Ethereum worth has damaged out of a bullish reversal sample as the availability of tokens held on exchanges continues to say no to report lows.

abstract

- Ethereum worth has elevated by 7% over the previous week.

- ETH international change reserves have fallen to multi-year lows.

- A falling wedge breakout was confirmed on the day by day chart.

The worth of Ethereum (ETH) fell over almost two weeks, from $3,633 recorded on November 10 to a month-to-month low of $2,680 on November 21, in response to knowledge from crypto.information. It then rebounded and rose above $3,000. Analysts say this stage must be maintained for the pattern to alter from bearish to bullish. The second-largest cryptocurrency, buying and selling at $3,013, is up 7.3% over the previous seven days, however remains to be down almost 40% from its all-time excessive in August of this 12 months.

There are three important components driving Ethereum costs larger this week.

First, the value of Ethereum rose, hitting multi-year lows as the availability of tokens held throughout exchanges continued to dwindle.

Based on CryptoQuant knowledge, international change reserves have plummeted from 20.9 million recorded in early July to 16.8 million on the time of writing. Decreased change provide means fewer tokens can be found for instant sale, which reduces instant promoting stress and customarily favors upward worth momentum.

Supply: CryptoQuant

You might also like: Ethereum community raises fuel restrict to 60 million, highest stage in 4 years

Second, the group hype surrounding Ethereum’s doable upcoming improve on December third can be driving up the altcoin’s worth. The improve would be the community’s greatest replace since “The Merge” and is predicted to deal with one of many community’s most urgent bottlenecks: rollup knowledge availability.

Third, capital inflows into Spot Ether ETFs additionally contributed to the bullish shift. The 9 U.S. Spot ETH ETFs have recorded web inflows of $236 million to this point this week, after three consecutive weeks of $1.7 billion in outflows from the funds, in response to SoSoValue knowledge.

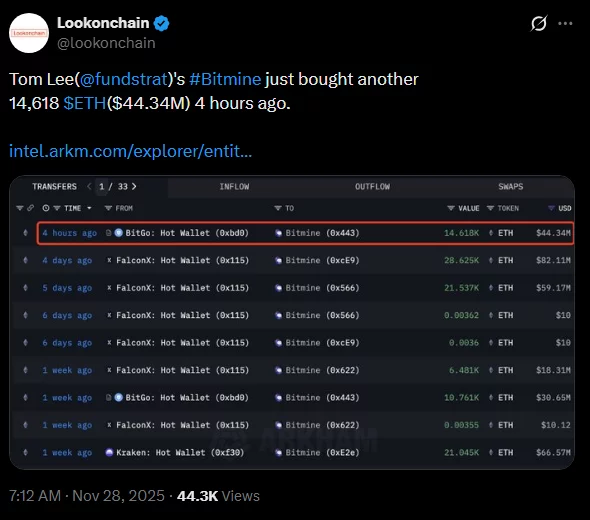

In the meantime, continued accumulation by institutional traders equivalent to Bitmine additionally served to spice up merchants’ confidence in Ethereum’s long-term prospects.

Bitmine’s Newest ETH Acquisition | Supply:X

On the day by day chart, Ethereum worth has damaged out of a descending wedge sample. This sample is a construction that varieties when an asset worth varieties consecutive lows and highs whereas buying and selling inside what seems to be two converging downward pattern strains.

Ethereum worth breaks out of falling wedge on day by day chart — November 28 | Supply: crypto.information

A breakout from such a sample is often an indication that the pattern is altering from bearish to bullish.

For now, the following main resistance lies on the 200-day transferring common of $3,096, which has been holding costs down since early November. A breakout from this stage might set off a rally in direction of $3,600, a zone roughly in keeping with the 61.8% Fibonacci retracement stage from the latest excessive to low.

The significance of this stage is that it incessantly serves as a pivot level the place giant worth reactions are likely to happen, usually attracting renewed shopping for curiosity from merchants waiting for affirmation of a broader pattern reversal.

Nonetheless, failure to carry the $3,000 help might end in a fall in direction of the following key help stage at $2,750, which coincides with the 38.2% Fibonacci retracement stage.

learn extra: Prime 4 the explanation why a bull market is close to within the crypto market

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies printed on this web page are for instructional functions solely.