Ethereum (ETH) buying and selling quantity continues to rise, and exercise on Binance can also be rising. ETH exercise is changing into extra speculative as this token gives directional buying and selling and fuels the derivatives market.

Ethereum is changing into a speculative asset attributable to elevated Binance exercise and the expansion of the derivatives market general. In comparison with the earlier cycle of Ether, the impact of spinoff quantity is extra pronounced. Beforehand, ETH spot demand was driving up the value, immediately reflecting the expansion of the ecosystem.

The token fell to the $3,000 degree earlier than recovering to $3,615.63. Ether additionally confirmed a bent to quickly rebuild its open curiosity. After hitting a low of $18 billion in early November, Ethereum’s open curiosity has rebounded to over $18 billion. Over the previous 24 hours, ETH open curiosity has recovered sooner than BTC and elevated greater than BTC. 5.5%.

ETH nonetheless controls 11.9% of the market cap and is buying and selling at 0.034 BTC.

ETH collects open curiosity instantly

The present ETH market cycle has far exceeded the 2021 bull market by way of derivatives open curiosity. The expansion of derivatives infrastructure and the demand for hedging by choices are altering the ETH market, resulting in extra speculative worth actions.

Binance stays the biggest market, with $7.1 billion in open curiosity. Nevertheless, the alternate has but to get well its peak open curiosity from August 2025.

ETH is extra unstable in comparison with BTC and in addition displays common altcoin recoveries extra rapidly. Nevertheless, as in previous cycles, the value restoration doesn’t essentially replicate Ethereum adoption or on-chain exercise. This time, the valuation of ETH could rely on derivatives exchanges, giving it new affect over Binance.

Binance has emerged as a number one venue for large-scale buying and selling, together with spot and derivatives markets. This alternate will take up nearly all of new token exercise in addition to speculative ETH exercise. HyperLiquid is influential, however it solely has $1.8 billion in open curiosity in Ether.

On the similar time, extra dramatic liquidations can happen if open curiosity is targeting one alternate. In consequence, Ethereum short-term liquidations amounted to $90.64 million previously 24 hours. Binance additionally led the day’s liquidation exercise, with whole liquidations totaling $7.8 million.

Can ETH revisit $4,000?

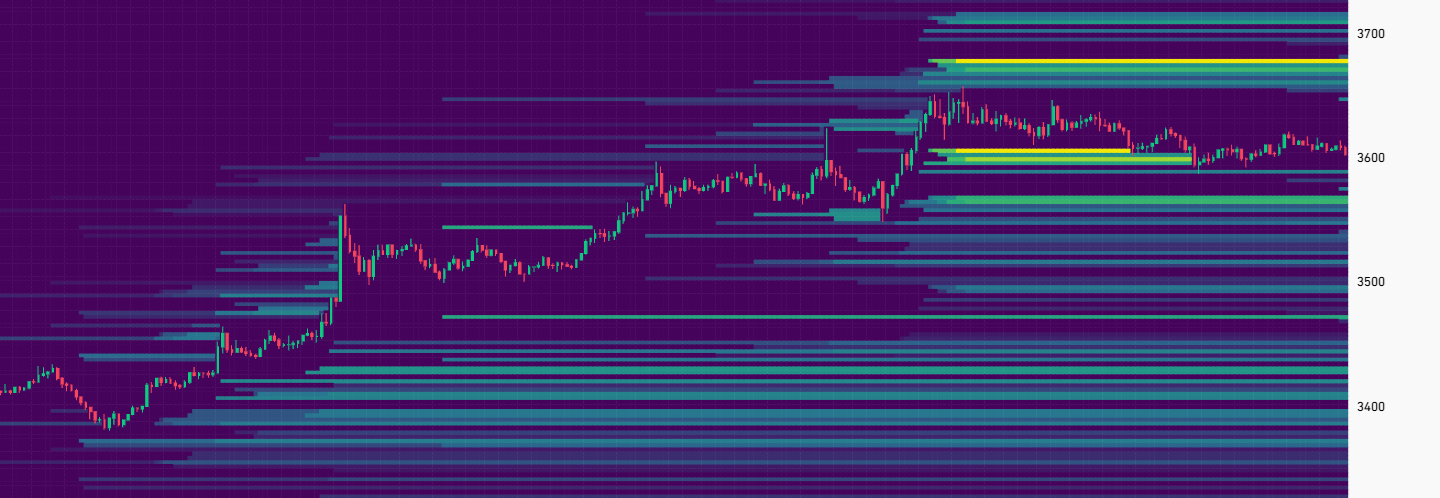

Primarily based on liquidity within the derivatives market, ETH shall be locked in a spread as a result of re-accumulation of lengthy liquidity.

On the draw back, ETH has positions as much as $3,300. Nevertheless, quick positions have risen to round $3,700, suggesting {that a} rise to $4,000 is unlikely within the quick time period.

ETH liquidated virtually all quick positions and re-accumulated lengthy liquidity supporting $3,300. |Supply: Coinglass.

At its present worth vary, ETH is poised for each a rally to a brand new worth vary and a short-term crash.

Ether is buying and selling at a slight premium within the futures market, suggesting a possible breakout. In perpetual futures, ETH obtained a slight low cost and traded close to $3,600.