The robust wave of institutional shopping for that has fueled Bitcoin’s rise since early 2024 may additionally amplify the correction if market fatigue continues, in keeping with Markus Thielen, CEO and former portfolio supervisor at 10x Analysis.

In an interview with Bloomberg, Thielen stated the crypto market, and Bitcoin (BTC) particularly, is displaying clear indicators of fatigue after a tough October that noticed the most important liquidation occasion in business historical past. These losses exacerbate the underlying macroeconomic dangers that Bitcoin more and more displays, he famous.

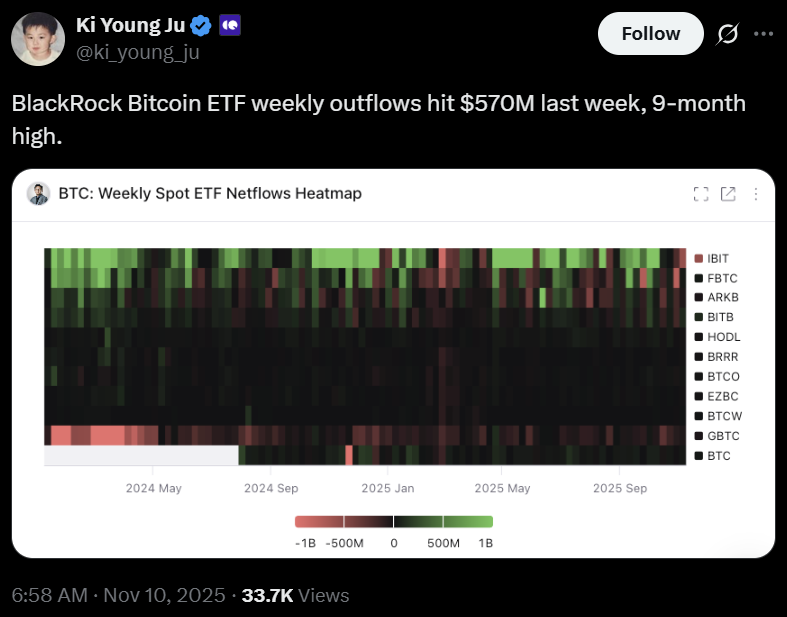

Thielen warned that institutional inflows, notably from spot Bitcoin exchange-traded funds (ETFs), are the first driver of inventory value features in 2024, so downward strain may speed up amongst that very same investor base if exercise continues to gradual.

“Sooner or later, a threat supervisor might step in and say, ‘We have to exit the place or scale back the place,'” Thielen stated. “There’s a threat that Bitcoin will proceed to underperform as folks must rebalance their portfolios.”

The feedback come amid rising outflows from U.S. spot Bitcoin ETFs. Final week, funds recorded a complete of $939 million in withdrawals, reflecting a decline in funding urge for food amongst institutional buyers, in keeping with CoinShares knowledge.

sauce: Ki Younger Joo

Associated: ISM Manufacturing PMI suggests Bitcoin cycle may lengthen past historic norms

Bitcoin efficiency can be poor in 2025

Surprisingly, Bitcoin has underperformed most main asset courses thus far this yr. That is an uncommon sample within the calendar yr following the latest halving. The world’s largest cryptocurrency has lagged gold, tech shares and even some Asian inventory indexes since January, regardless of hitting a number of all-time highs, together with a peak above $126,000 in early October.

Bitcoin has outperformed gold in annual returns for many of its historical past, however 2025 is shaping as much as be completely different. Bitcoin is up greater than 8% because the starting of the yr, whereas spot gold is up 57%. sauce: curved

Nonetheless, Thielen’s 10x Analysis shouldn’t be utterly bearish on Bitcoin. As Cointelegraph lately reported, the corporate believes shorting Ether (ETH) is a more practical hedge than betting on Bitcoin itself, and Bitcoin stays a most well-liked asset for institutional buyers in search of publicity to cryptocurrencies.

A lot of Bitcoin’s current weak spot has been attributed to whales, that are massive Bitcoin holders, profiting above the $100,000 stage. Alex Saunders of Citigroup instructed Bloomberg that the variety of wallets holding greater than 1,000 BTC has been progressively reducing in current weeks.

Associated: Sorry, Moonvember Candidates, Macro Uncertainty Indicators a Sideways Moon