A handful of huge offers drove practically half of Web3 enterprise capital exercise within the third quarter of this yr, in keeping with Galaxy Digital analysis launched this week.

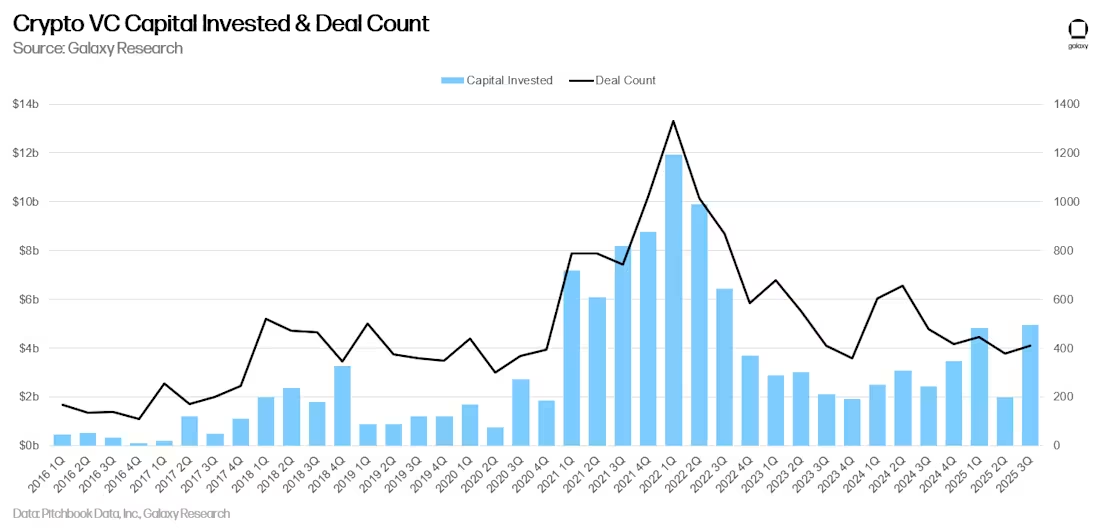

VCs invested $4.65 billion in crypto-focused startups and personal corporations in 415 offers over the identical interval, a rise of 290% from the second quarter, however exercise stays beneath 2021-2022 ranges, the report notes. This progress is primarily pushed by later-stage corporations, indicating that capital continues to be concentrated round established corporations relatively than early start-ups.

Cryptocurrency VC funding capital and variety of transactions. Supply: Galaxy Digital

Simply seven offers accounted for about 50% of all capital pumped into crypto corporations, together with a $1 billion spherical for European fintech large Revolut, which noticed their valuation soar to $75 billion. One other $500 million was invested in Kraken, giving the US trade a worth of $15 billion.

It’s price noting that this quarter, the trade raised an extra $800 million, rising its valuation to $20 billion.

Different giant checks went to blockchain infrastructure platform Erebor, crypto asset administration firm Treasury, tokenized fee community Fnality, Mesh Join, which connects monetary establishments to blockchain, and cryptocurrency custody platform ZeroHash.

Collectively, these seven offers raised greater than $2.26 billion within the third quarter, accounting for 48.7% of all enterprise capital poured into crypto and blockchain-related corporations throughout the identical interval. Regardless of enhancing sentiment and elevated exercise, Galaxy Digital means that “the golden age of pre-seed crypto enterprise investing is behind us.”

In line with Galaxy’s separate Q3 report, crypto lending surged final quarter to a brand new all-time excessive, led by DeFi lending.