Ethereum is at present beneath the $3,200 milestone after failing to keep up its 100-day transferring common. On-chain provide dynamics stay fascinating regardless of the broad downward development over the previous few weeks. However technically talking, patrons are quickly dropping floor as momentum shifts additional in sellers’ favor.

technical evaluation

Written by Shayan

each day chart

On the each day timeframe, ETH stays simply above the important thing assist zone round $3,000. The value has fallen beneath the $3,800 stage and the 100-day transferring common situated round $3,400, with each ranges turning into resistance. The 200-day transferring common can be now regularly tilting, reflecting the weakening of the medium-term development.

The RSI has additionally dropped to round 33, indicating bearish momentum, however ETH can be approaching oversold territory. If the asset can’t maintain above $3,000, the subsequent main assist will probably be across the $2,500 zone, which additionally aligns with the earlier demand space originally of Q3. If patrons need to regain management, they might want to retake $3,800 on robust quantity and reverse the 100-day and 200-day transferring averages once more.

4 hour chart

On the 4-hour chart, ETH broke the bearish flag to the draw back, confirming its continued decline. After failing to reclaim the $3,600 resistance space, the value bought off closely and is now testing the $3,000 demand zone. The construction stays bearish, with clear highs and lows forming since early October.

Momentum stays weak. The RSI continues to be hovering round 33 on this timeframe, indicating the potential of additional decline. If the $3,000 assist zone breaks, the subsequent necessary stage to have a look at would be the $2,600 space. A brief-term pullback in the direction of $3,300 and even $3,400 might merely present a promoting alternative except there’s a spike in quantity or a clear break by means of the $3,800 resistance zone.

On-chain evaluation

trade reserves

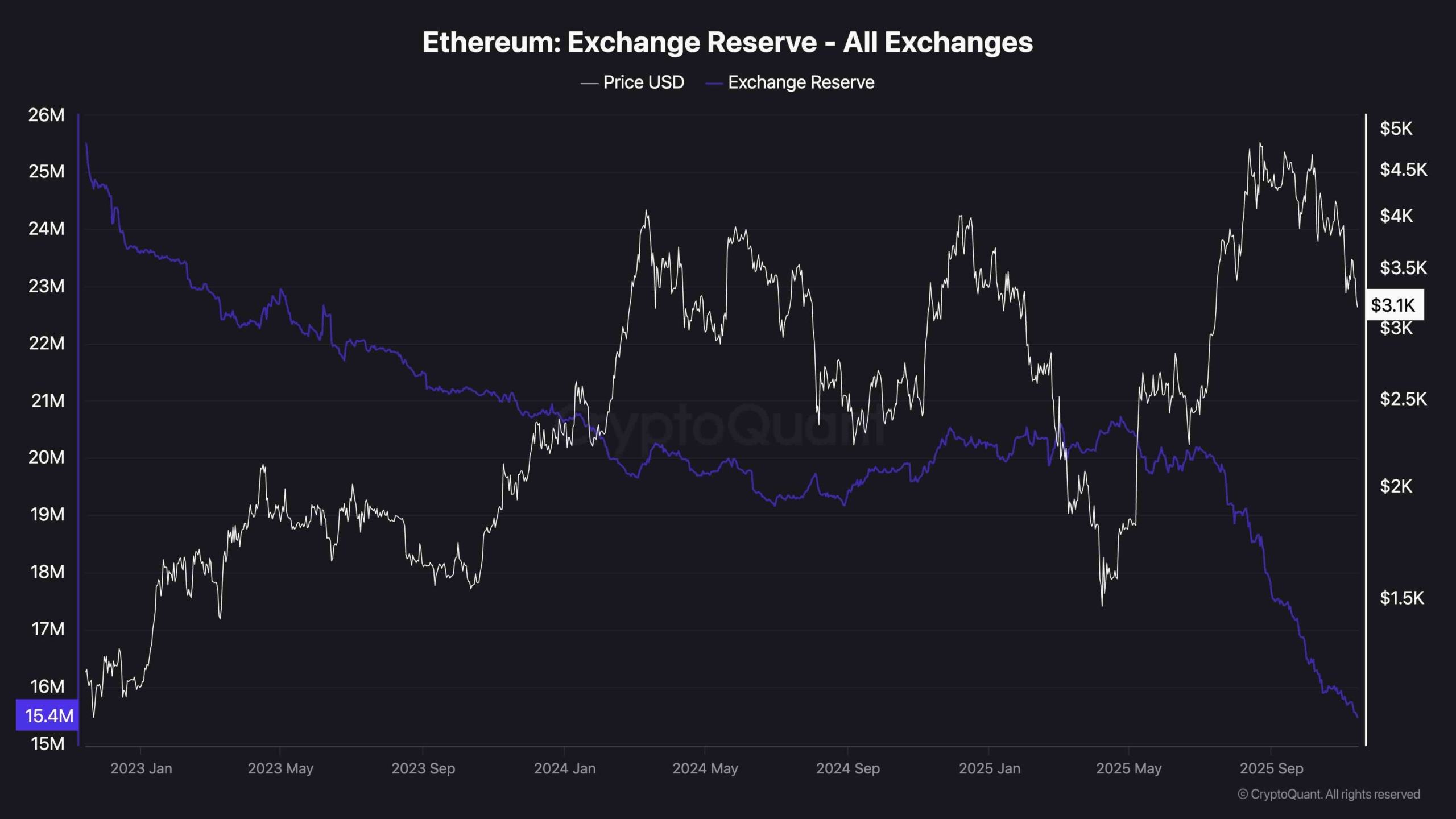

Ethereum’s trade reserves proceed to say no and are at present at multi-year lows. Simply over 15 million ETH is being held on centralized exchanges, which is a structurally bullish check in the long run and signifies that the development of accumulation and self-custody continues.

Nevertheless, regardless of this bullish provide development, current worth actions point out that demand is just not robust sufficient to soak up the present spot promoting. In different phrases, provide is low however patrons should not intervening aggressively sufficient to permit a correction just like the one we’re at present witnessing. Till demand recovers meaningfully, costs could stay below stress even with constructive on-chain flows.