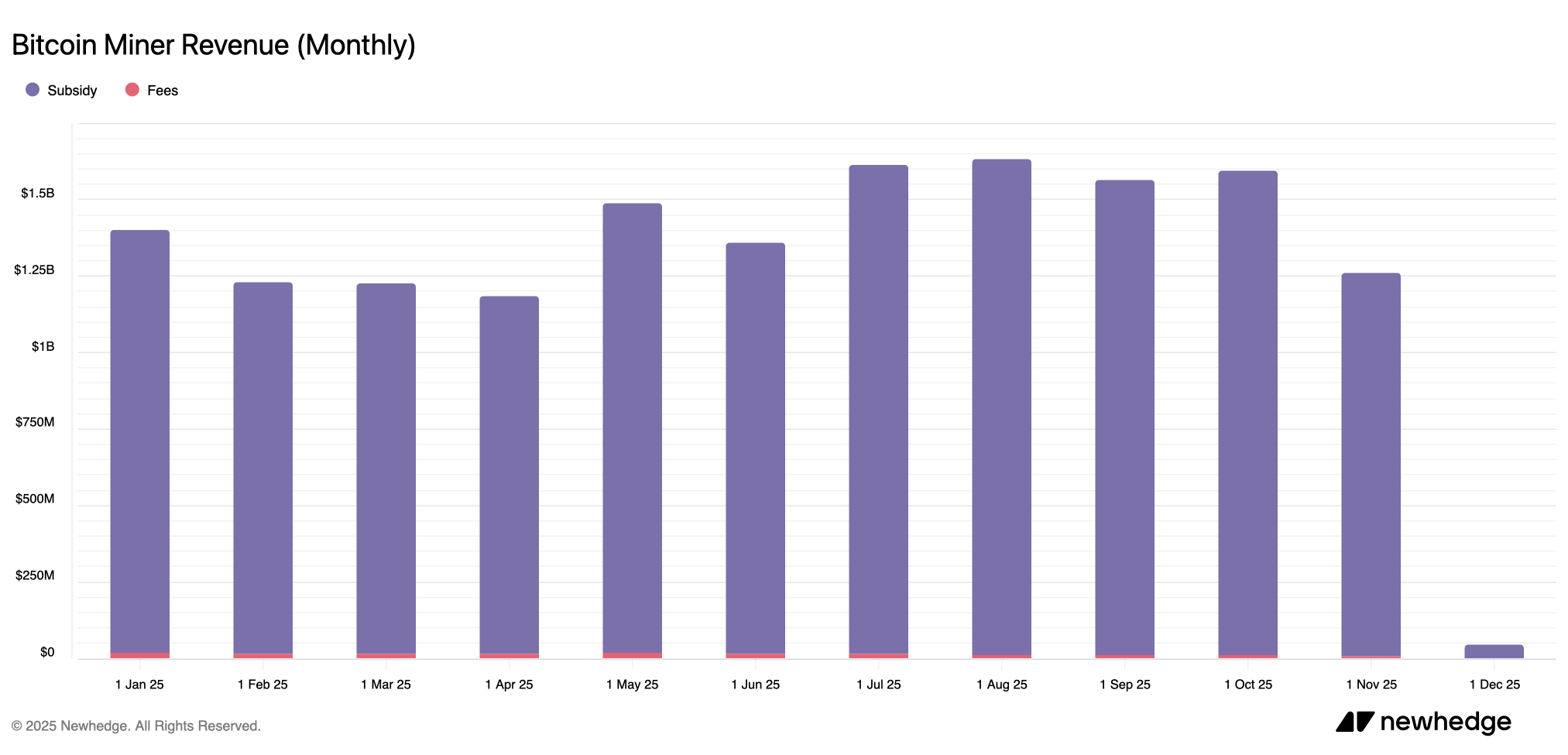

Bitcoin miners continued to plod by means of November, which was the fourth least worthwhile month of 2025, based on knowledge. From begin to end, the mining pool processed roughly 453 blocks and picked up a complete of $1.262 billion in income. This income contains each grants and charges collected alongside the way in which.

Miners grapple with plummeting Bitcoin spot market

Sadly for miners, November’s income was about 20.9% decrease than October, as earnings fell from $1.595 billion to $1.262 billion, based on figures recorded by newhedge.io. The truth is, November’s income was the bottom since April and ranked because the fourth-lowest month of 2025.

The hardest interval of the 12 months stays April with $1.18 billion, adopted by March with $1.22 billion, February with $1.23 billion, and November’s whole. Of the $1.262 billion raised in 30 days, solely about $9 million got here from on-chain charges. Because of this the charges will common out to about 0.71% of the entire block reward.

The highest three mining swimming pools, Foundry, Antpool, and F2Pool, collected roughly $368.3 million, $239.9 million, and $139.5 million, respectively. Over 30 days, Foundry recorded about 29.14% of the entire hashrate, whereas Antpool’s compute share was about 18.98% and F2Pool’s contribution was about 11.04%. ViaBTC adopted intently behind, contributing 10.38% of the general hashrate.

learn extra: Ether ETF leads weekly rally as Bitcoin and Solana keep within the inexperienced

What’s not good is that BTC value as soon as once more dropped considerably on November thirtieth, and the decline continued till December 1st. Estimated hash costs, or hash energy in petahash per second (PH/s), by way of hashrateindex.com are already at critical lows, with Bitcoin valued at $85,879 as of 9 a.m. ET on Monday, so one petahash is now price simply $36.39. The decline in Bitcoin’s USD worth performed a big position within the drop in income in November in comparison with October, and is an enormous a part of the strain miners are presently feeling.

Regardless of the powerful situations, miners proceed to maneuver ahead and need to adapt to narrower revenue margins and decrease hash costs whereas ready for a extra pleasant market to return. With revenues compressed, charges subdued, and Bitcoin buying and selling softening into early December, the sector is relying solely on one of the best by way of effectivity, scale, and persistence. It is the one device left when the community refuses to offer anybody a break.

Continuously requested questions ❓

- How a lot income did Bitcoin miners earn in November? It earned about $1.262 billion, making it the fourth least worthwhile month of 2025.

- Why did miner income lower in comparison with October? Falling Bitcoin costs and weak hash costs drove November’s decline.

- Which pool generated essentially the most mining income? Foundry, Antpool, and F2Pool led the month with the best whole funds.

- How have charges affected miners’ income? On-chain charges accounted for under about 0.71% of whole compensation in November.