Bitcoin (BTC) continues to navigate a posh market setting outlined by shifting ETF flows, macro headwinds, and evolving investor sentiment. Regardless of gaining simply 2% over the previous week, the flagship cryptocurrency is down greater than 8% month-on-month, briefly falling under $100,000 earlier than stabilizing round $105,000.

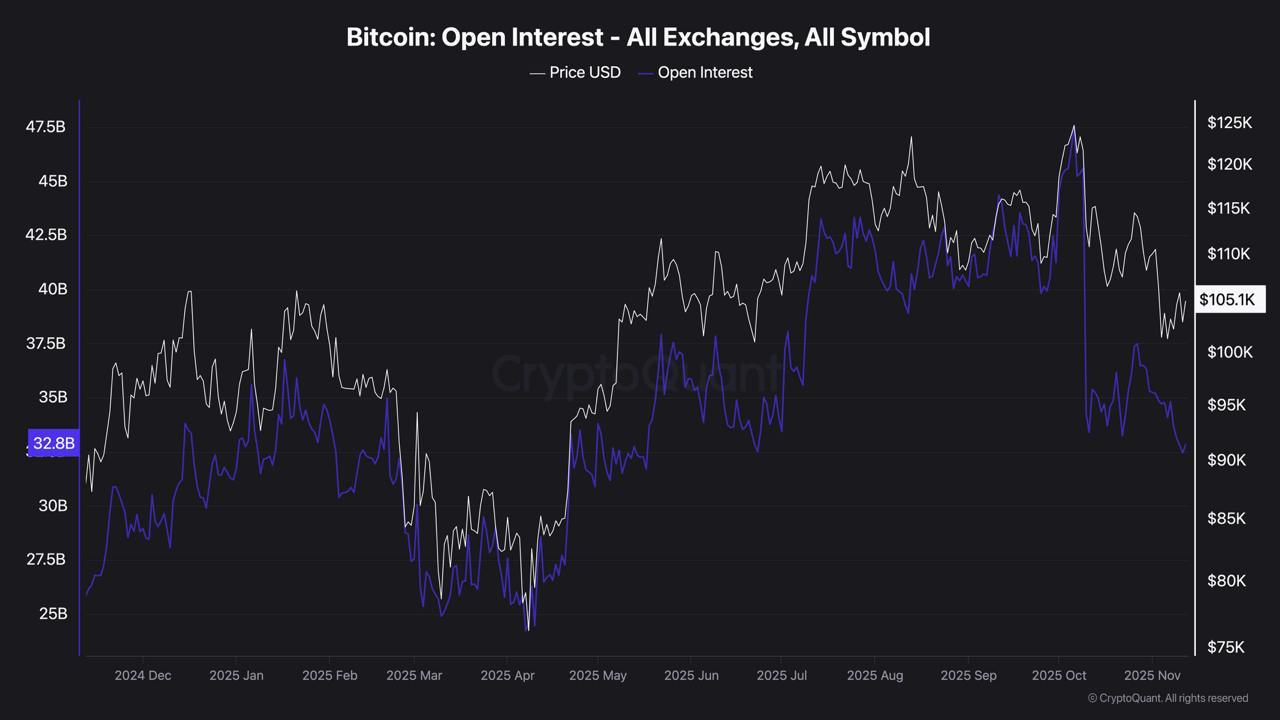

On the identical time, sure indicators are displaying alarm. Bitcoin open curiosity throughout exchanges has fallen to its lowest degree in seven months and is presently hovering round $32.1 billion, in line with information obtained from Finnvold’s analytics platform. cryptoquant November twelfth.

This was notable on the time as a result of open curiosity represents the entire quantity of futures contracts excellent and serves as a barometer for speculative participation. A contraction sometimes signifies merchants are unwinding leveraged positions and sometimes displays diminishing confidence or elevated uncertainty.

Curiously, this decline comes amid waning short-term enthusiasm for spot Bitcoin ETFs, which have been a key driver of demand originally of the yr. After weeks of document inflows, ETF momentum has slowed, with some funds seeing modest outflows as buyers reassess their danger publicity.

The softening in derivatives buying and selling subsequently displays that pause, suggesting that institutional buyers could also be shifting to the sidelines whereas ready for clearer macro and regulatory indicators.

Bitcoin on-chain information

Nonetheless, behind the scenes, structural indicators proceed to supply help. The correlation between the US 10-year Treasury yield and Bitcoin reversed to -0.88, highlighting Bitcoin’s rising attraction as a portfolio hedge in opposition to conventional markets. In the meantime, on-chain information reveals that long-term holders proceed to build up, suggesting confidence in Bitcoin’s long-term retailer of worth function regardless of waning speculative enthusiasm.

Wanting forward, analysts are eyeing a restoration in open curiosity and new inflows into ETFs, a mixture that might reintroduce volatility and directional momentum. On the draw back, the $100,000 to $104,000 zone stays a key help space. Failure to maintain this degree might result in additional deleveraging, whereas a sustained shut above $106,000 might reignite bullish sentiment.