Bitcoin ETFs are already reshaping the way in which buyers work together with cryptocurrencies, however 2026 might be a special 12 months. Rising institutional investor curiosity, world regulatory readability, and elevated competitors amongst asset managers will see these funds play a good larger position in capital flows into Bitcoin.

Why the highest 5 Bitcoin ETFs might be much more essential in 2026

Bitcoin ETFs are not only a comfort. These have grow to be a most well-liked entry level for establishments trying to expose their wallets, non-public keys, or cryptocurrencies with out having to cope with the operational disruption that comes with direct storage.

Because the ETF ecosystem matures, a number of developments are taking form.

- Capital from pension funds, hedge funds, and company treasuries continues to rise.

- A payment struggle amongst main issuers has led to extra investor-friendly merchandise.

- ETF inflows and outflows at present have extra affect on Bitcoin’s short-term value than retail buying and selling.

So if you wish to perceive the place your good cash goes, look to the ETF market.

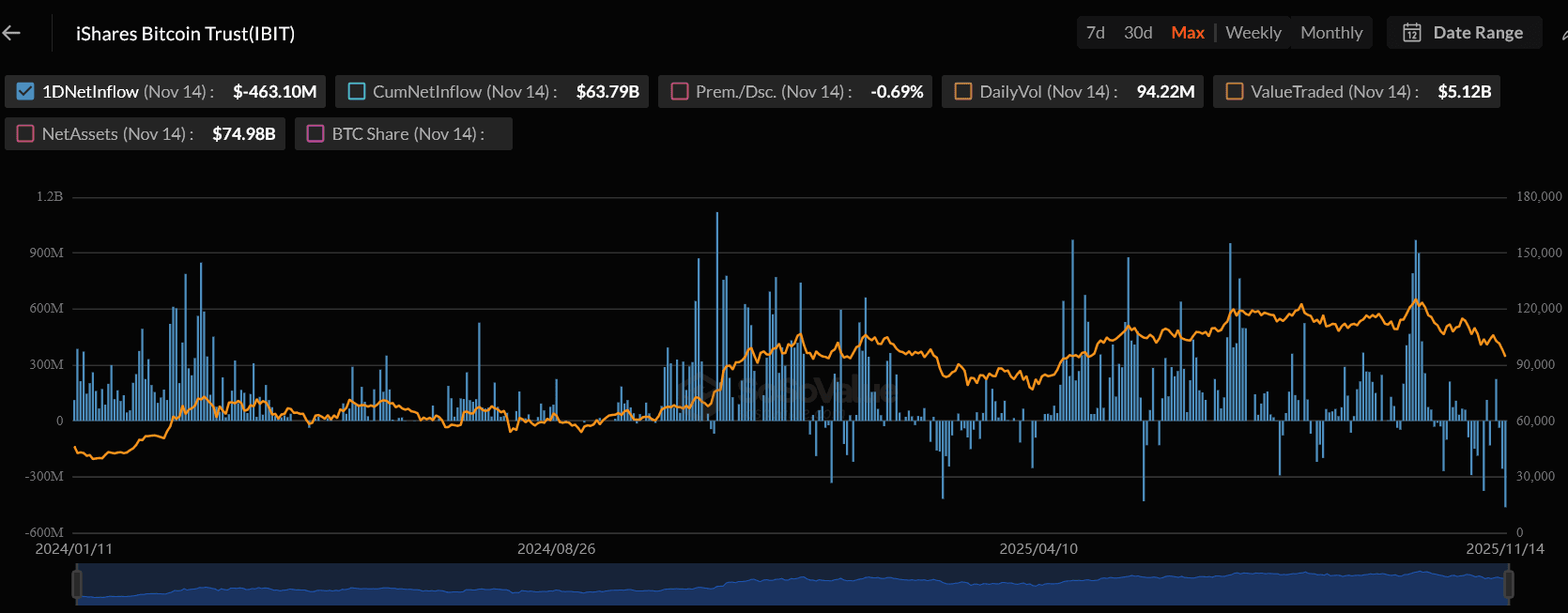

1. iShares Bitcoin Belief ETF (IBIT)

BlackRock’s IBIT: SoSoValue

Blackrock’s IBIT stays the heavyweight champion. With over $74 billion in AUM and essentially the most liquid ETF within the sector, it continues to be the go-to ETF for establishments in search of scale and stability. If there may be an ETF that can lead the market in 2026, it is going to be this ETF. Even a modest spike in inflows right here could cause important fluctuations within the value of Bitcoin.

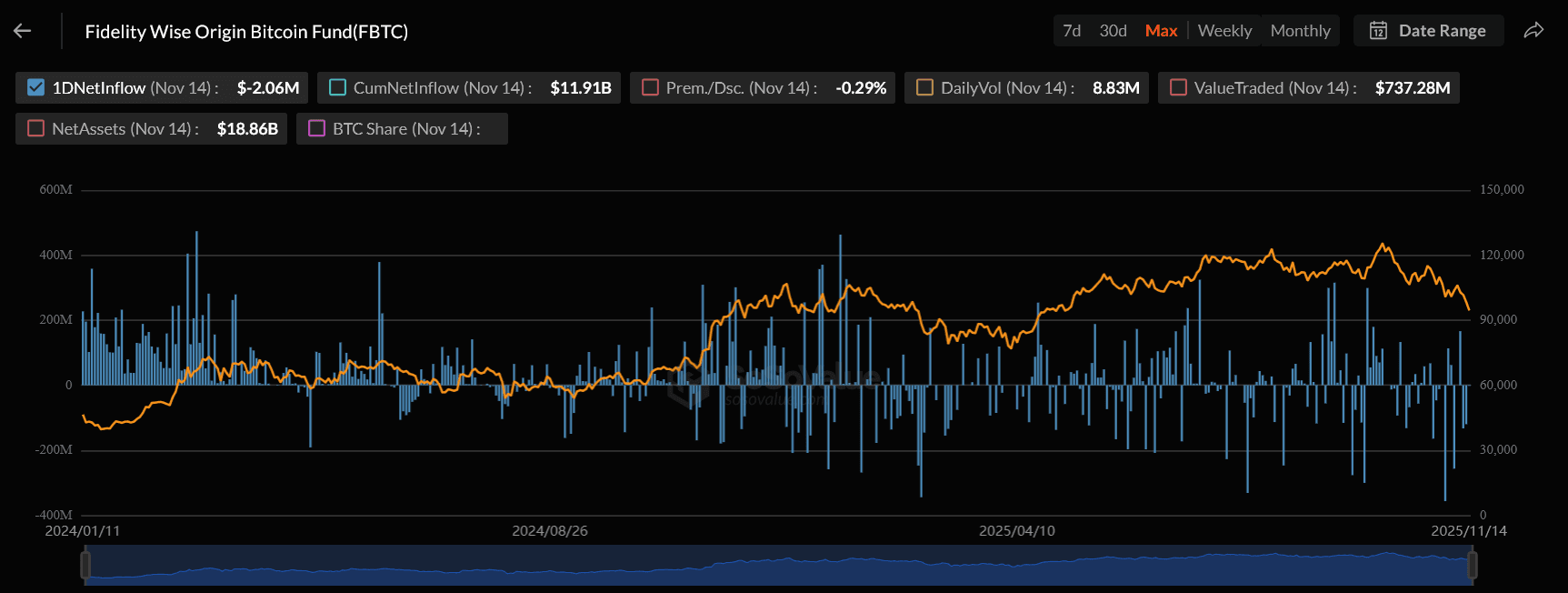

2. Constancy Clever Origin Bitcoin Fund (FBTC)

FBTC: Soso Worth

Constancy brings a long-standing fame that appeals to conservative, conventional buyers. FBTC is predicted to shine in 2026 as retirement funds and long-term institutional buyers improve their Bitcoin allocations. Constancy’s research-driven method and low payment construction guarantee this ETF attracts inflows.

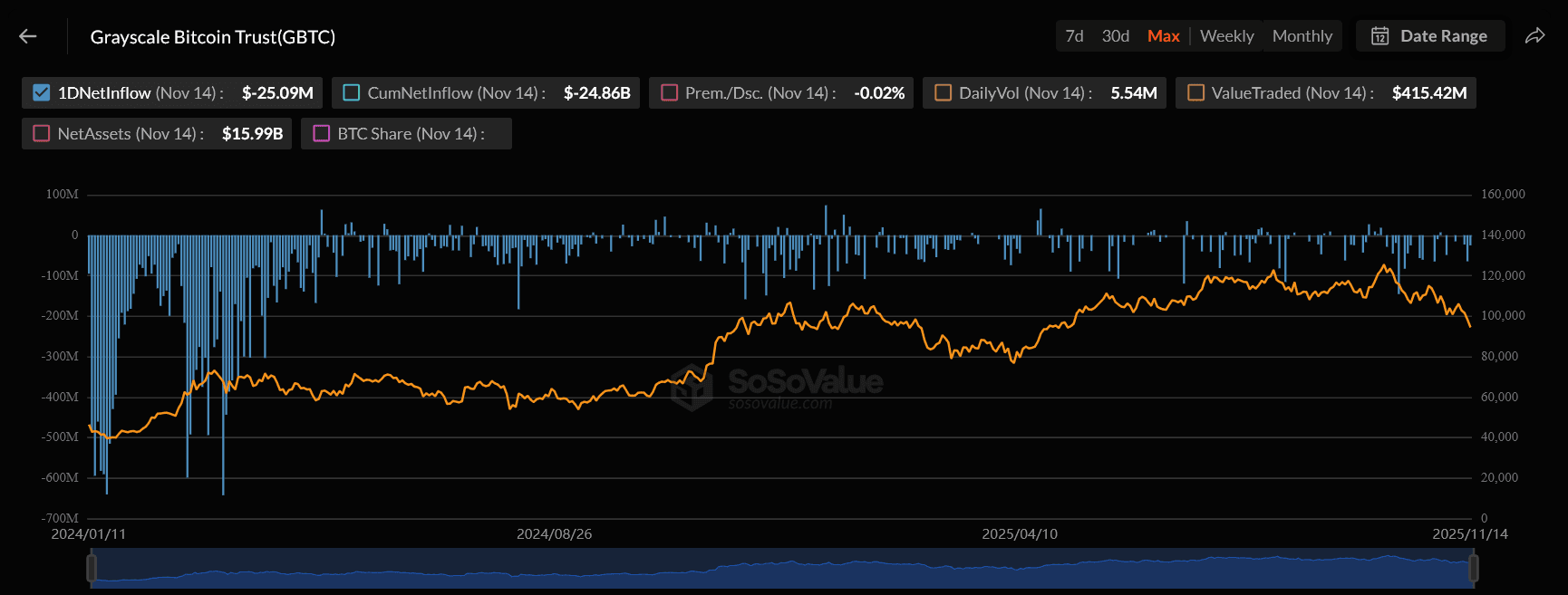

3. Grayscale Bitcoin Belief ETF (GBTC)

GBTC: SoSoValue

GBTC was as soon as the cornerstone of institutional Bitcoin publicity earlier than the ETF was accepted. Even when different firms overtake it, the huge asset base left behind by GBTC will nonetheless give it clout. The affect in 2026 will rely upon whether or not Grayscale continues to decrease charges and modernize its construction to stay aggressive.

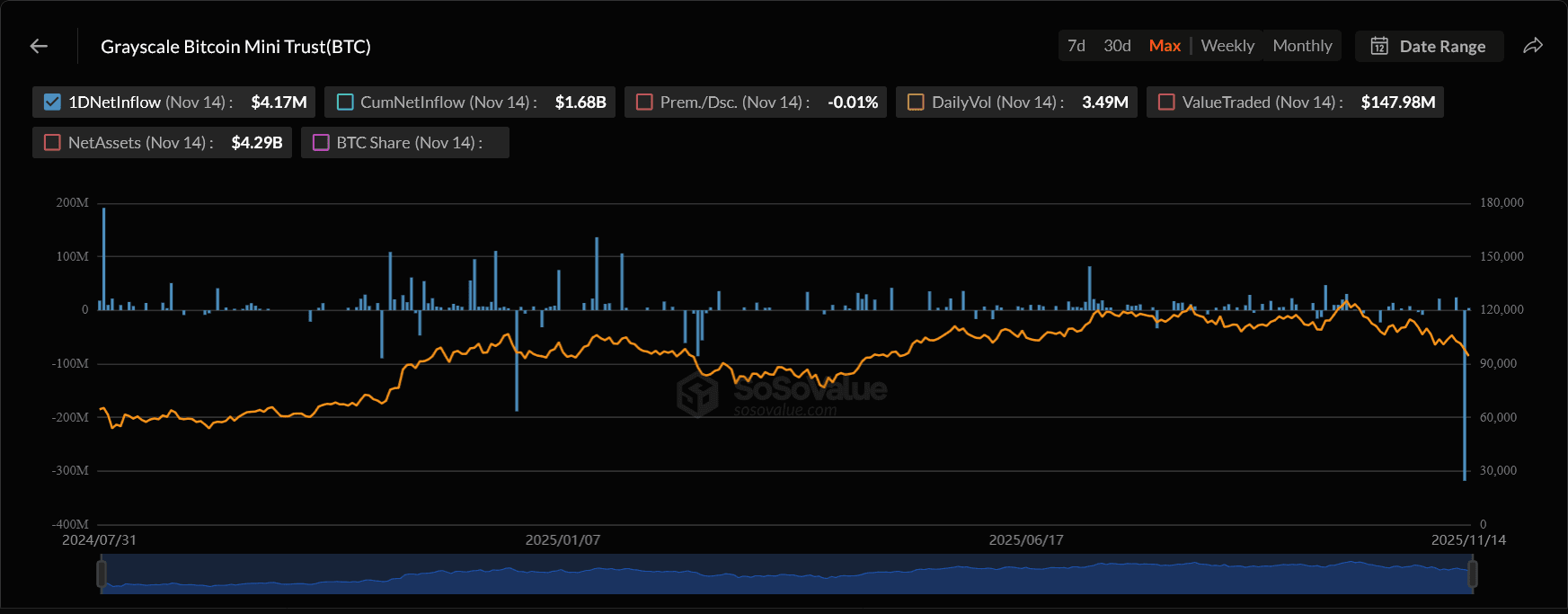

4. Grayscale Bitcoin Mini Belief (BTC)

BTC:SoSoValue

Mini Belief was designed to be leaner and cheaper than GBTC, and its simplicity has helped it discover its personal viewers. As payment competitors intensifies subsequent 12 months, this ETF may see a major surge from cost-conscious buyers and smaller establishments getting into the Bitcoin marketplace for the primary time.

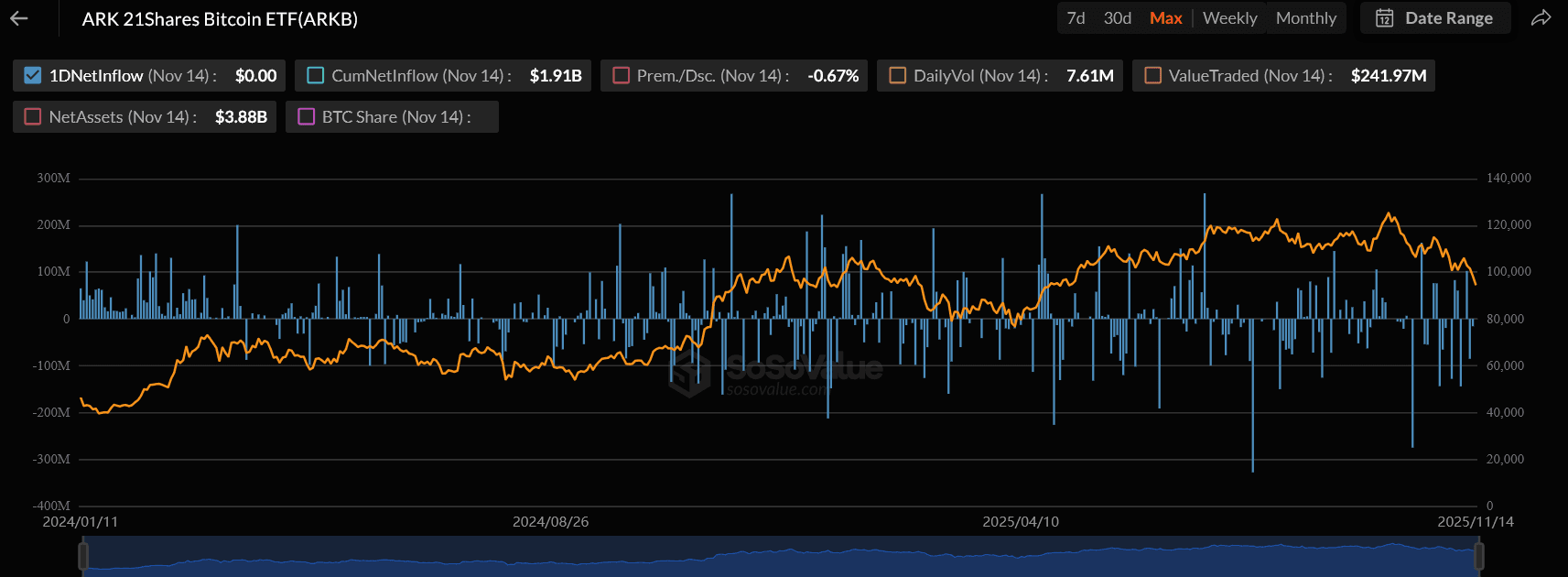

5. ARK 21Shares Bitcoin ETF (ARKB)

ARKB:SoSoValue

ARK Make investments has constructed a model round innovation, and ARKB matches completely into that theme. Cathie Wooden’s constantly bullish outlook on cryptocurrencies has attracted growth-focused buyers searching for extra than simply passive publicity. If Bitcoin enters an additional growth part in 2026, ARKB is prone to outperform when it comes to inflows because of its viewers and technique.

Prime 5 Bitcoin ETFs: What This Means for Traders in 2026

Monitoring these ETFs is not nearly understanding the place the massive bucks are. It is about studying the market ambiance. Capital inflows often sign elevated confidence amongst institutional buyers. Spills typically sign alarm. And since ETFs at present account for a big share of Bitcoin in circulation, their actions may amplify each rallies and corrections.

Whether or not you are buying and selling short-term or occupied with the long-term, listening to the ETF panorama could be of nice profit. These 5 funds, greater than another, will form the story of 2026.

conclusion

These high 5 Bitcoin ETFs are a bridge between conventional finance and digital belongings. In 2026, that bridge might be even busier. IBIT units the tempo, Constancy brings reliability, Grayscale fights to take care of its heritage, Mini Belief maintains value competitiveness, and ARKB leverages its suite of improvements.

If you’d like a transparent image of the place institutional buyers are heading subsequent 12 months, begin by taking a detailed have a look at these 5 ETFs.