Bitcoin is buying and selling close to $91,000, however the market setup is beginning to present one of many clearest threat alerts this month. Costs have been rising inside a slim construction after a pointy drop, however on-chain knowledge and derivatives positioning now point out strain is constructing beneath the floor.

When these situations come collectively, the market typically strikes quicker than anticipated. Merchants are paying shut consideration as a number of indicators are trending in the identical route.

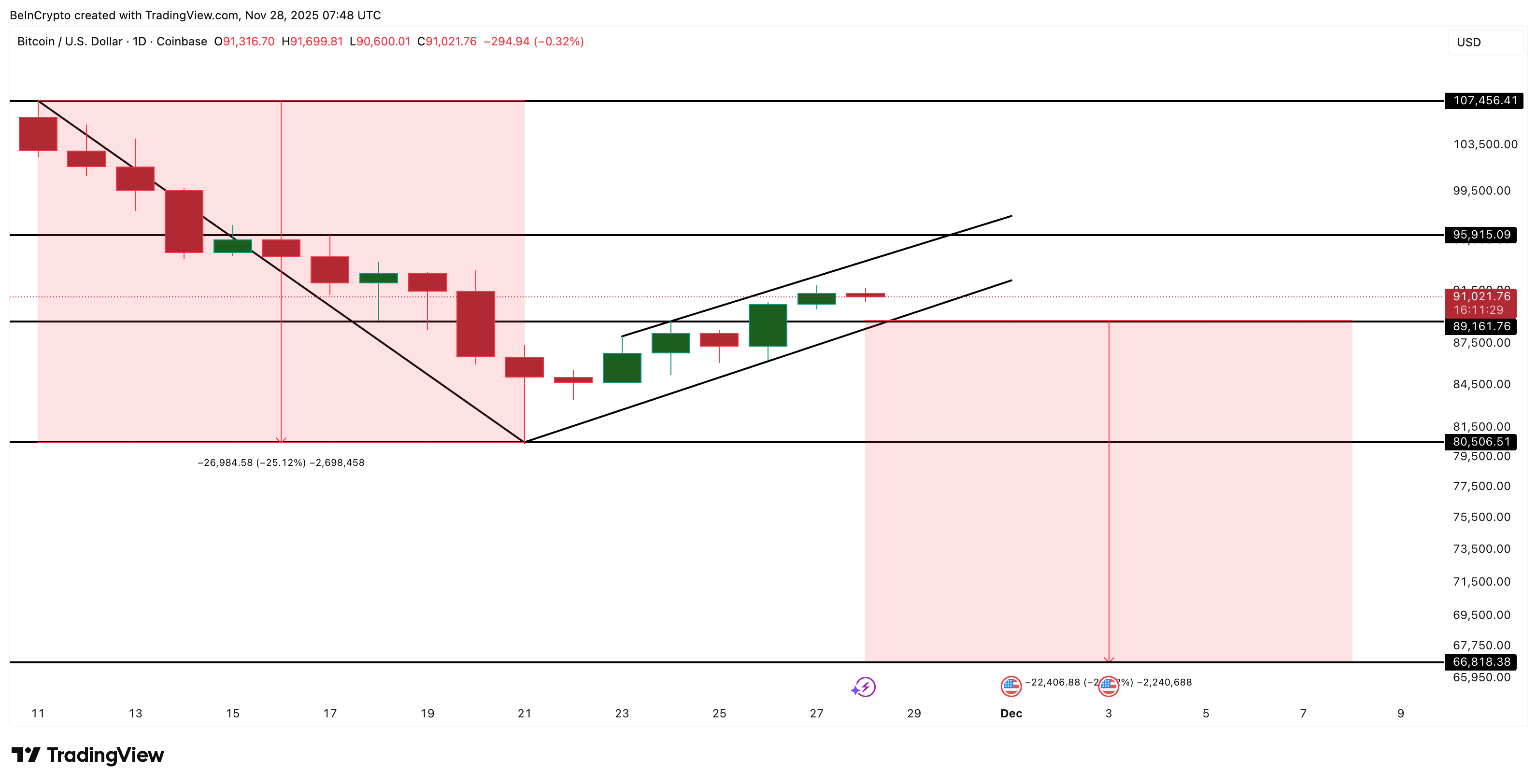

A big bear flag sample is setting a threat window

Bitcoin costs plummeted from November eleventh to November twenty first, forming an extended draw back that shaped a “pole”. Since then, costs have been slowly rising inside a slim channel. This creates a “flag”.

Pole and flag is a steady sample. Arrange the pole with a robust fall. A sluggish, tight rebound varieties a flag. Breaking the decrease pattern line typically leads to a repeat of the earlier drop dimension.

Need extra token insights like this? Subscribe to editor Harsh Notariya’s every day crypto publication right here

Bitcoin Threat Flag: TradingView

Earlier falls have measured 25%, and flags sometimes mirror that motion. This offers you a clear threat window that enables for deeper slides if help fails. This construction doesn’t itself verify a failure, however it does give a transparent technical warning.

Elevated threat for each spot and derivatives

On-chain situations improve the draw back threat flagged by the sample.

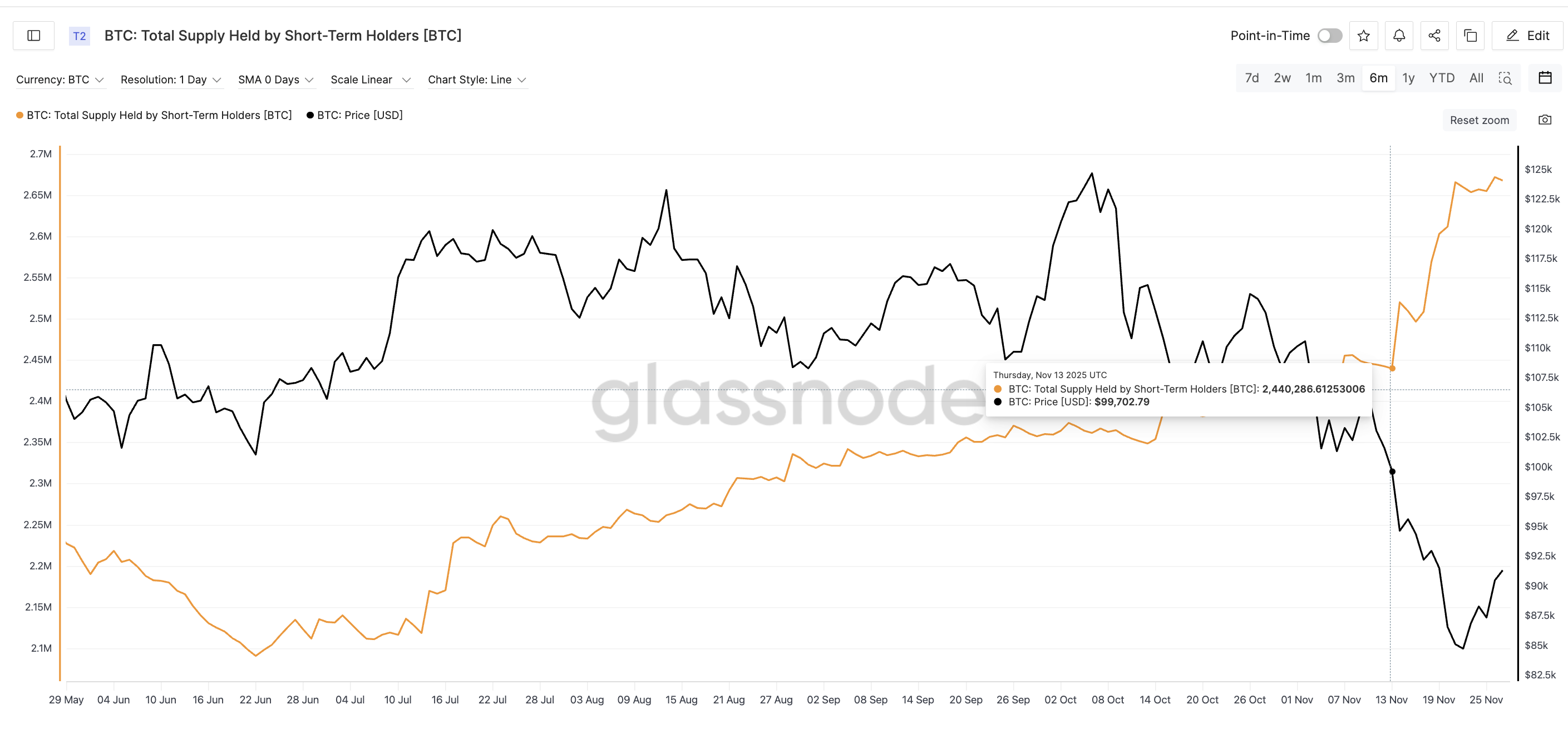

The full quantity of BTC held by short-term holders has elevated from roughly 2.44 million BTC on November thirteenth to roughly 2.67 million BTC (a rise of almost 10%), the best degree in six months. These are low-conviction cash, sometimes purchased inside the previous few months, and offered as quickly as volatility spikes. Rising provide of short-term holders throughout a weak rally typically means extra “quick cash” heading for the exits collectively.

Elevated provide of short-term holders: Glassnode

Derivatives additionally place factors in the identical approach.

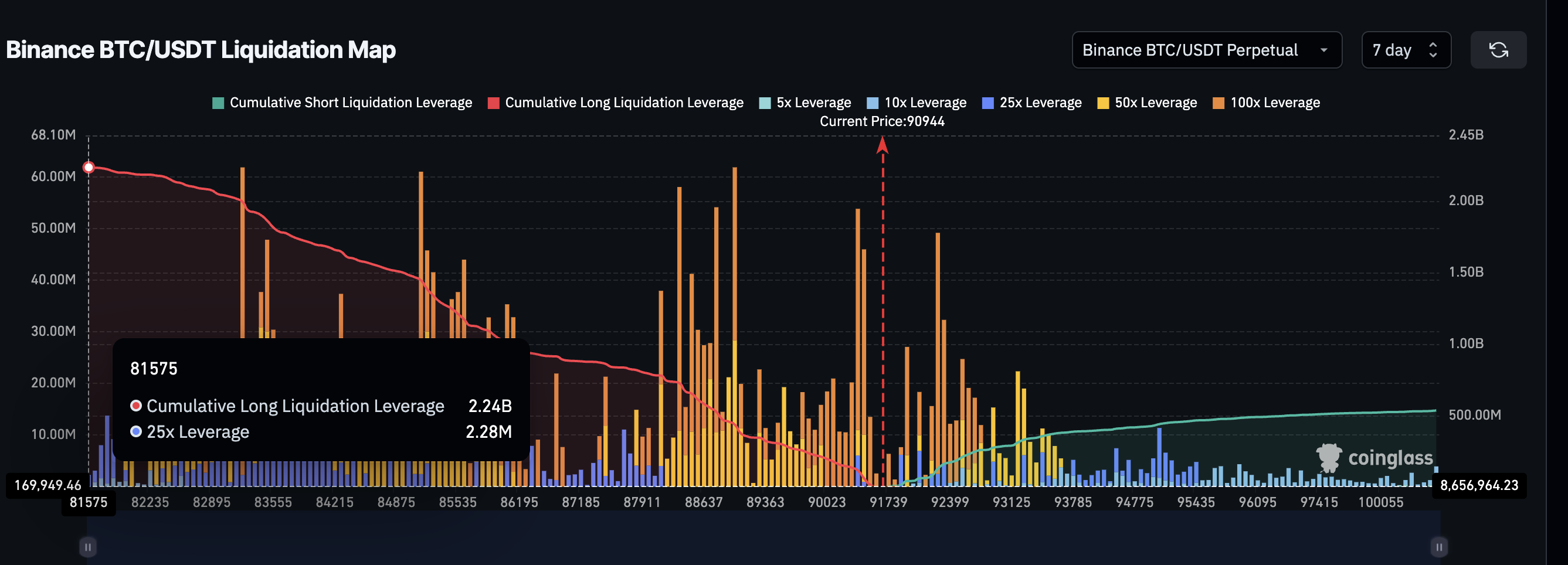

Binance’s BTC/USDT liquidation map reveals lengthy liquidation leverage of about $2.24 billion beneath worth, whereas quick above worth is simply about $536 million. In different phrases, about 81% of the present liquidation threat is in lengthy positions, and longs have about 4 instances as many potential liquidations as shorts.

Lengthy Squeeze Threat Construct: Coinglass

A transparent transfer beneath the present flag help (highlighted later) won’t solely push the spot worth decrease. It may additionally set off a series of pressured lengthy exits, amplifying the draw back worth motion that begins the sample.

Key Bitcoin Worth Ranges Will Decide Whether or not a Breakdown Happens

The primary key degree is $89,100. A clear drop beneath it’ll break the flag and open a squeeze zone. If this occurs, the following help might be close to $80,500. If the strain continues, a full flag extension would level to a 25% improve to $66,600.

Your entire threat is eradicated above $95,900. This degree is above the midpoint of the flag, indicating that patrons are regaining momentum. In that case, Bitcoin may try a transfer in direction of $107,400.

Bitcoin Worth Evaluation: TradingView

Bitcoin worth is at the moment situated between these two strains. A clear break beneath $89,100 confirms the chance. Will probably be eliminated if it exceeds $95,900.

The put up “Bitcoin’s Vital Worth Dangers ‘Flag’ Raised — Right here’s Why a 25% Drop is Attainable” was first printed on BeInCrypto.