Miners have been actively depositing BTC on Binance, becoming a member of inflows from newly created whale wallets. Though mine reserves stay excessive, they may nonetheless trigger short-term promoting strain.

Whereas securing short-term income from BTC, miners keep a steadiness of 1.89 million cash, together with outdated wallets the place they by no means switch belongings. Binance has turn out to be the primary place for BTC deposits within the quick time period, as miners are at present producing cash for revenue.

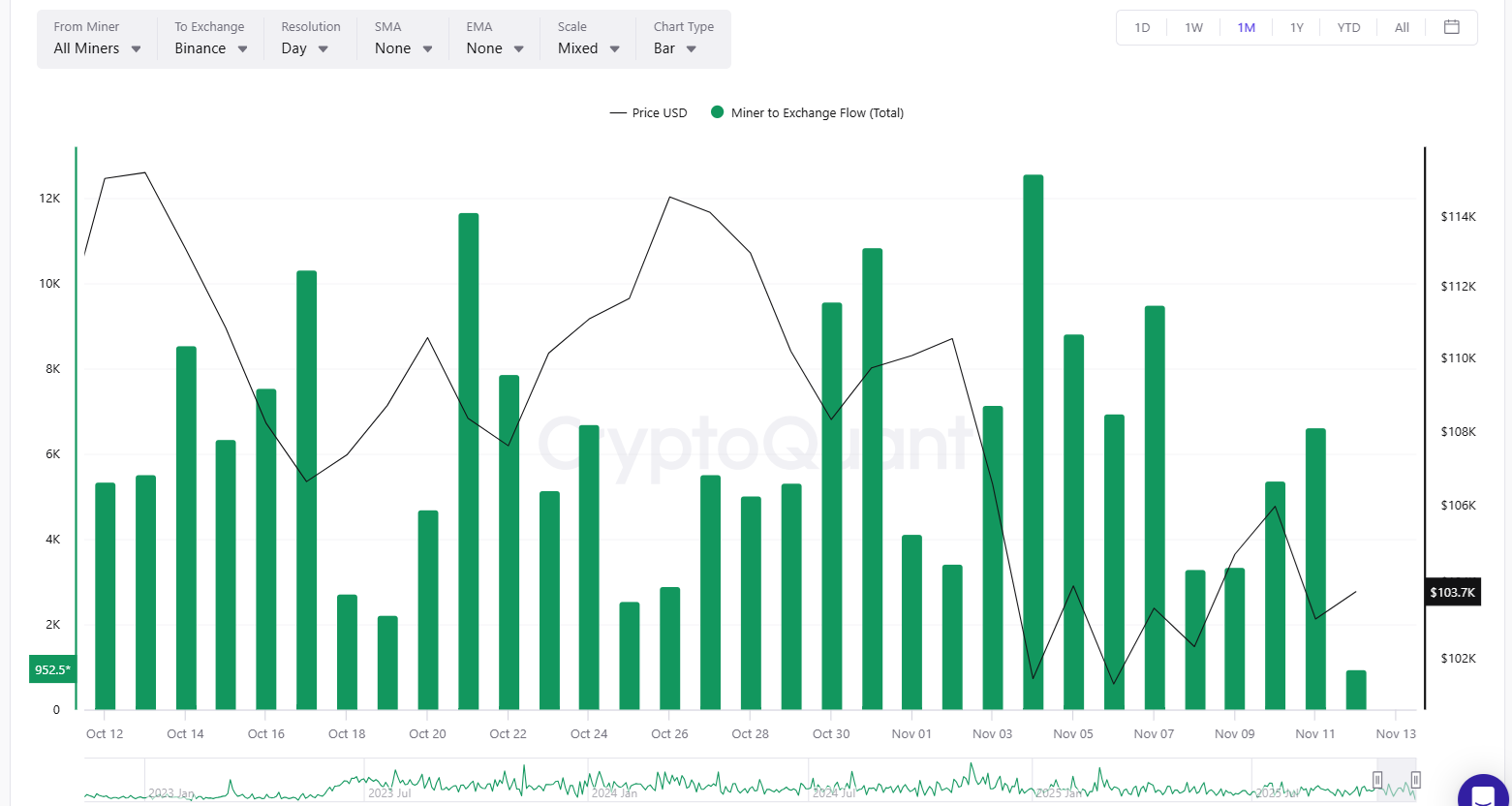

Miner inflows to Binance remained excessive in November, with over 71,000 BTC month-to-date. |Supply: CryptoQuant.

Though miners are working beneath essentially the most aggressive situations in historical past, BTC stays comparatively stagnant, buying and selling at $104,115.

In early November, day by day deposits flowing into Binance reached a peak of 12,564 BTC. Miner deposits additionally far exceed current purchases from finance firms. Beforehand, all of the newly mined BTC was not sufficient to fulfill demand.

Block manufacturing is at present worthwhile, so miners could also be seeking to lock in income. Regardless of the decrease block reward, miners are utilizing extra environment friendly machines and are capable of promote extra cash for revenue. The market nonetheless has the capability to soak up BTC even at costs above $100,000.

Miner manufacturing capability falls beneath all-time excessive

Miners achieved a brand new exercise report in October, making BTC much more aggressive. Many of the cash produced went to the biggest pool. On the similar time, after the institution of recent mining knowledge facilities, mining has primarily turn out to be an exercise that includes giant investments.

BTC issue is at an all-time excessive and has been growing for many of the current revaluation interval. Mining is very aggressive, so there are few makes an attempt to close down capability to cut back issue. New capability is coming on-line after miners modernized their fleets with the most recent ASICs.

BTC miners aren’t seeing something dire state of affairs It’s because mining prices have additionally fallen since July. Extra environment friendly equipment made block manufacturing aggressive once more, and miners had been capable of make the most of cheaper energy contracts. For miners, the previous few months have been one of many longest durations of the yr with no indicators of misery or mining BTC at the next value than the market worth.

BTC trade reserves stay low

Total, BTC overseas trade reserves stay low regardless of current deposits. Spot gross sales are assembly demand as BTC transitions to new whale wallets.

Binance holds over 566,000 BTC in reserves, a internet enhance of over 10,000 cash in a number of weeks. Nevertheless, even Binance’s reserves have decreased in comparison with earlier cycles.

The the explanation why miners promote are numerous. Some firms could also be seeking to promote outdated cash and pivot and fund new AI knowledge facilities.

Total, the price of producing cash varies broadly between miners. Older mining operations can value not less than $45,000 to supply a coin. New investments have produced as much as $117,000 of BTC. current evaluation This disparity means that it may result in additional consolidation within the mining area.