Essential factors

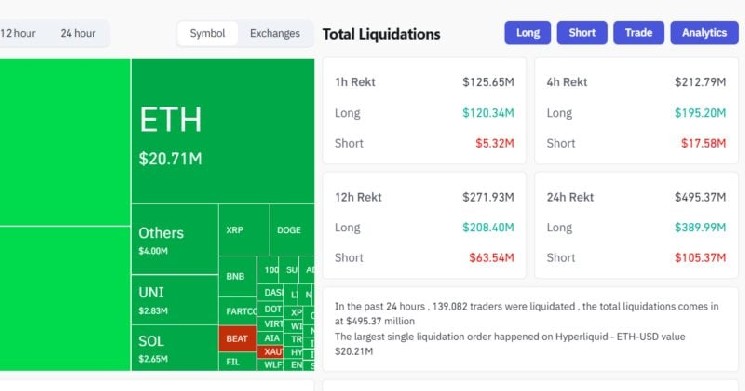

- When Bitcoin fell under $103,000, over $120 million of lengthy positions had been liquidated.

- Main exchanges similar to Binance and Bybit have pressured the closing of leveraged lengthy positions.

Bitcoin fell under $103,000, with greater than $120 million in liquidations and widespread pressured closures of leveraged lengthy positions throughout main exchanges.

The drop in costs brought about a sequence liquidation impact, amplifying the downward motion. Exchanges similar to Binance and Bybit reported important lengthy place extinctions throughout value sweeps.

Cryptocurrency markets have seen elevated volatility in current buying and selling, with liquidation occasions creating additional downward stress on digital belongings. An actual-time liquidation heatmap from main exchanges highlighted the dominance of lengthy place liquidations as Bitcoin retreats from excessive ranges.

The liquidation means exchanges are pressured to shut buying and selling positions that had been betting on value will increase to unwind leveraged positions amid market volatility.