Spot Bitcoin and Ether exchange-traded funds (ETFs) are going through their largest every day outflows since their inception, however two new altcoin merchandise are bucking the pattern.

Regardless of the widespread market rout, the Solana (SOL) and XRP (XRP) ETFs have but to document a single day of outflows since their launch, in line with crypto ETF knowledge aggregator SoSoValue. This offers the 2 altcoin ETFs a uncommon inexperienced mark in an in any other case purple ETF atmosphere.

The quantity of influx is turning into appreciable. In accordance with the info, the Solana-based spot ETF has recorded cumulative internet inflows of almost $500 million, whereas the XRP ETF has recorded cumulative internet inflows of $410 million up to now.

The divergence comes amid one of the vital extreme multi-week outflows within the historical past of the Spot Bitcoin (BTC) and Ether (ETH) ETF. Whereas flagship crypto merchandise are present process large redemptions, regular inflows into new ETFs counsel small however notable hints of confidence amongst buyers searching for publicity past the 2 largest belongings.

Solana ETF noticed inflows in November. Supply: Farside Traders

XRP and Solana ETFs document constant inflows regardless of market stress

On Thursday, Bitwise Asset Administration launched the XRP ETF underneath the ticker “XRP.” The ETF had a robust debut, elevating $105 million on its first buying and selling day, in line with SoSoValue knowledge.

Asset supervisor Canary’s XRPC added one other $12.8 million on Thursday, bringing the day’s complete inflows to $118 million.

Canary CEO Steven McClurg congratulated Bitwise on its launch and mentioned the corporate is “supporting” Bitwise regardless of being a competitor within the area.

sauce: Stephen McClurg

Canary additionally contributes to the consistency of XRP ETF inflows. It at the moment holds the document for the most important day of XRP ETF inflows, with $243 million in inflows into XRPC on November 14th.

Solana-based ETFs confirmed the same sample of resilience, posting constant every day inflows regardless of the broader market decline.

SOL-based ETF merchandise have seen every day inflows of $8.26 million to $55.61 million this week, with November nineteenth seeing the very best every day inflows.

Associated: $5 billion disappears in in the future, meme coin market sinks to 2025 lows

Regardless of ETF beneficial properties, Solana and XRP tokens are within the purple

Though SOL and XRP-based ETFs have posted regular beneficial properties, the efficiency of the underlying belongings behind the exchange-traded merchandise has been weak over the previous month.

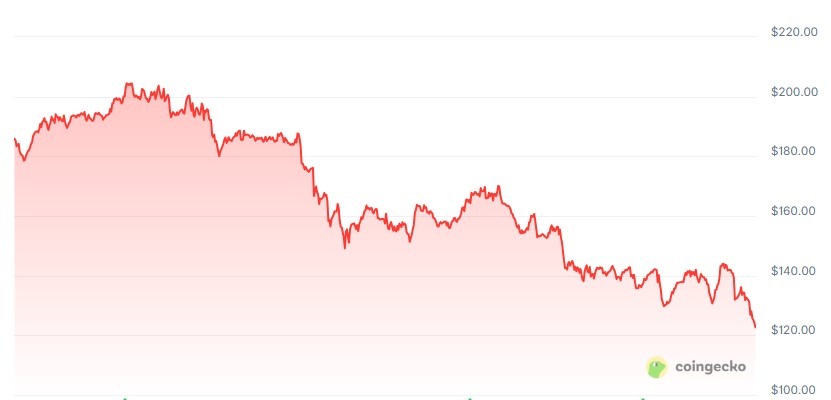

In accordance with CoinGecko knowledge, Solana has fallen 32.5% within the final month and 10.9% within the final week. On the time of this writing, the token is buying and selling at $122.94, which represents a 52.3% decline over the past yr.

Solana 30 day value chart. Supply: CoinGecko

In the meantime, XRP has proven the same efficiency lately, dropping 21.2% up to now 30 days and 16.6% within the final week.

However its annual chart tells a special story. In accordance with CoinGecko, the asset is at the moment buying and selling at $1.86, representing a rise of 49.9% over the previous yr.

journal: Bitcoin whale metaplanet is “underwater” however control extra BTC: Asia Categorical