HSBC, the world’s megabank, is doubling down on tokenization over stablecoins as international banks rush to maintain tempo within the stablecoin race.

HSBC Holdings plans to start out providing tokenized deposits to company prospects in the USA and United Arab Emirates within the first half of 2026, in line with a Bloomberg report on Tuesday.

Manish Kohli, international head of funds options at HSBC, stated HSBC’s Tokenized Deposit Service (TDS) permits prospects to ship cash domestically and internationally in seconds, 24 hours a day.

“The subject of tokenization, stablecoins, digital cash, digital currencies is clearly gaining loads of momentum. We’re making huge bets on this house,” Kohli stated.

Tokenized deposits and stablecoins

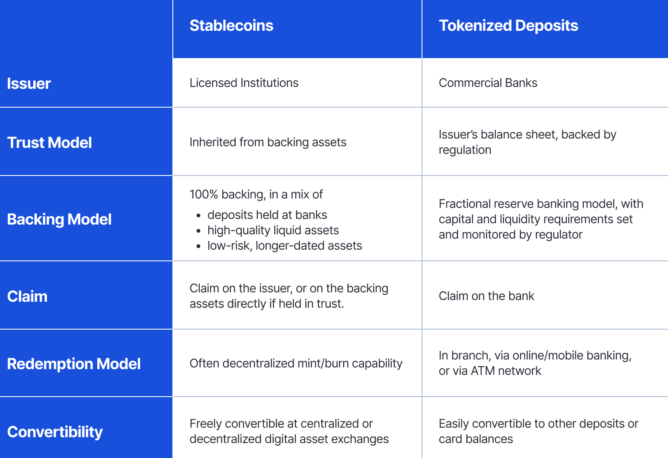

Tokenized deposits are digital representations of financial institution deposits issued on blockchain by regulated banks, permitting for fast transfers and programmable funds 24/7.

In contrast to stablecoins, which are sometimes tied to fiat currencies such because the US greenback and backed by property akin to authorities debt, deposit tokens are created utilizing the issuer’s steadiness sheet.

Though stablecoin issuers like Circle should not allowed to pay yield on stablecoins held by customers, tokenized deposits provide curiosity funds as considered one of their main options.

Stablecoins and tokenized deposits: Supply: Fireblocks

Kohli stated HSBC plans to develop use circumstances for tokenized deposits in programmable funds and autonomous treasuries, techniques that deploy automation and AI to independently handle money and liquidity dangers.

“Virtually each massive firm we discuss to is going through huge themes round monetary reform,” stated the HSBC govt.

The potential for launching HSBC stablecoin can’t be denied

The product’s enlargement within the US and UAE is the newest following HSBC’s launch in Hong Kong in Might, with Ant Worldwide changing into the primary buyer to make the most of the TDS resolution.

Since then, the financial institution has expanded its providers to a number of markets together with Singapore, the UK and Luxembourg.

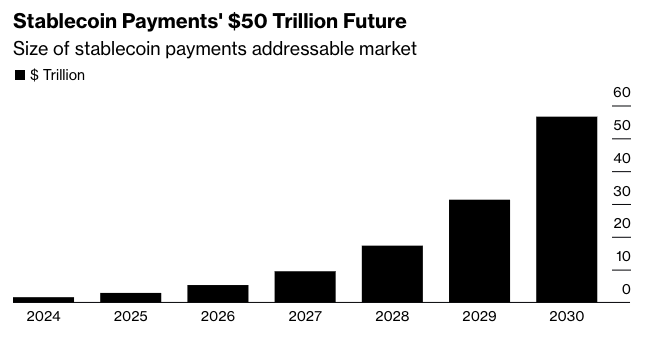

Supply: Bloomberg Intelligence

HSBC’s selection to maneuver ahead with tokenized deposits comes as main banks like JPMorgan double down on the expertise.

Associated: How TradFi Financial institution is driving a brand new stablecoin mannequin

On November 12, JPMorgan launched JPM Coin, a deposit token representing banks’ US greenback deposits. The corporate opposes the token to conventional stablecoins, with JPMorgan blockchain govt Naveen Marella stressing that the deposit token will function inside the framework of a standard financial institution.

Whereas HSBC promotes tokenized deposits, it has not dominated out the opportunity of issuing stablecoins.

“That is one thing we are going to proceed to evaluate,” Kohli stated, including: “There are some issues that must be completed, and that’s the authorized framework must be extra clear.”

journal: Saylor denies Bitcoin decline, XRP ETF debuts on prime chart: Hodler’s Digest, November 9-15