Bitcoin’s sharp correction from $110,000 to round $80,000 is said to heavy promoting by early whales with a value base close to $16,000. CryptoQuant CEO Ki Younger Ju famous that on-chain indicators point out that Bitcoin is presently within the “shoulder” section of the cycle, suggesting restricted upside potential within the brief time period.

This sell-off has overwhelmed institutional demand from ETFs and MicroStrategy, shaping the outlook for cryptocurrencies in 2025. In an interview with Upbit’s Upbitcare, Ju stated: > Early Bitcoin whales gasoline promoting strain

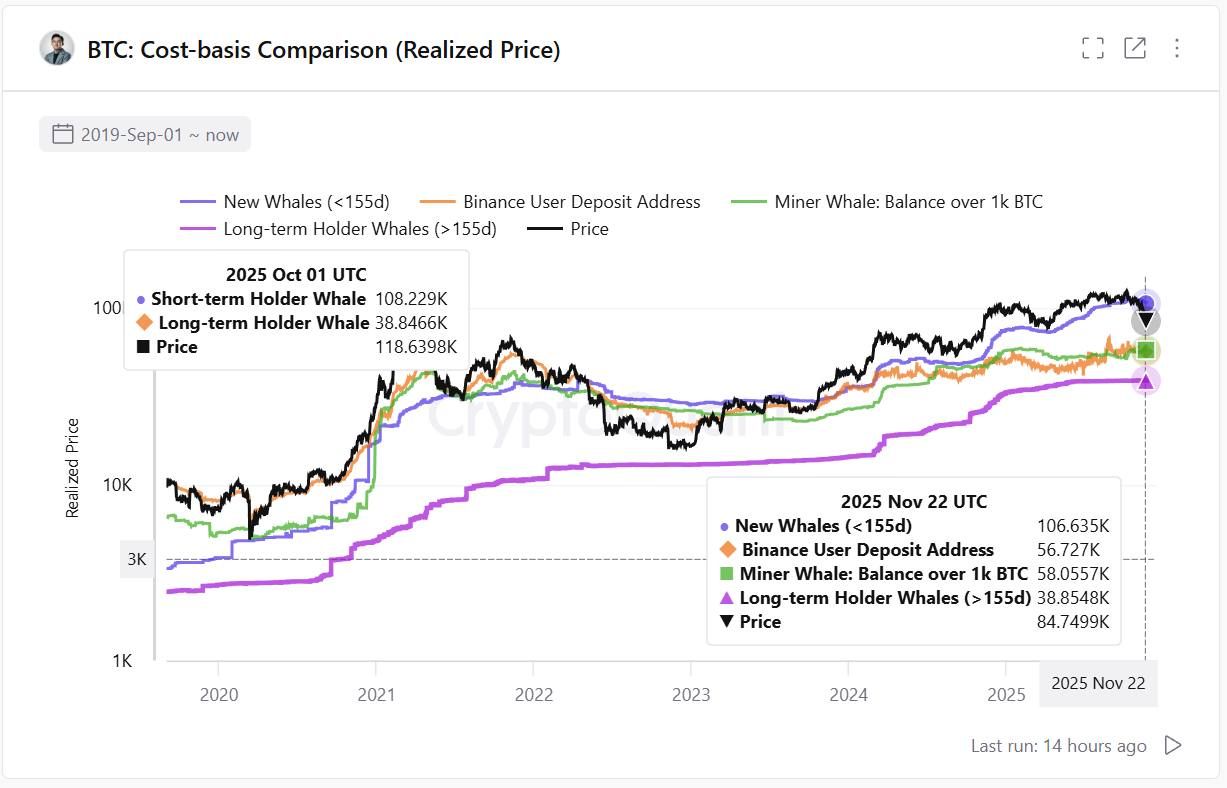

Ki Younger Ju explains that immediately’s market is formed by competitors between two main teams of whales. Legacy whales holding almost $16,000 value of Bitcoin on a median price foundation are promoting at charges value a whole bunch of tens of millions of {dollars} every day, and are beginning to understand enormous earnings. This persistent sell-off is exerting sturdy downward strain on the Bitcoin worth.

On the similar time, institutional traders via the Bitcoin Spot ETF and MicroStrategy are accumulating important positions. Nevertheless, their buying energy doesn’t match the dimensions of the preliminary whale gross sales. Based on Ju, the common price base for wallets holding 10,000 BTC or extra for greater than 155 days is often round $38,000. Binance merchants entered positions value round $50,000, so many market members have made earnings and might promote if they want.

Value-based comparability throughout completely different Bitcoin holder classes. Supply: CryptoQuant

The CryptoQuant CEO famous that inflows into spot ETFs and MicroStrategy have been driving the market increased in early 2025, however these inflows are actually declining. Outflows are beginning to dominate the market. For instance, the Bitcoin ETF recorded web inflows of $42.8 million on November 26, 2025, bringing cumulative inflows to $62.68 billion, based on knowledge from Pharcyde Buyers. Regardless of these numbers, sustained promoting from early whales outweighs institutional accumulation.

Market cycle evaluation suggests restricted upside

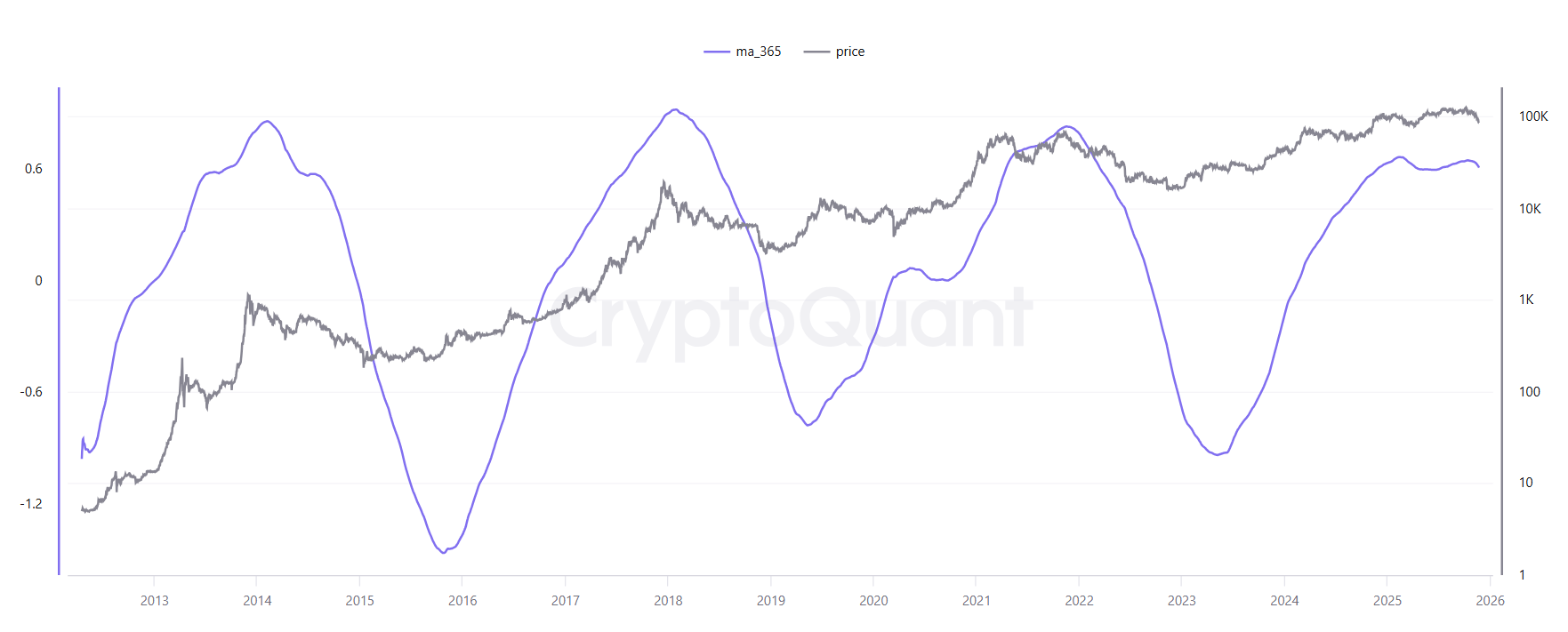

On-chain P&L metrics present necessary perception into market cycles. Ju’s evaluation utilizing a P&L index utilizing a 365-day transferring common reveals that the market has entered a “shoulder” stage. This late-cycle situation signifies subdued progress potential and elevated threat of correction.

The valuation multiplier displays a impartial to flat outlook. In earlier cycles, every new greenback amplified market cap progress. Now, that synergy has pale. This means that market leverage is inefficient and its construction doesn’t assist important earnings.

A revenue and loss index that reveals Bitcoin’s present cycle place. Supply: CryptoQuant

Ju would not anticipate a dramatic 70-80% drop. Nonetheless, he believes a correction of as much as 30% is cheap. A drop from $100,000 might imply Bitcoin falls to round $70,000. He makes use of knowledge from OKX futures lengthy/brief ratios, foreign money leverage ratios, and purchase/promote circulate patterns to assist this view.

Ju stated goal=”_blank” rel=”noopener”>He highlighted the significance of latest posts and urged merchants to make use of indicators for conviction somewhat than hypothesis. His focus continues to be on the interpretation of on-chain knowledge, trade exercise, and market construction.

By no means commerce with out knowledge. pic.twitter.com/JnAtLwpdGa

— Younger Judgment_ November 27, 2025

This complete evaluation offers a grounded evaluation based mostly on on-chain proof. As early Bitcoin whales proceed to promote at a revenue, monetary establishments are dealing with robust instances. Excessive leverage ratios, impartial valuation multipliers, and late-cycle stance restrict the market’s potential for important upside within the close to time period.