The insider whale who shorted the market simply earlier than the October 11 liquidation is again with a brand new transfer. Whales deposited ETH with Aave to borrow extra stablecoins.

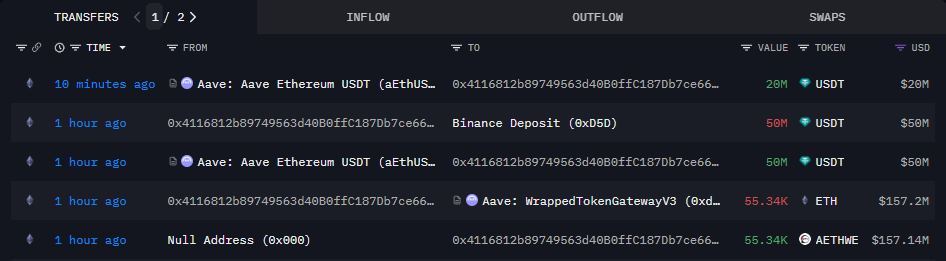

One of many high-profile whales generally known as 1011 sellers has launched a brand new ETH-based technique. This time, the whale used the Aave lending protocol to steal the worth of ETH. The whale deposited 55,240 ETH with Aave and borrowed a tranche of $50 million USDT and one other tranche of $20 million USDT.

The 2 wallets, recognized as belonging to 1011 Whale, recognized for shorting the market throughout the October financial downturn, borrowed USDT from Aave and deposited the stablecoin on Binance. |Supply: Arkham Intelligence

The whale used two recognized wallets. tackle Unstake and provides away 20 million USDT. one other tackleWhale holds over 70,000 wrapped ETH in Aave. Regardless of earlier token brief promoting episodes, Whale has vital publicity to ETH.

The stablecoin was then despatched to Binance in two transactions. For OG Whale, this ETH switch is the primary pockets exercise in three months. In the meantime, Whale primarily held BTC positions and switched to lengthy bets on HyperLiquid within the brief time period.

1011 Instantly after whale exercise, new pockets was created and 42,000 ETH was withdrawn from Binance. Right now, it stays unclear whether or not the wallets are linked in any manner.

October eleventh Whales could also be making ready to purchase ETH at low costs

Latest exercise on Ethereum has elevated hypothesis that the whale, recognized as Garrett Zinn, will use borrowed funds to build up extra ETH and different property. Whales are generally known as market indicators of potential modifications in sentiment, and thus far they’ve made strikes at key moments.

As of December 1st, the whales had nothing. place About Hyper Liquid. Whale presently holds $176 million in property, most of which is wrapped ETH on USDT and Aave.

1011 Whales had been additionally lively in early November. Nevertheless, as of November twelfth, the whale had closed all its lengthy positions in ETH, reaching a revenue of $2.85 million.

Whales haven’t expressed long-term perception in ETH, however have taken benefit of the market restoration. Present borrowing means whales could also be ready to purchase native lows or market bottoms within the brief time period.

Whale additionally posted ETH stakingindicating not less than a partial allocation to long-term bullish expectations from Ethereum. 1011 Whale deposited ETH together with a number of different wallets, all selecting the identical staking sensible contract from the chosen staking pool.

Throughout the latest market downturn, Aave lowered its TVL to $31 billion as a result of drop in ETH value. Simply as some scorching whales have entered the market, ETH has returned to the $2,800 degree following the latest decline.

Can ETH recuperate to the next vary?

ETH has proven some indicators of reversal over the previous few days, together with new purchases from whales. Nevertheless, after a collection of lengthy liquidations, the token fell once more.

ETH open curiosity continues to say no 31 factorsindicating a deepening worry. In weaker positions, ETH may see renewed shopping for curiosity as whales rotate positions to decrease the typical value.