Sharplink, the primary publicly traded firm to make use of Ethereum (ETH) as its major reserve asset, has gained consideration for migrating ETH to an OTC alternate.

The transfer comes as ETH has fallen greater than 20% in November. The transfer has sparked hypothesis that Sharplink could promote to chop losses or rebuild its portfolio.

SharpLink faces file unrealized losses

In line with Onchain Lens, utilizing Arkham information, a SharpLink-linked pockets transferred 5,442 ETH (price roughly $17.02 million) to Galaxy Digital, a number one digital asset administration platform.

A pockets linked to SharpLink (@SharpLink) deposited 5,442 $ETH price $17.02 million to #GalaxyDigital.

Are you promoting it now? https://t.co/3SUaNoIIjv pic.twitter.com/KLtiYrevJX

— Onchain Lens (@OnchainLens) November 19, 2025

The transfer has raised considerations that the corporate is attempting to promote to chop losses or rebalance its holdings.

In line with Strategic ETH Reserve (SER) information, Sharplink has unrealized losses of $479 million because of the decline in ETH costs. CryptoQuant information exhibits an excellent larger variety of over $500 million.

SharpLink DAT Unrealized P&L. Supply: CryptoQuant.

In line with information from CoinGecko, SharpLink’s common buy worth is $3,609. ETH is presently falling in direction of the $3,000 stage. The corporate made its most up-to-date acquisition a month in the past, however has not added to its place since then.

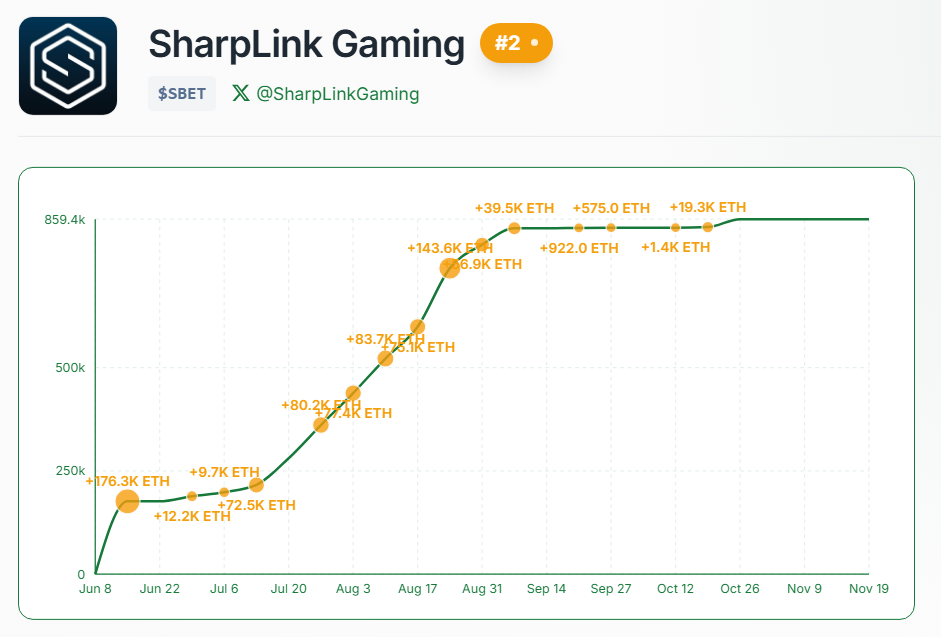

Buy SharpLink ETH. Supply: Strategic ETH Reserve (SER)

“With ETH buying and selling near this value base, this transfer strongly suggests the opportunity of OTC gross sales or main portfolio rebalancing to scale back threat publicity,” commented investor Rose.

SharpLink is presently the second largest ETH holding establishment after Bitmine. The corporate holds 859,853 ETH, representing 0.712% of the whole ETH provide, and is price over $2.6 billion.

In the meantime, SBET inventory has fallen from over $80 when Sharplink launched its ETH reserve technique to $10.55 as we speak. This represents a lower of over 86%. SBET is presently buying and selling at a 19% low cost to NAV.

SharpLink Gaming’s SBET worth. Supply: Yahoo Finance.

Total, ETH accumulation exercise amongst DATs slowed in November. Purchases are not made day by day as they have been in earlier months. This transformation suggests a shift in sentiment from aggressive accumulation to warning towards the top of 2025.

SharpLink maintains dedication to ETH accumulation technique regardless of worth drop

Nonetheless, within the newest announcement relating to X, SharpLink reported that it generated 336 ETH in staking rewards final week. This brings the cumulative staking rewards to 7,403 ETH, equal to roughly $1.1 million in generated worth.

SharpLink cumulative staking rewards. Supply: Sharplink

Virtually all the firm’s ETH is staked. This demonstrates the corporate’s long-term dedication to its technique regardless of market fluctuations.

“Our funds proceed to create worth no matter worth,” Sharplink stated.

SharpLink Gaming reported third quarter 2025 income of $10.8 million, a rise of 1,100% 12 months over 12 months. Internet revenue reached $104.3 million because of the firm’s Ethereum monetary technique.

With this report, SharpLink turned one of many first ETH-based DATs to file optimistic income.

SharpLink’s actions, like these of different ETH-focused DATs, present that these firms are betting on a a lot bigger long-term technique. Bitwise CIO Matt Hougan not too long ago said that solely complicated, value-added DATs deserve a premium, whereas passive DATs threat buying and selling at a reduction.

The put up SharpLink strikes ETH to Galaxy Digital with $479 million in unrealized losses appeared first on BeInCrypto.