Bitcoin investor Technique Inc. has confronted robust occasions this 12 months, resulting in hypothesis that its high-conviction Bitcoin technique could also be unraveling. Trying past one 12 months’s charts reveals a unique story.

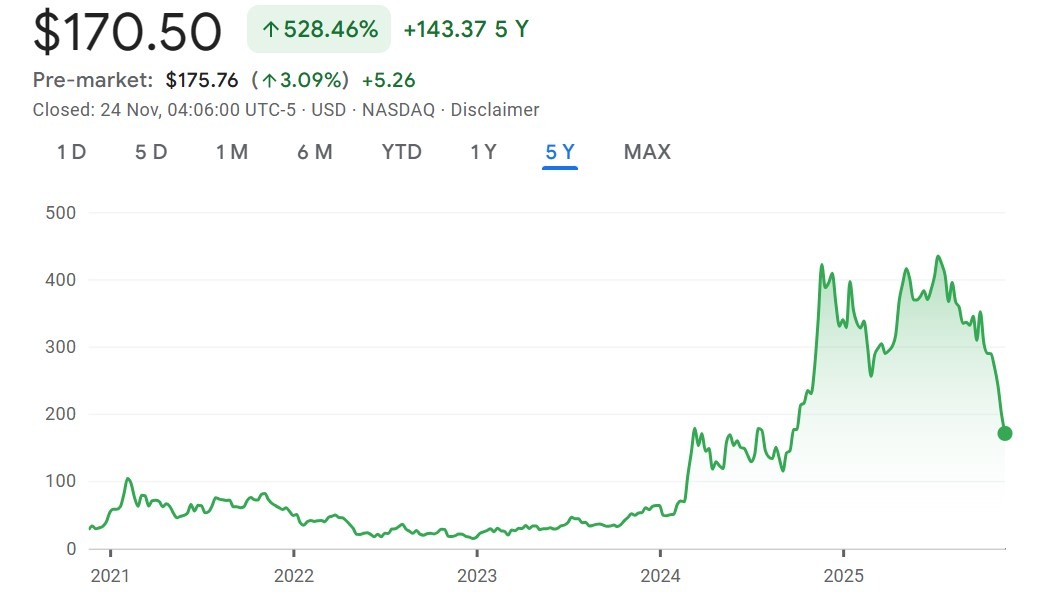

In accordance with Google Finance information, Technique (MSTR) inventory is down about 60% over the past 12 months and greater than 40% year-to-date (YTD). The inventory was buying and selling close to $300 in October, however has fallen to about $170 on the time of writing.

Whereas some could interpret this as an “publicity” of the corporate’s Bitcoin mannequin, Technique nonetheless maintains double-digit positive aspects on Bitcoin purchases, and its long-term inventory efficiency continues to outperform main tech shares.

In accordance with information from BitcoinTreasuries.NET, Technique acquired Bitcoin (BTC) at a mean worth of $74,430. Bitcoin is buying and selling round $86,000 and the technique continues to be up practically 16% on its BTC investments.

Technique inventory is up greater than 500% in 5 years, in response to Google Finance information. By comparability, Apple recorded a 130% enhance and Microsoft recorded a 120% enhance over the identical interval.

In simply two years, Technique inventory is up 226%, outpacing Apple’s 43% rise and Microsoft’s 25% rise over the identical interval.

Strategic shares are nonetheless up greater than 500% over the previous 5 years. Supply: Google Finance

Buyers are shorting methods as a hedge towards lengthy cryptocurrencies

This downturn could have much less to do with Bitcoin’s fundamentals and extra to do with how main traders are hedging their crypto publicity.

In a latest interview with CNBC, Bitmine Chairman Tom Lee defined that the technique has develop into the simplest solution to hedge towards Bitcoin.

“Some folks can hedge all of their crypto utilizing MicroStrategy’s extremely liquid choices chain,” he stated. “The one handy solution to hedge somebody’s longs is to quick MicroStrategy or purchase a put.”

This dynamic turned the technique into an unintended stress valve for the crypto market, absorbing hedging, shorting, volatility and market jitters that had little to do with the effectiveness of the underlying Bitcoin technique or its long-term idea.

Regardless of the droop in inventory costs, technique committee chairman Michael Thaler expressed his willpower to “not again down” from X.

sauce: michael saylor

On November seventeenth, Technique introduced that it had acquired 8,178 BTC for $835.6 million. This buy was a major enhance in comparison with earlier investments that ranged from 400 to 500 cash per week. This buy elevated the full holdings to 649,870 BTC, price roughly $56 billion.

Associated: Metaplanet considers elevating $135 million via new Class B shares to gasoline additional Bitcoin purchases

Digital property authorities bonds face widespread weak point in inflows

On November 6, crypto market maker Wintermute cited stablecoins, exchange-traded funds (ETFs), and digital asset bonds (DATs) as the principle sources of liquidity for cryptocurrencies, saying lowered liquidity was the reason for the latest market downturn.

The corporate additionally stated that liquidity inflows have reached a plateau in all three areas.

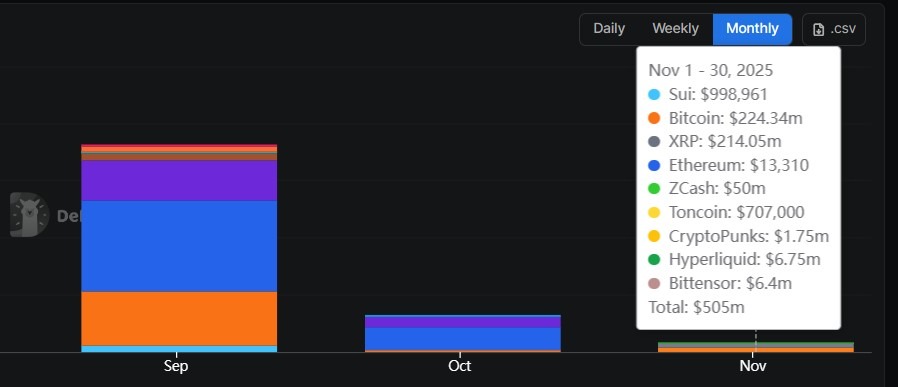

Knowledge aggregator DefiLlama revealed that DAT inflows started to gradual in October following the liquidation of $20 billion in crypto positions. DAT inflows fell from about $11 billion in September to about $2 billion in October, an 80% decline.

Inflows decreased additional in November. As of Monday, DAT inflows this month remained at about $500 million, down 75% from October.

There was an inflow of DAT over the previous three months. Supply: Defilama

journal: 2026 is the 12 months of sensible privateness in crypto: Canton, Zcash and extra