Monetary establishments are transferring away from Ethereum (ETH) and selecting proprietary blockchains custom-made to fulfill their wants.

Latest developments equivalent to Klarna’s launch of stablecoins on various networks and the rise of privacy-focused chains like Canton have raised questions concerning the community’s dominance.

Enterprise blockchain adoption alerts new risk to Ethereum: This is why

On November twenty fifth, Klarna introduced KlarnaUSD, changing into the primary financial institution to concern a stablecoin on Stripe and Paradigm’s funds blockchain, Tempo. This determination sparked debate within the cryptocurrency group. Some see this as a bearish sign for Ethereum.

“Can somebody please inform me why this isn’t bearish for Ethereum? The massive fintechs which might be making huge strikes into stablecoins haven’t launched it on Ethereum. If Tempo didn’t exist, this most likely would have launched on Ethereum or ETH L2…Tempo is gaining market share in stablecoins, which is the principle theme of Ethereum,” the analyst mentioned.

Ethereum hosts main stablecoins equivalent to Tether (USDT) and USDC (USDC), which have a mixed market capitalization of over $100 billion. These trigger vital community exercise and fees. By selecting Tempo, Klarna bypasses the Ethereum ecosystem and probably bypasses liquidity and innovation.

One other analyst, Zach Strains, emphasised that Klarna’s determination reveals that whereas public chains proceed to be overshadowed by massive fintech firms, enterprise blockchain adoption is on the rise.

“It’s yet one more affirmation that the Corpo L1 chain is right here to remain and that our favourite commoditized ‘impartial’ public chain #375936 is as soon as once more being rampaged by fintechs,” he mentioned.

The rise of cantonal networks additional exemplifies this. It is a Layer 1 community constructed with privateness controls at its core. Establishments can select how seen or restricted their actions are, permitting them to arrange methods starting from fully permissionless to fully personal.

Regardless of these variations, functions on Canton can join and work together over the community. Goldman Sachs’ Digital Asset Platform (GS DAP) makes use of Canton’s community natively.

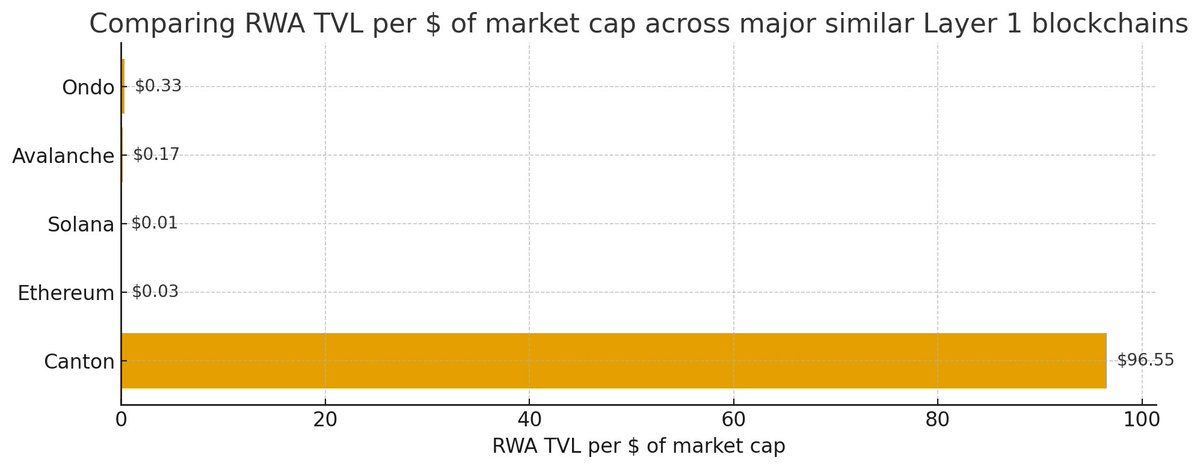

Notably, Canton has demonstrated outstanding ranges of capital effectivity, producing roughly $96 of RWA Whole Worth Locked (TVL) for each $1 of market capitalization. In distinction, Ethereum generates roughly $0.03 of RWA TVL for each $1 of market capitalization.

Comparability of RWA TVL per $1 market capitalization. Supply: X/MattMena__

However why are establishments transferring away from Ethereum? Privateness could also be a significant factor on this exodus. Public blockchains like Ethereum present everlasting visibility of all transactions. It is a central problem for establishments.

This transparency is a big threat when banks and companies switch massive quantities of cash. Rivals can analyze patterns, make front-of-the-line offers, and uncover strategic enterprise relationships.

COTI Community evaluation reveals that firms adopting Web3 usually overlook blockchain transparency as a disadvantage. The article factors out that public blockchains expose all transactions and metadata, which may expose delicate information and undermine negotiation leverage. This raises regulatory considerations relating to legal guidelines equivalent to GDPR and exposes commerce secrets and techniques.

This disconnect explains why establishments are constructing personal blockchains or looking for public networks with enhanced privateness. Transparency, a recognized advantage of cryptocurrencies, creates vulnerabilities when coping with multi-billion greenback transactions and delicate relationships.

This pattern suggests a cut up. Public networks like Ethereum are used for decentralized or retail use, whereas establishments transfer to personal or specialised chains with confidentiality. As finance undergoes a digital transformation, it stays unclear whether or not Ethereum will have the ability to regain the belief of establishments or whether or not specialised networks will have the ability to take over.

This text Establishments transfer to devoted blockchains as privateness considerations drive shift away from Ethereum initially appeared on BeInCrypto.