Bitcoin has rebounded practically 5% from right this moment’s lows close to $88,400 and is simply on the sting of falling wedge assist. Though the rebound was sturdy, it was solely up 2% on the every day chart. Admittedly, it does not do justice to the power the Bitcoin worth has proven over the previous few hours.

This transfer occurred shortly, following the worth and briefly touching the decrease trendline, elevating questions as as to if this may very well be the start of a near-term backside. Nevertheless, regardless of how sturdy the rebound appears, it’s nonetheless one, or fairly two, main resistance zones that decide whether or not the pattern has reversed or not.

Falling Wedge Rebound and Uncommon On-Chain Divergence Emergence

The falling wedge has been guiding Bitcoin’s decline for weeks, however right this moment’s response reveals that the decrease sure stays energetic. What makes bounces extra fascinating is the on-chain conduct behind them.

Bitcoin Decline Wedge: TradingView

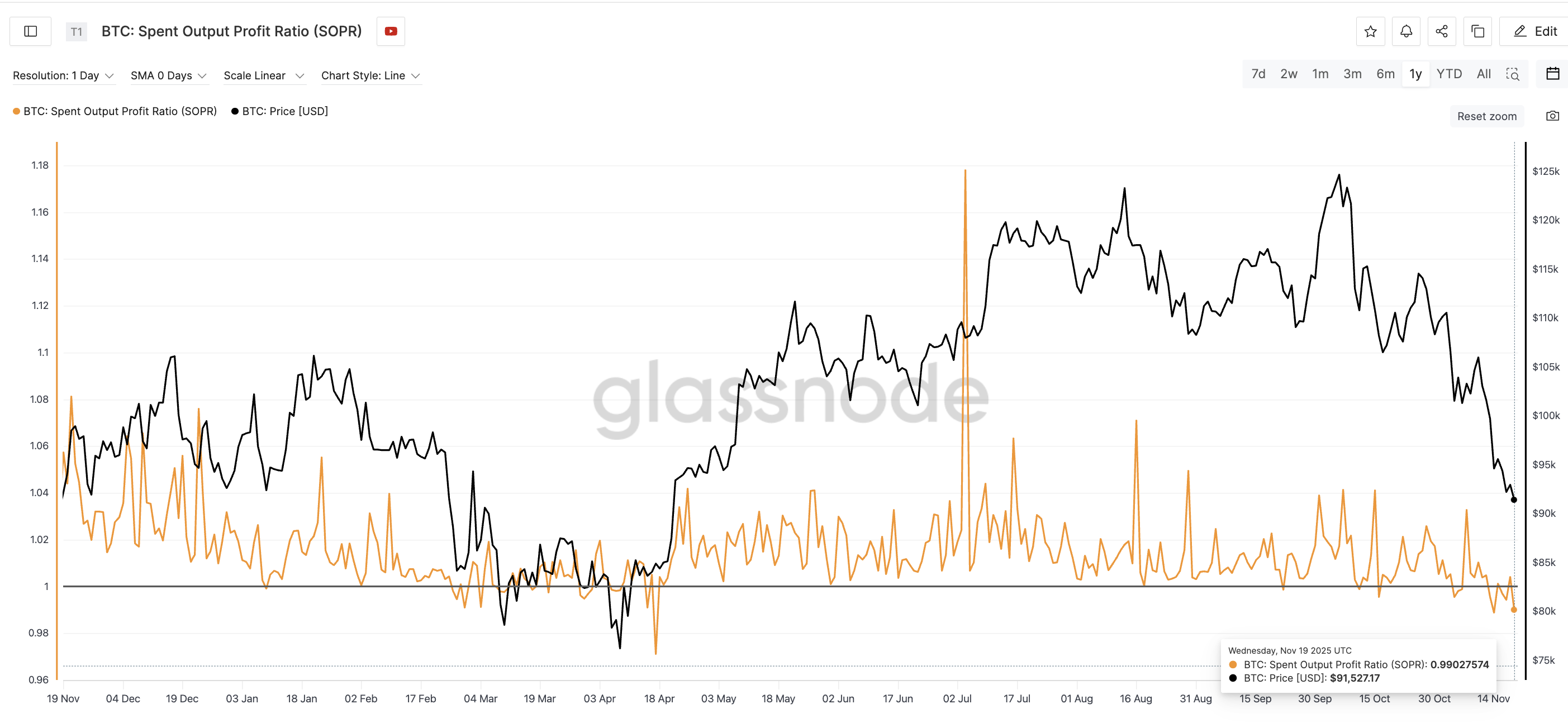

From November 14th to November nineteenth, Bitcoin worth hit a brand new low, however the SOPR (expended output return) elevated from 0.98 to 0.99, making a brand new low. SOPR signifies whether or not the coin used was bought with a revenue or a loss. When SOPR falls under 1, most merchants promote at a loss.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

SOPR Divergence Flash: Glassnode

If the worth continues to fall after which rises, it signifies that holders should not panic promoting and are refusing to let go at a cheaper price. It’s an expression of sturdy perception.

An analogous sample was seen between March thirtieth and April eighth. Although the market was nonetheless in a downtrend, BTC worth hit one other low at the moment, and SOPR rose from 0.994 to 0.998. This divergence has reached its backside. From there, Bitcoin soared 46% inside a couple of weeks, from $76,270 to $111,695.

The identical fashion of on-chain divergence is flashing once more inside the falling wedge. Notice that technical divergences can fail in extreme downtrends. On-chain divergences turn out to be extra necessary as a result of they mirror precise spending conduct fairly than simply chart patterns.

Heavy provide zone nonetheless prevents pattern reversal

Nevertheless, for SOPR divergence to happen, Bitcoin worth should exceed an necessary stage.

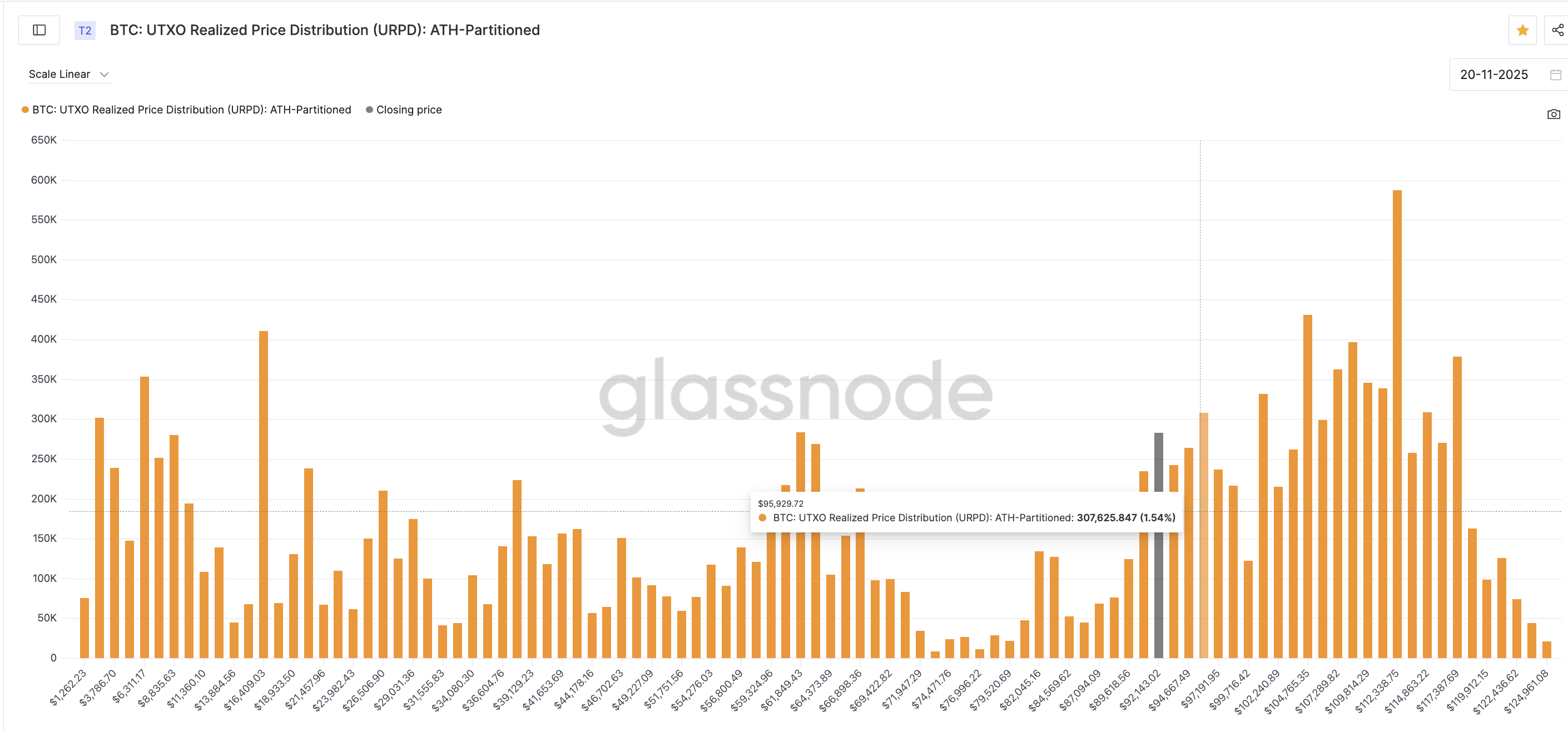

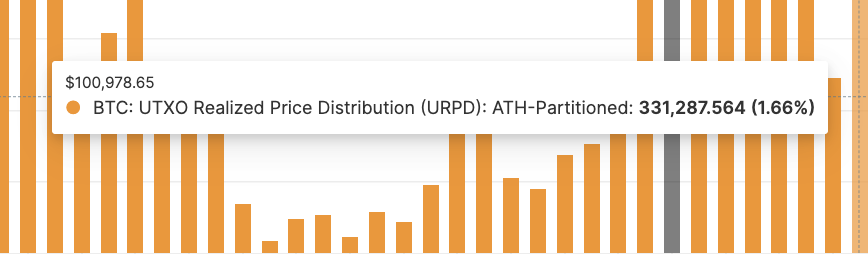

Glassnode’s URPD (UTXO Realized Value Distribution) knowledge reveals two provide clusters that sit simply above the present rebound. The primary one prices about $95,900 and the second prices practically $100,900.

First BTC resistance or provide cluster: Glassnode

These ranges additionally coincide with main technical resistance zones, which we are going to talk about subsequent.

UTXO Realized Value Distribution (URPD) reveals the final quantity of provide moved at every worth stage. This highlights the place there are massive clusters of holders, usually appearing as assist or resistance.

Excessive BTC provide cluster: Glassnode

In these areas, many previous patrons could attempt to exit once more. Clearing each ranges confirms that the pullback turns right into a pattern reversal.

Vital Bitcoin worth ranges

Bitcoin worth first wants to interrupt above $95,700, the identical stage the place it refused to recuperate on November fifteenth. This resistance stage can also be in keeping with the primary URPD cluster described above.

If this may be cleared, there’s a chance of attacking the Fibonacci barrier at $100,200, which is positioned under the $100,900 URPD cluster. Solely above this zone can the descending wedge really reverse right into a bullish course.

If BTC worth loses its latest low of $88,400 close to the underside of the wedge, there’s a threat that the worth may fall if the market weakens.

Bitcoin Value Evaluation: TradingView

To this point, Bitcoin has achieved clear wedge bounces and uncommon on-chain divergences. When these two come collectively, the opportunity of forming a backside will increase. Nevertheless, the resistance at $95,700 after which $100,200 nonetheless determines whether or not Bitcoin has simply turned bullish or if that is only a non permanent pullback.

The put up Has Bitcoin turned bullish after a 5% rally? 2 Resistance Ranges Say Not But appeared first on BeInCrypto.