Bitmine, the crypto asset firm that accumulates Ether (ETH) and Bitcoin (BTC), introduced on Friday that it plans to launch a “Made in America Validator Community” (MAVAN) to stake its ETH holdings.

In response to a BitMine announcement, the corporate is piloting MAVAN with three staking infrastructure suppliers forward of a deliberate launch in Q1 2026.

Proof of Stake (PoS) Staking of tokens to validate a blockchain secures the community and generates income within the type of staking rewards paid within the blockchain community’s native token (ETH on this case).

“At scale, we consider our technique is greatest within the long-term greatest pursuits of our shareholders,” BitMine Chairman Tom Lee stated in a press release.

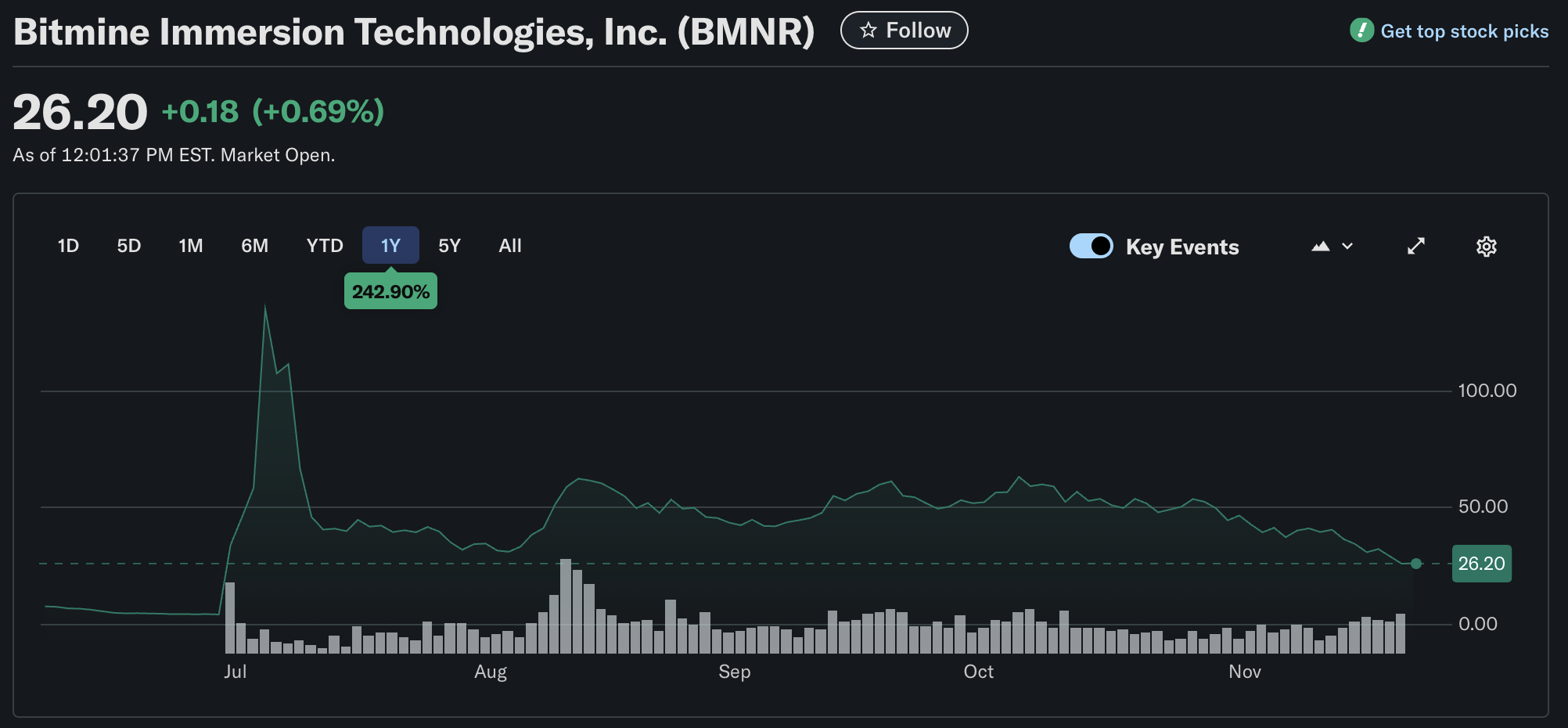

Bitmine’s inventory worth has crashed, together with different crypto treasury firms which have seen gradual bleeding in 2025. supply: Yahoo Finance

The announcement comes amid a major downturn for the crypto market and crypto treasury firms. The corporate has skilled a collapse in its a number of on-net asset worth (mNAV), a key metric that tracks the value premium positioned on shares of crypto treasury firms.

Associated: Tom Lee speculates that injured market makers are behind the crypto disaster

BitMine suffers from plummeting ETH worth and market collapse

In response to a report by analysis agency 10x Analysis, Bitmine has unrealized losses of greater than $3.7 billion because of the plummeting ETH worth.

A report printed on Thursday pegged the value of ETH at $3,023, however ETH’s decline widened on Friday, with the value dropping to round $2,700 on the time of writing.

The worth of ETH hit an all-time excessive of over $4,900 in August earlier than crashing. sauce: TradingView

The drop in worth signifies that the corporate is at present underwater by greater than $1,000 per ETH it holds, regardless of having constructed up property in direction of all-time highs in July and August.

A crash in ETH beneath $3,000 might wipe out a 12 months’s price of earnings for crypto firms that maintain ETH, and additional declines in worth might result in additional monetary stress for these firms.

“Treasury firms will face a harsh actuality: Attracting new retail traders might be practically unimaginable when present shareholders are saddled with billions of {dollars} in losses,” 10x Analysis wrote.

The treasury mannequin faces elevated competitors and market share erosion from asset managers akin to BlackRock and exchange-traded fund suppliers, permitting traders to achieve publicity to digital property and staking rewards at decrease prices, in line with 10x Analysis.

journal: If the crypto bull market is ending… it is time to purchase a Ferrari: CryptoKid