BTC will proceed to move into exchanges and cash will transfer to the change with essentially the most liquidity. This alteration alerts that buyers are able to take income or rebuild their portfolios as Bitcoin seems for route once more.

BTC flows to exchanges continued to extend in November, with a complete of 580,000 BTC flowing into centralized markets. In comparison with final yr’s interval, international change flows have decreased. Nevertheless, as BTC has fallen beneath $90,000 a number of occasions, there was a current shift to identify buying and selling and change deposits.

Binance nonetheless leads by way of deposit quantity, with 163,800 BTC inflows. Coinbase absorbed 130,000 BTC.

BTC traded slightly below $92,000 as a result of current change stability modifications. The current decline to $88,000 is as soon as once more related to the liquidation of lengthy positions, relatively than an indication of promoting stress or capitulation.

Binance switched to BTC inflows in November

On Binance, after spot buying and selling turned lively, Bitcoin started flowing again to the change from the top of October. The influx coincided with a decline in BTC costs because the main coin misplaced its earlier place of over $110,000.

Smaller markets resembling Bybit and OKX didn’t see a surge in BTC deposits. Causes for this might embrace motion of the coin by US-based buyers, who had been most lively within the fourth quarter. Moreover, Coinbase’s flows are linked to institutional investor platforms and have absorbed a number of the current ETF gross sales.

Binance’s BTC reserves started to rise in late October, signaling a swap to identify buying and selling as whale exercise will increase. |Supply: CryptoQuant.

Binance additionally generated a number of the greatest gross sales throughout BTC declines, typically deepening the decline and triggering waves of liquidations. Exchanges soak up BTC throughout each bullish durations for revenue taking and lively buying and selling.

Binance additionally has a report provide of stablecoins, offering important exit liquidity. A portion of the deposited BTC may additionally be held as collateral for opening by-product positions.

BTC strikes on-chain

BTC began shifting on-chain from September, growing the variety of days for coin destruction metric. Provide actions have accelerated over the previous two months, coinciding with a interval of elevated buying and selling volatility.

Causes may embrace ETF gross sales, foreign money arbitrage, or collateral posting. The on-chain motion coincided with the rise of perpetual futures DEXs, which additionally require collateral.

A rise in coin inflows doesn’t equate to a rise in lively addresses. Deposits are comprised of a comparatively small variety of wallets. Latest exercise is normally associated to whales, particularly new wallets making strategic strikes.

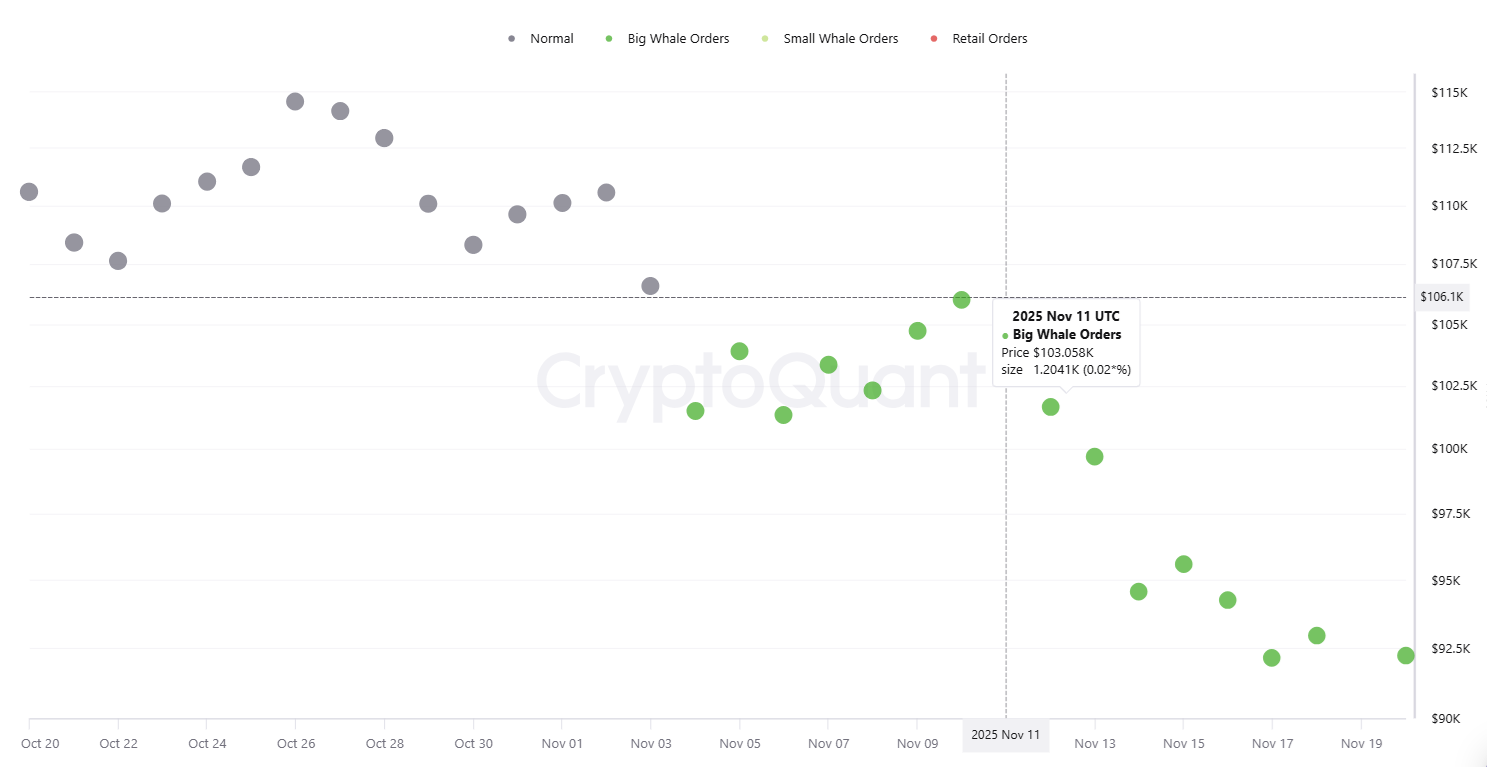

BTC orders additionally mirrored the growing affect of whales. Since early October, BTC order measurement has been growing, indicating continued whale exercise. The change comes after a impartial or retail-based shopping for interval in October.

The market switched to whale orders in November as worth weak point led to makes an attempt to purchase again BTC in decrease ranges. |Supply: CryptoQuant.

Latest whale exercise additionally provides hope for a re-accumulation and rebuild earlier than persevering with the BTC bullish cycle. To this point, most BTC holders haven’t deserted their spot positions, even with an unfavorable value foundation. The market in 2025 may even present extra hedging alternatives as choices buying and selling open curiosity and buying and selling quantity will peak and derivatives buying and selling exercise will improve.