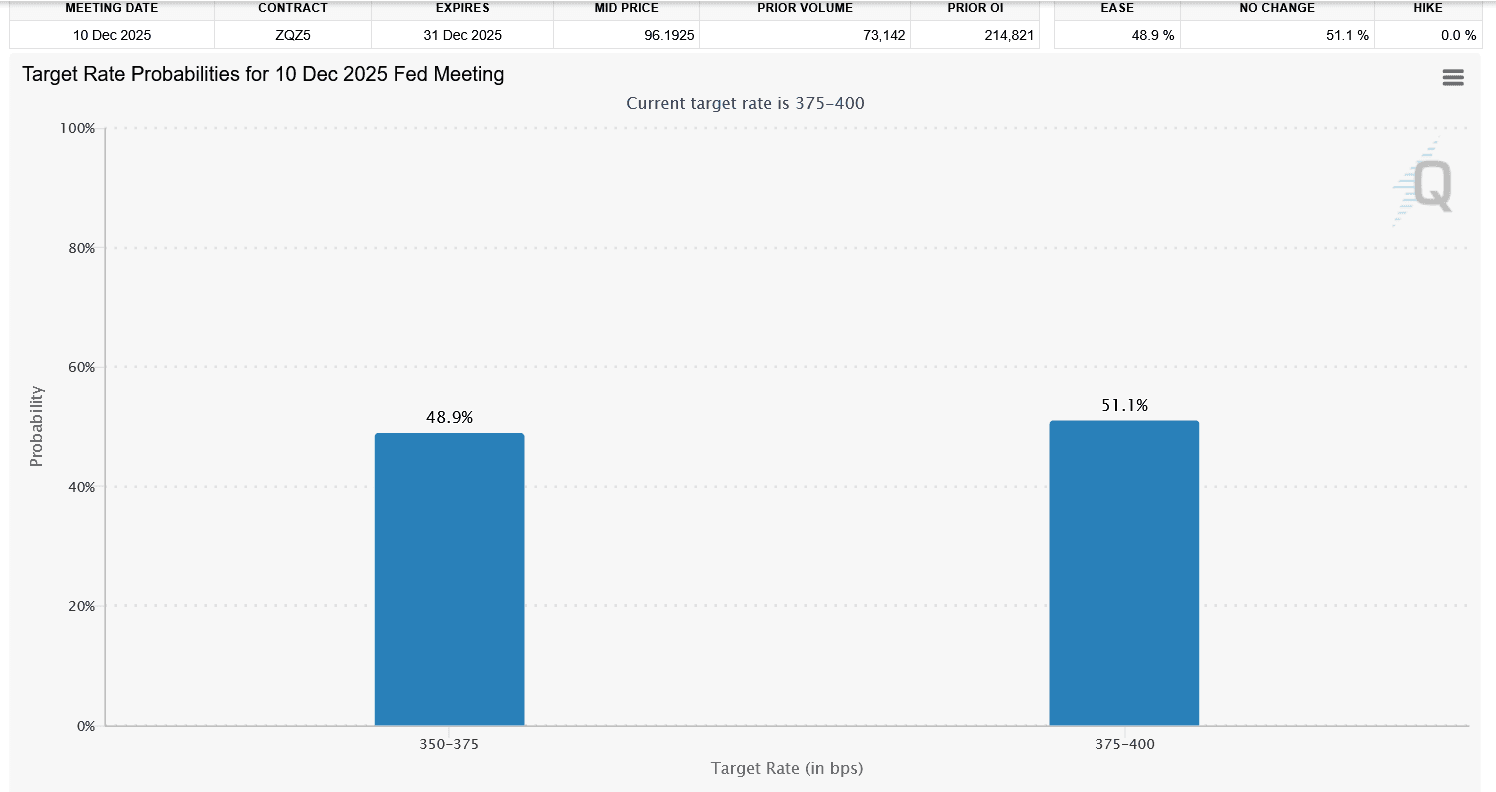

The worth of Ethereum has been trending downward in latest weeks, and the motion isn’t random. The Fed’s message trapped the market in a holding sample. Jerome Powell opened the door to a price lower earlier this yr, however now he is half-heartedly closed the door and urged everybody to not get too snug. His assertion {that a} price lower in December was “removed from assured” set the tone for the general macro image. That single phrase took away the arrogance that the market had began to construct, and the impact could be seen immediately on the ETH chart.

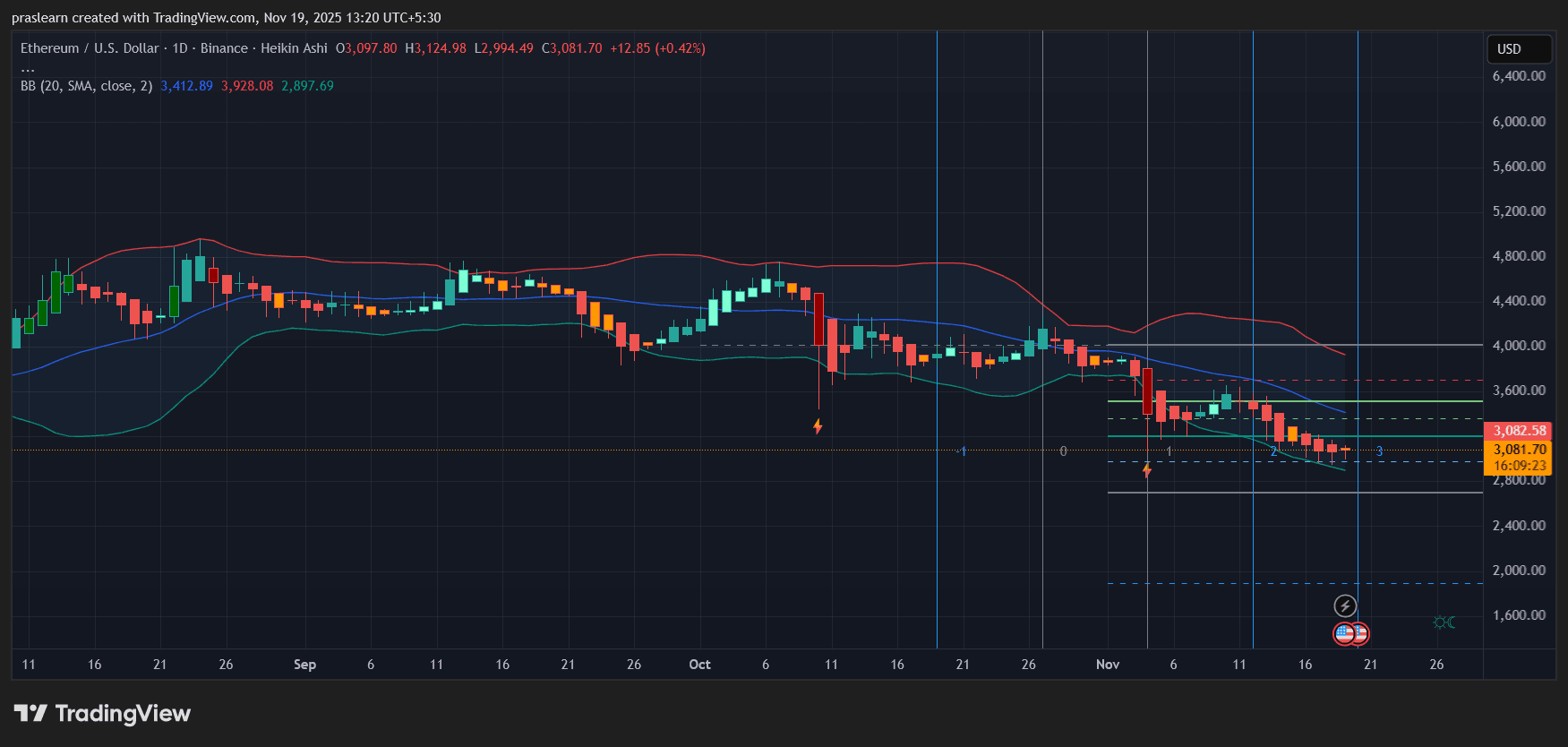

You may see that the Heikin Ashi candlestick has clearly misplaced momentum. Any makes an attempt to interrupt out of the lows will likely be absorbed earlier than ETH reaches mid-price ranges. The 20-day common, situated close to the middle of the Bollinger Bands, has hit a ceiling. ETH continues to fail when utilizing it. This reveals that the market desires to recuperate, however merely would not belief the macro setting sufficient to make that transfer.

Ethereum Value Prediction: How Fed Messaging is Placing Strain on ETH

Mr. Powell isn’t alone in his cautious stance. John Williams talks about balancing inflation and employment with out dashing. Michael Barr warns of a two-speed financial system the place low-income households are already feeling the pressure. Lisa Prepare dinner stated she hasn’t decided but for December, which confirms that there isn’t any alignment throughout the firm.

Austan Goolsby likens the state of affairs to driving in fog. This implies visibility is poor and nobody desires to speed up. Philip Jefferson advocates for a sluggish method, and Albert Moussallem opposes untimely easing. If all the coverage committee speaks on this tone, danger belongings will instantly go into “wait-and-see” mode.

Ethereum is responding precisely as anticipated. Charts replicate temper. The candlesticks are uneven, hesitant on the upside, pushed deep down on the draw back, and don’t have any actual momentum in both route.

Ethereum Value Prediction: What the ETH Value Chart Actually Exhibits

ETH/USD day by day chart – TradingView

ETH value has been hovering close to the decrease Bollinger Bands for days now, which generally signifies sustained downward stress quite than a one-off correction. It is not a meltdown. It is extra like a relentless leak. Patrons are defending the zone round 3080, however it isn’t sturdy sufficient to tug ETH again into the bullish construction. Every bounce seems weaker than the final, and the descending channel is the backbone of this whole motion.

The issue is confidence. Taking a look at value traits, we are able to see that though there’s some market shopping for, the market is cautious, and main corporations usually are not actively taking positions forward of the December assembly. The construction of ETH completely displays this warning. The market isn’t in a state of panic, however it’s not at all optimistic both. It’s caught within the center, caught between decreased volatility and unclear macro indicators.

Is ETH value nearing a reversal or getting ready for additional decline?

If we wish to reverse the ETH value, we first must regain the Bollinger mid-region between 3350 and 3420. That stage is at the moment above the shifting common. It is a psychological barrier that displays the market’s willingness to belief the Fed once more. If costs push up strongly, you may see sentiment change shortly. However for now, ETH is much from breaking that line.

Given the construction, a extra sensible state of affairs is for it to proceed downward. ETH value is hovering dangerously near the 3000 zone, and if the value loses it, the subsequent cushion is round 2880. Beneath that, the chart slides deeper in direction of 2720. None of those actions are sudden. This chart suggests a sluggish and extreme decline following months of unsure financial coverage and weak danger urge for food.

This Ethereum value chart completely displays the Fed’s communication sample. Confusion on the prime is resulting in hesitation out there. There’s a lack of sturdy opinions, there’s a lack of decisive motion, there’s a lack of conviction. Till the Fed offers clear route, or the market receives sturdy sufficient new labor and inflation information, Ethereum will proceed to float on this tightening downtrend.

Presently, $ETH is within the midst of macro fog, with each the charts and commentary telling the identical story. The subsequent massive transfer will not occur till the uncertainty is resolved.