For years, U.S. banks handled Bitcoin as one thing finest noticed from afar.

The property had been remoted from core banking methods resulting from capital controls, custody issues and reputational dangers, and resided on specialised exchanges and buying and selling apps.

Nonetheless, that angle is lastly starting to crumble.

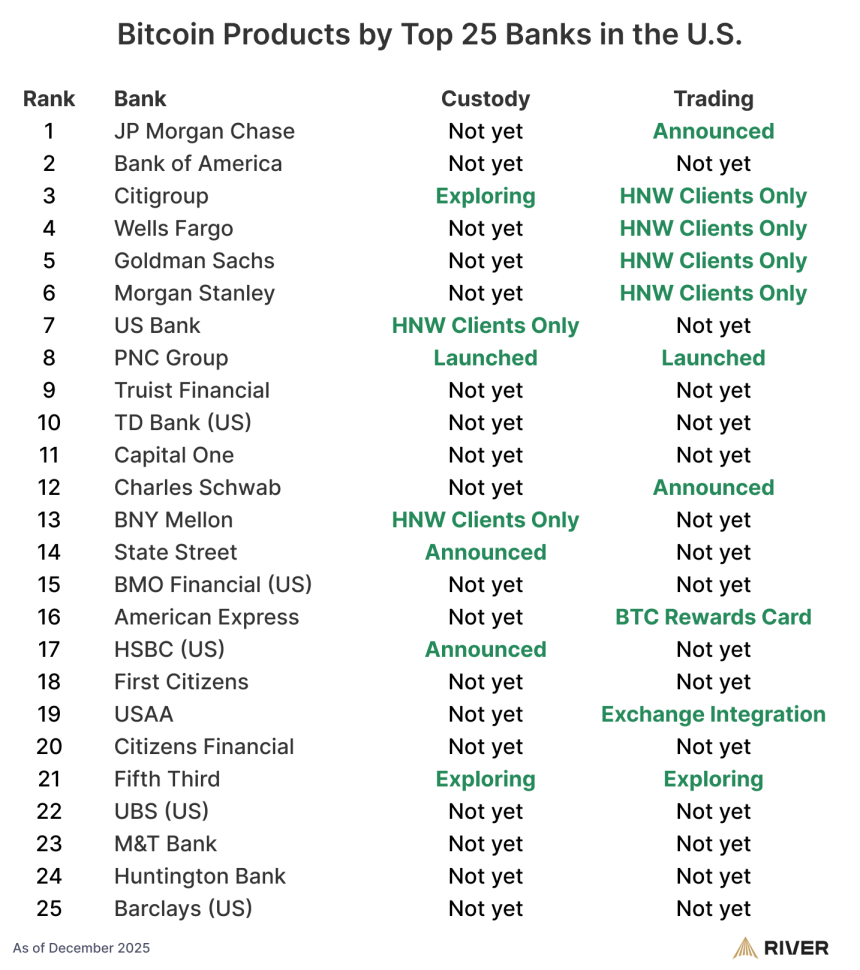

Based on River information, practically 60% of the nation’s 25 largest banks are actually instantly promoting, storing, and advising on Bitcoin.

Spot ETF approval dominated headlines in 2024. The story of 2025 is quiet. Cryptocurrencies are shifting from fringe allocation to on a regular basis gadgets inside mainstream wealth administration workflows.

If the present timeline holds, 2026 would be the first yr wherein Bitcoin appears like the usual commodity quite than the exception.

From ETF pass-through to white label buying and selling

The ETF complicated was step one within the institutional adoption of Bitcoin. This supplied banks with a solution to meet buyer demand inside a well-known wrapper, with asset managers and specialist custodians shouldering a lot of the operational burden.

Notably, ETF buying and selling additionally supplied a real-time stress check for these establishments, as flows had been shifting in each instructions with out breaking the market plumbing.

Importantly for the Threat Committee, Bitcoin’s volatility might be managed throughout the established supervisory framework, even when it isn’t lowering.

The subsequent step is to permit at the very least some purchasers to carry and commerce the underlying property from the identical interface they use for every thing else.

PNC Monetary Companies Group’s enlargement into personal banking is the obvious instance. Slightly than constructing a cryptocurrency trade, PNC is utilizing Coinbase’s “Crypto-as-a-Service” stack.

Banks handle buyer relationships, suitability checks, and reporting, whereas Coinbase supplies buying and selling and core administrative companies behind the scenes.

Variations on that “white label” construction have gotten the business’s compromise. This enables banks to say “sure” to buyer requests with out having to launch their very own pockets infrastructure or blockchain operations.

Moreover, latest steering from the Workplace of the Comptroller of the Forex (OCC) clarifies how nationwide banks can deal with digital forex transactions as risk-free principal transactions that contain purchases from liquidity suppliers and gross sales to prospects at practically the identical time.

This reduces the influence on capital from market dangers and makes it simpler to arrange a Bitcoin desk alongside overseas trade or mounted revenue operations.

Nonetheless, we stay cautious. Banks are beginning with probably the most subtle prospects and restricted merchandise.

By means of background, Charles Schwab and Morgan Stanley intention to launch spot buying and selling of Bitcoin and Ethereum on their voluntary platforms within the first half of 2026.

Nonetheless, entry is anticipated to be measured by strict quota caps, conservative margin guidelines, and stricter eligibility checks.

regulatory stack

Underpinning this modification is a regulatory and constitution panorama that more and more matches conventional establishments higher than their rising opponents.

The GENIUS Act established a federal framework for stablecoin issuers. The OCC has issued conditional nationwide belief charters to crypto firms, creating regulated counterparties that fall inside present danger and capital regimes.

This mix permits banks to assemble a plug-and-play stack. US Bancorp has reinstated its institutional Bitcoin custody service with NYDIG as a sub-custodian.

Different giant incumbents, together with BNY Mellon, are constructing digital asset platforms geared toward monetary establishments that need their Bitcoin to be held by the identical manufacturers that safe U.S. Treasuries and mutual funds.

For rich prospects, optics are necessary. Shopping for Bitcoin by a Morgan Stanley or Schwab interface and having your positions seem on the identical dashboard or assertion as different securities feels basically completely different than transferring funds to an offshore venue.

As such, banks are utilizing their belief and regulatory standing to reposition crypto exchanges and infrastructure firms as back-end utilities quite than front-of-house manufacturers.

In consequence, the normalization schedule is compressed, however not instantaneous.

Beginning in January 2026, Financial institution of America will permit Merrill, Personal Financial institution, and Merrill Edge advisors to suggest crypto exchange-traded merchandise.

This could transfer Bitcoin away from “unilateral” entry to property that may be integrated into mannequin portfolios, and would expose it to the identical allocation mechanisms that move to fairness and bond ETFs.

New piping, new dangers

The identical structure that makes it straightforward for banks to reply shortly additionally introduces new vulnerabilities.

Most establishments providing or planning to offer entry to cryptocurrencies haven’t constructed their very own vaults. As an alternative, it depends on a handful of infrastructure suppliers akin to Coinbase, NYDIG, and Fireblocks for execution, pockets know-how, and key safety.

That focus creates one other sort of systemic danger. The chance-free principal mannequin and ETF wrapper restrict the quantity of full market danger that banks have to tackle their stability sheets.

Nonetheless, counterparty and operational dangers are usually not eradicated.

As such, a serious outage, cyber incident, or enforcement motion at a core sub-custodian couldn’t solely influence particular person crypto merchants, however might concurrently spill over into the personal banking sector, institutional custodian operations, and mannequin portfolios of a number of giant establishments.

Given this, banks are actually tying their reputations and repair ranges to vendor resiliency that did not exist 10 years in the past.

Threat groups can attempt to alleviate this drawback by insisting on modularity in order that distributors might be swapped out, and by retaining preliminary packages small relative to the general property.

However the path is obvious. The rising share of Bitcoin publicity will place it on the intersection of huge banking wealth platforms and concentrated crypto professionals.

From pilot merchandise to straightforward merchandise

Consolidation is continuing regardless of residual dangers.

US Bancorp’s resumption of custody, PNC’s personal financial institution deal, Schwab and Morgan Stanley’s 2026 targets, Financial institution of America’s advisory go-ahead, and JPMorgan’s crypto adoption all level to the identical end result. In different phrases, Bitcoin is woven into the operational material of mainstream finance, quite than working outdoors of it.

None of this ensures a clean transition, as BTC worth volatility stays, insurance policies might change, and main incidents in crypto infrastructure might delay or reverse elements of the roadmap.

But when the present trajectory holds, by 2026 the query going through many high-net-worth purchasers can be much less about whether or not banks supply Bitcoin in any respect and extra about the way to cut up their publicity between ETFs, direct holdings, and advisory fashions. It can even be necessary to know which establishments might be trusted between them and the underlying rails.

Banks might not have chosen Bitcoin as their most popular innovation venture. They settle for it as a result of their purchasers already settle for it.

The continued pivot is to construct sufficient equipment across the property in order that these prospects and their balances do not drift perpetually elsewhere.