Ethereum continues to commerce underneath heavy stress because the market struggles to regain momentum after weeks of regular decline. The asset is buying and selling across the $3,060 to $3,080 space, which is at the moment appearing as the principle short-term assist.

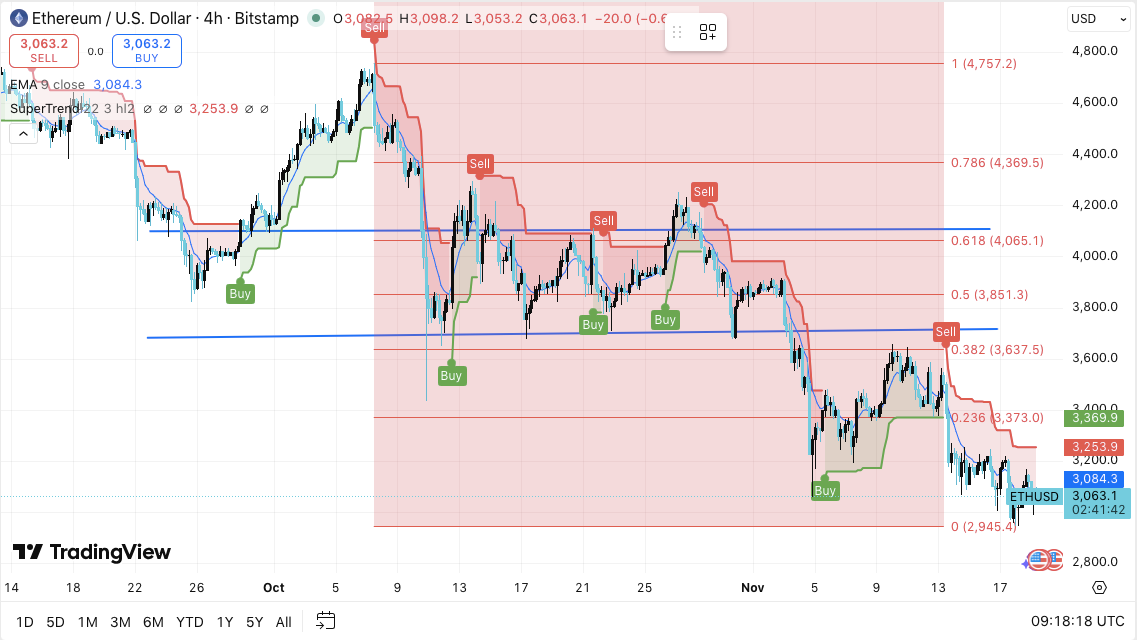

Along with this instant zone, merchants are looking forward to structural weak spot forming on decrease time frames. The 4-hour chart reveals repeated failures with reducing resistance, constant promote alerts, and sustained trades under the 9-EMA. Because of this, market sentiment stays defensive as Ethereum makes an attempt to stabilize close to present ranges.

Market construction displays sustained bearish dominance

Ethereum maintains a transparent sample of highs and lows. Any rebound try rapidly evaporates as sellers achieve the higher hand after every restoration. Worth motion stays trapped throughout the downtrend that has been resulting in a downtrend for a number of weeks.

Moreover, the $3,200 to $3,250 space is the primary main hurdle. This zone coincides with SuperTrend resistance and caps a number of restoration makes an attempt. Past that, the 23.6% Fibonacci stage of $3,373 is the important thing axis.

Worth has struggled at this level all through the month, reinforcing the significance of value to pattern reversals. Moreover, larger resistance close to $3,637 continues to restrict a stronger breakout.

ETH value dynamics (Supply: TradingView)

The instant concern is the $3,060-$3,080 assist space. A transparent breakdown under this space reveals a 0% Fibonacci stage at $2,945. This level represents the bottom swing stage within the present construction. Subsequently, dropping this space may speed up the downward motion.

Derivatives knowledge reveals robust participation regardless of pushback

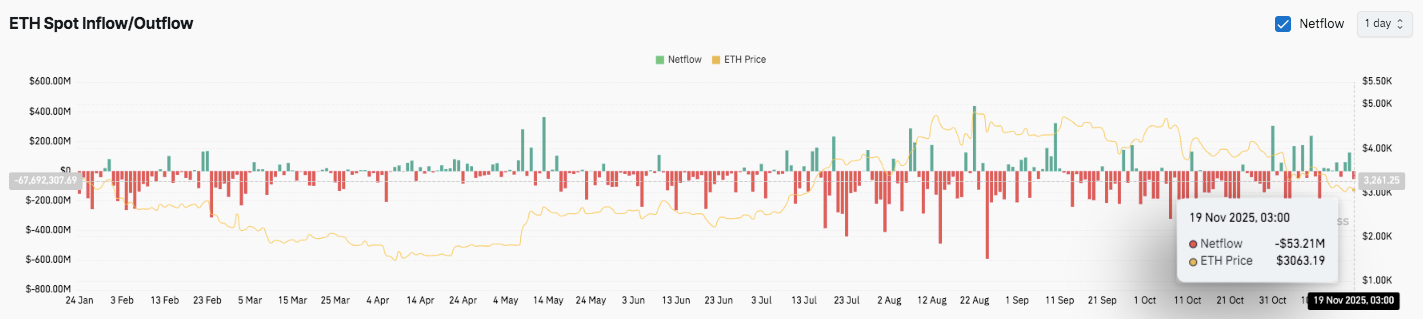

Supply: Coinglass

Ethereum futures open curiosity stays excessive regardless of continued volatility. Open curiosity rose sharply from late July to September. Ranges peaked above $40 billion as leveraged exercise elevated. Moreover, merchants maintained their positions through the latest selloff.

Associated: PI Worth Prediction: PI Worth Stays Medium as Merchants Monitor Upcoming Unlocks

As of November 19, open curiosity was $38.62 billion and the worth was buying and selling round $3,121. This pattern means that speculative involvement stays robust. Market individuals proceed to place for the upcoming transfer regardless of the broader correction atmosphere.

Supply: Coinglass

Along with futures buying and selling, spot flows additionally replicate cautious sentiment. Outflows dominated the pattern from August to November, usually coinciding with value declines.

The newest readings present a web outflow of $53.21 million. This sample signifies distribution by massive holders. Nevertheless, occasional spikes in inflow led to short-term stability, suggesting the potential for selective accumulation.

Ethereum neighborhood considers long-term protocol adjustments

Aside from value developments, the controversy surrounding Ethereum’s long-term security continues to develop. Vitalik Buterin lately highlighted the necessity to improve quantum efficiency inside 4 years. He additionally inspired the transition to ossification of core protocol options.

Subsequently, innovation is more likely to more and more transfer in the direction of layer 2 networks, wallets, and privateness instruments. This route brings new discussions about Ethereum’s evolution because the community prepares for future technological challenges.

Technical outlook for Ethereum value

Ethereum’s key ranges stay well-defined because the asset trades inside a persistent downward construction.

Upside ranges embrace $3,200, $3,250, and $3,373, which pose instant hurdles to any try at restoration. A breakout above $3,373 may prolong to $3,637, the place the 38.2% Fibonacci stage was the higher certain for the earlier reversal.

The draw back zone is equally necessary. The $3,060 to $3,080 band acts as short-term assist, whereas the breakdown reveals a $2,945 stage that coincides with the present swing low and 0% Fibonacci marker. This space represents the strongest structural mattress on the chart.

Worth motion reveals that Ethereum is buying and selling inside a gentle downward channel, with decrease highs and decrease lows guiding the momentum. A supertrend promote sign and sustained rejection on the 9-EMA strengthens the bearish atmosphere. Subsequently, ETH continues to compress in the direction of the decrease certain of the sample, and a decisive transfer may trigger important volatility enlargement in both route.

Will Ethereum maintain this zone?

Ethereum’s near-term route will depend upon whether or not patrons can defend the $3,060 assist pocket lengthy sufficient to problem the $3,200 to $3,250 zone. Sustained inflows and a restoration of the 9-EMA will strengthen the bullish try in the direction of $3,373 and $3,637. Moreover, rising open curiosity suggests robust participation and will amplify the transfer as soon as value breaks out of the channel.

Associated: Starknet Worth Prediction: STRK Stays in Breakout Zone as Consumers React to $3M Spot Influx

Nevertheless, failure to carry $3,060 dangers ETH being pulled in the direction of a broader accumulation base at $2,945. When it collapses, the construction turns into even weaker and might promote deeper orthodontic stress. For now, Ethereum is buying and selling at a pivotal level. Market move and pattern affirmation will proceed to be the figuring out issue for the following significant leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.