Ethereum has been underneath heavy promoting strain over the previous few days because the broader cryptocurrency market enters a extreme correction. Nonetheless, regardless of the volatility and widespread fears, ETH held agency to the important thing degree of $3,000. That is an space that many analysts consider is crucial to sustaining the broader bullish construction.

Now that costs have stabilized and consumers are beginning to emerge once more, some market observers have begun calling for a possible restoration, arguing that Ethereum’s droop could also be nearing its finish.

Including gas to this story is the continued build-up of key gamers, particularly Tom Lee’s Bitmine. Properly-known Wall Road strategist, co-founder of Fundstrat International Advisors, and longtime Bitcoin and Ethereum bull Tom Lee has been probably the most influential voices within the digital asset marketplace for practically a decade. His firm, Bitmine, operates as a large-scale institutional cryptocurrency funding agency targeted on long-term accumulation, market shaping, and strategic positioning throughout panic intervals.

Based on latest on-chain knowledge, Bitmine has continued to buy ETH regardless of the worth drop, displaying sturdy confidence within the asset’s long-term prospects. This habits stands in sharp distinction to the broader market, the place short-term holders are giving in.

Bitmine continues to build up ETH regardless of market weak spot.

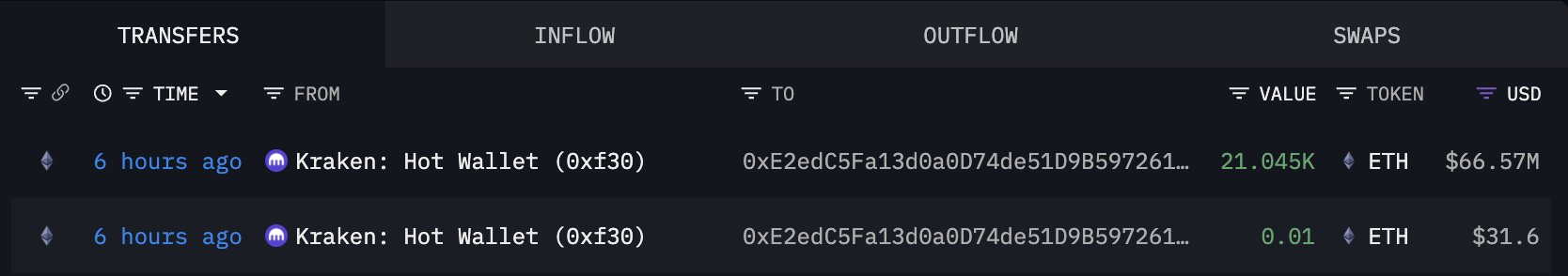

Accumulation exercise round Ethereum just isn’t slowing down in any respect, in response to the newest on-chain knowledge from Lookonchain. 0xE2ed, a newly flagged pockets believed to be related to Tom Lee’s Bitmine, obtained 21,054 ETH (value $66.57 million) from Kraken only a few hours in the past. These strikes reinforce the view that giant, subtle gamers are treating the latest correction as a chance fairly than a risk.

The timing of this switch is noteworthy. Ethereum has been underneath sustained promoting strain for a number of weeks, with sentiment turning sharply bearish because the market struggles with fears, liquidations and a widespread rotation into stablecoins. Nonetheless, regardless of this surroundings, Bitmine linked wallets proceed to aggressively take in provide.

This sample is according to Bitmine’s broader technique of accumulating high-quality cryptocurrency belongings over intervals of uncertainty to safe long-term upside. Massive inflows into amassed wallets throughout downturns have traditionally signaled sturdy confidence amongst institutional contributors, typically outpacing restoration phases and renewed energy.

Let’s assume this pockets is definitely linked to Bitmine. On this case, it signifies that among the most well-capitalized contributors out there are assured within the long-term worth of Ethereum no matter its short-term volatility.

ETH Value Evaluation: Testing Lengthy-Time period Assist Amid Excessive Volatility

Ethereum’s weekly chart exhibits the asset exploring a important zone with its value hovering simply above $3,000, a degree that has traditionally served as a key demand space. After weeks of sustained promoting strain, ETH has retreated from the $4,500 area and is at present retesting its long-term transferring common. Specifically, the 200-share MA sits slightly below the present value, appearing as a structural anchor that has supported Ethereum in earlier cyclical corrections, together with the extreme capitulation seen in mid-2022 and the restoration part in 2023.

The latest candle construction displays elevated volatility. Lengthy wicks counsel a robust response from consumers close to the $3,000 threshold. There was a slight improve in buying and selling quantity throughout this recession, indicating energetic participation from each sellers locking in income and consumers taking positions for a possible reversal. Nonetheless, ETH is under its 50-week MA, displaying that near-term momentum continues to pattern bearish.

Nonetheless, the broader sample is just like the sooner cycle decline, the place Ethereum made a better low after which retraced sharply earlier than resuming its macro uptrend. If ETH can maintain this help and regain the $3,300-$3,500 area, this might signify renewed energy. Nonetheless, a weekly shut under $3,000 dangers opening the door to a deeper correction goal close to $2,700.

Featured picture from ChatGPT, chart from TradingView.com