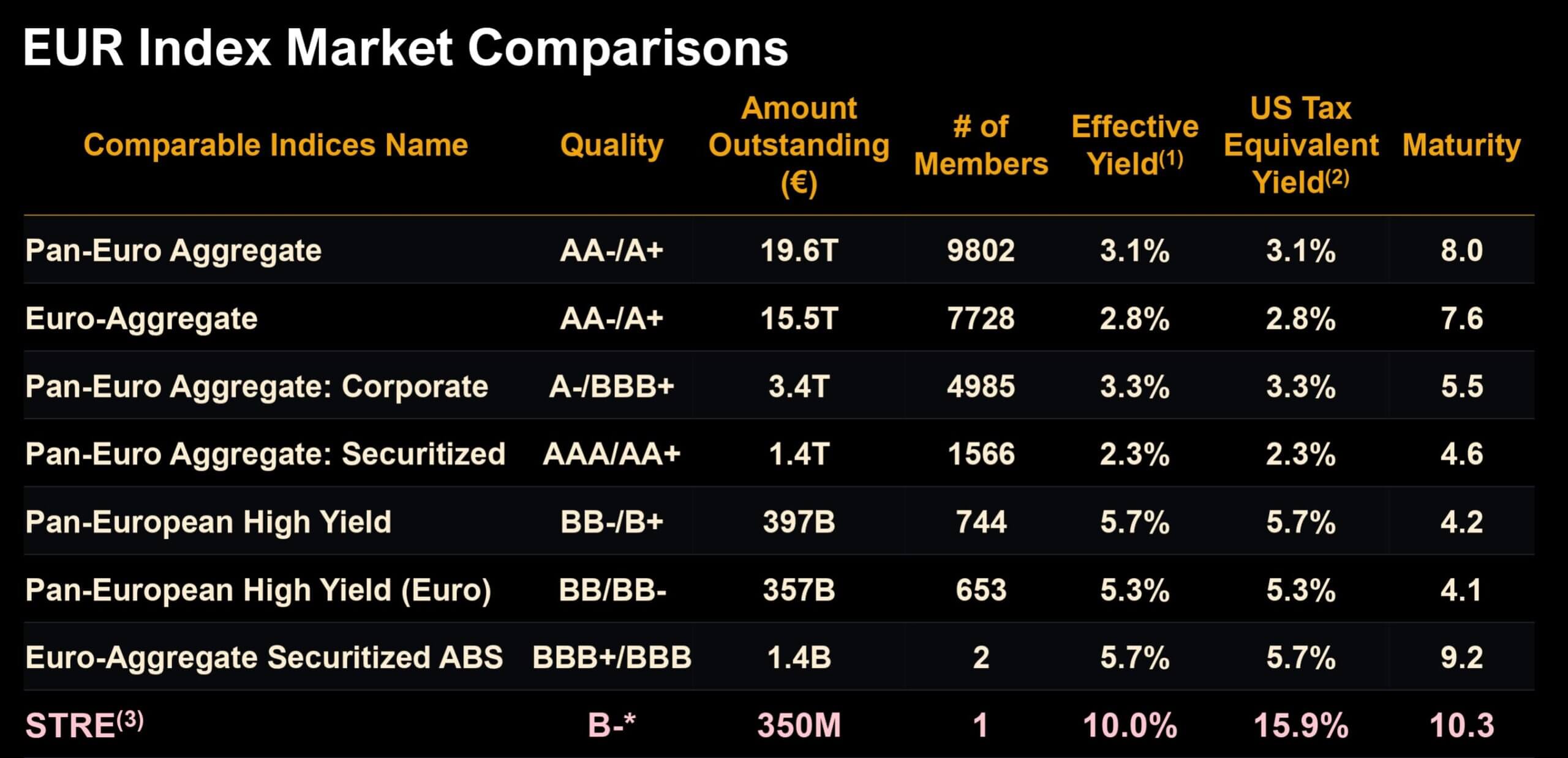

Even after the European Central Financial institution’s tightening cycle, spreads on euro-denominated company bonds stay slender by historic requirements, in keeping with BNY Mellon. The area has seen the second highest funding grade inflows within the final six years, with a complete market measurement of greater than €3.2 trillion throughout over 3,700 issuers.

STRE’s 10% coupon stands out, as BBB yields shut to three.5% and Single B yields round 6.5% (FTSE Russell). Bitcoin analyst Adam Livingston stated:

“Even earlier than taxes, STRE doubles high-yield coupons and triples investment-grade coupons. Yields after U.S. tax equivalents explode to fifteen.9 p.c due to ROC therapy.”

STRC reaches par and resumes US faucet

In the meantime, the European itemizing is following developments domestically and will rekindle extra sources of capital for the corporate.

At Technique’s third-quarter earnings convention, the corporate introduced that it’ll elevate the coupon of its U.S.-listed floating fee Collection A Perpetual Stretch Most well-liked (STRC) by 25 foundation factors to 10.5% in November.

This adjustment is geared toward stabilizing the market value and maintaining the popular value close to the $100 goal.

Following this announcement, STRC reached a par worth of $100 for the primary time since its founding in July.

Mark Harvey, an investor at Technique, famous that this growth will enable the corporate to promote new shares and funnel that liquidity into BTC.

he stated:

“The TAM of $STRC is $33 trillion. That is $33 trillion of yield-seeking capital that will probably be drawn to STRC like a magnet as a result of it presents larger yields (10.5%). So, we’ll observe that steering and begin issuing new shares via ATMs to purchase Bitcoin. Merely put, as soon as STRC crosses $100, meaning we’ll begin funneling that $33 trillion into BTC. It is a highly effective catalyst for Bitcoin. ”

Monetary analyst Rajat Soni echoed this enthusiasm, saying:

“STRC $100 means Technique can begin ATM operations for shares to purchase Bitcoin…an entire new supply of funding has been unlocked.”

The truth is, Thaler defined, “As soon as credit score buyers start to know the enchantment of digital credit score, they are going to wish to purchase extra credit score, and we’ll promote extra credit score and subject extra credit score.”

He added:

“We consider that may result in a rise within the worth of our inventory as fairness buyers start to understand the distinctiveness of the Bitcoin monetary mannequin, significantly our uniqueness and our capability to subject digital credit score at scale around the globe.”

What does this imply for Bitcoin?

At its peak, Technique Inc. was probably the most energetic firm shopping for Bitcoin.

Based on Bitwise knowledge, the corporate added over 40,000 BTC in Q3, far outpacing all different public holders. Analysts say such purchases have repeatedly supported market sentiment and, at instances, supported the asset’s spot value.

Based on CryptoQuant analyst JA Maarturn, Technique’s inventory value stays “extremely correlated with the value of Bitcoin,” reflecting that the corporate’s trades usually mirror trades within the cryptocurrency itself.

With the return of STRC and the arrival of STRE, that connection may as soon as once more be strengthened, because it creates a bicontinental funding loop that may reignite company Bitcoin accumulation.

Past the technique’s stability sheet, Twin Preferences deepens the monetary integration of Bitcoin with the normal ecosystem. Every time a inventory is offered, conventional yield-seeking capital is channeled into publicity to Bitcoin’s stability sheet worth, successfully changing buyers’ need for revenue into oblique demand for the asset.

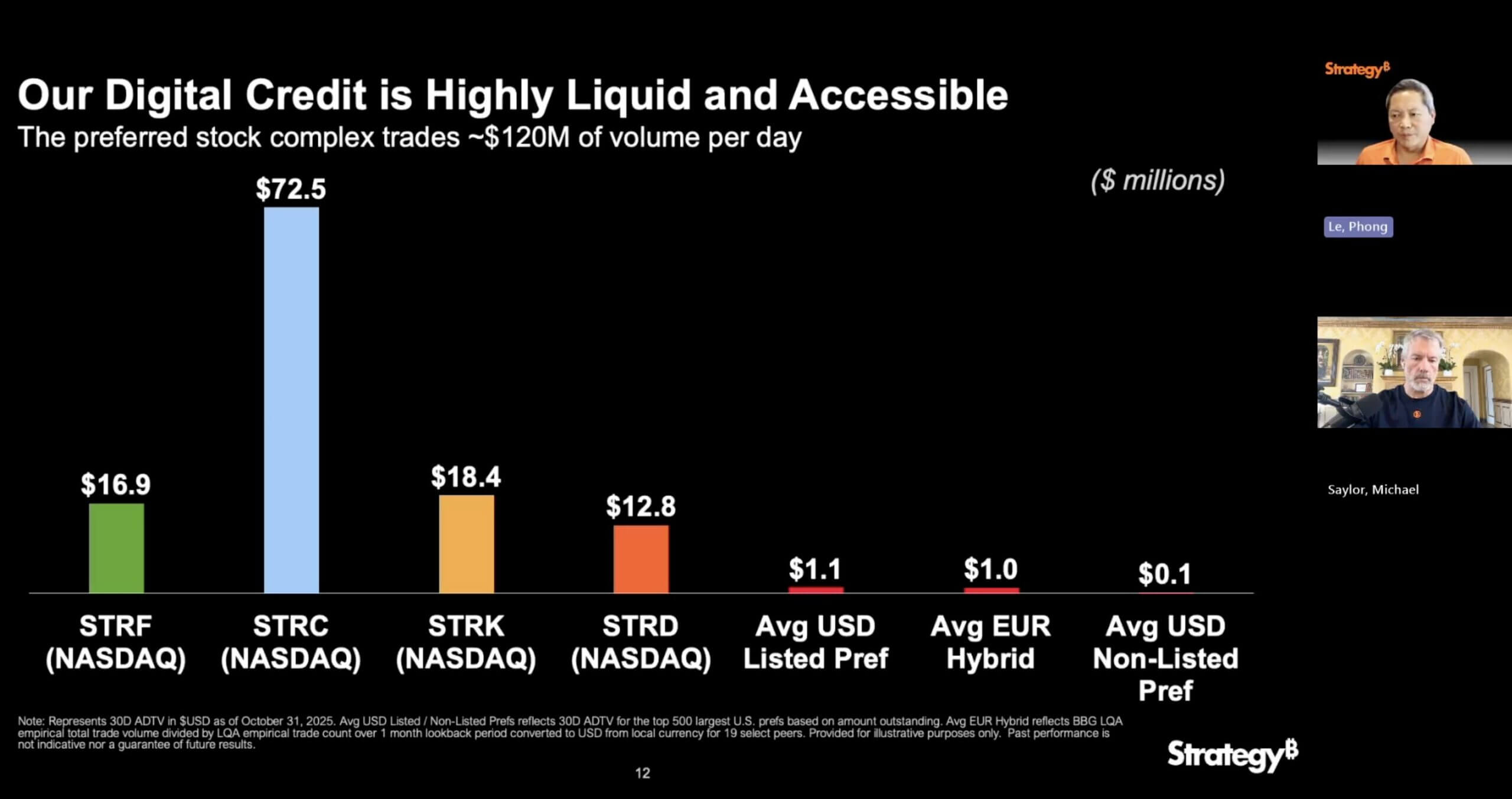

Bitcoin analyst Peter Duan additionally famous that these merchandise will introduce an essential “liquidity” aspect to the market.

Based on him:

“One of many extremely undervalued elements of the MSTR most well-liked inventory is the truth that it has large liquidity backed by the world’s most primitive asset, Bitcoin. For reference, the typical USD-listed most well-liked inventory has a The typical euro-listed most well-liked inventory has day by day liquidity of solely $1.1 million. In different phrases, the liquidity of the technique’s most well-liked shares ranges from 12x to 70x.

This depth is essential as a result of elevated turnover reduces funding friction and accelerates the stream of funds between investor demand and Bitcoin acquisition.

Subsequently, if STRC maintains par and STRE beneficial properties momentum in Europe, every new tranche may function a direct liquidity conduit from conventional markets to the crypto economic system.

Moreover, Thaler’s mannequin recasts Bitcoin’s macroscopic position as a collateral base for yield engineering, somewhat than only a speculative reserve.

This gives a transparent suggestions loop and reveals {that a} wholesome most well-liked market permits new issuance and funds Bitcoin purchases. These purchases reinforce the market’s notion of stability sheet worth and shortage.