On Friday, the market capitalization of Bitcoin mining shares rose 9.43%, with the entire prime 10 publicly traded miners by market capitalization closing within the inexperienced, together with three shares with double-digit beneficial properties. With one week left on the 2025 calendar, practically your entire mining group, excluding two laggards, seems poised to finish the 12 months on a constructive word.

Sturdy buying and selling on Friday places listed Bitcoin miners in for a loud run into 2026

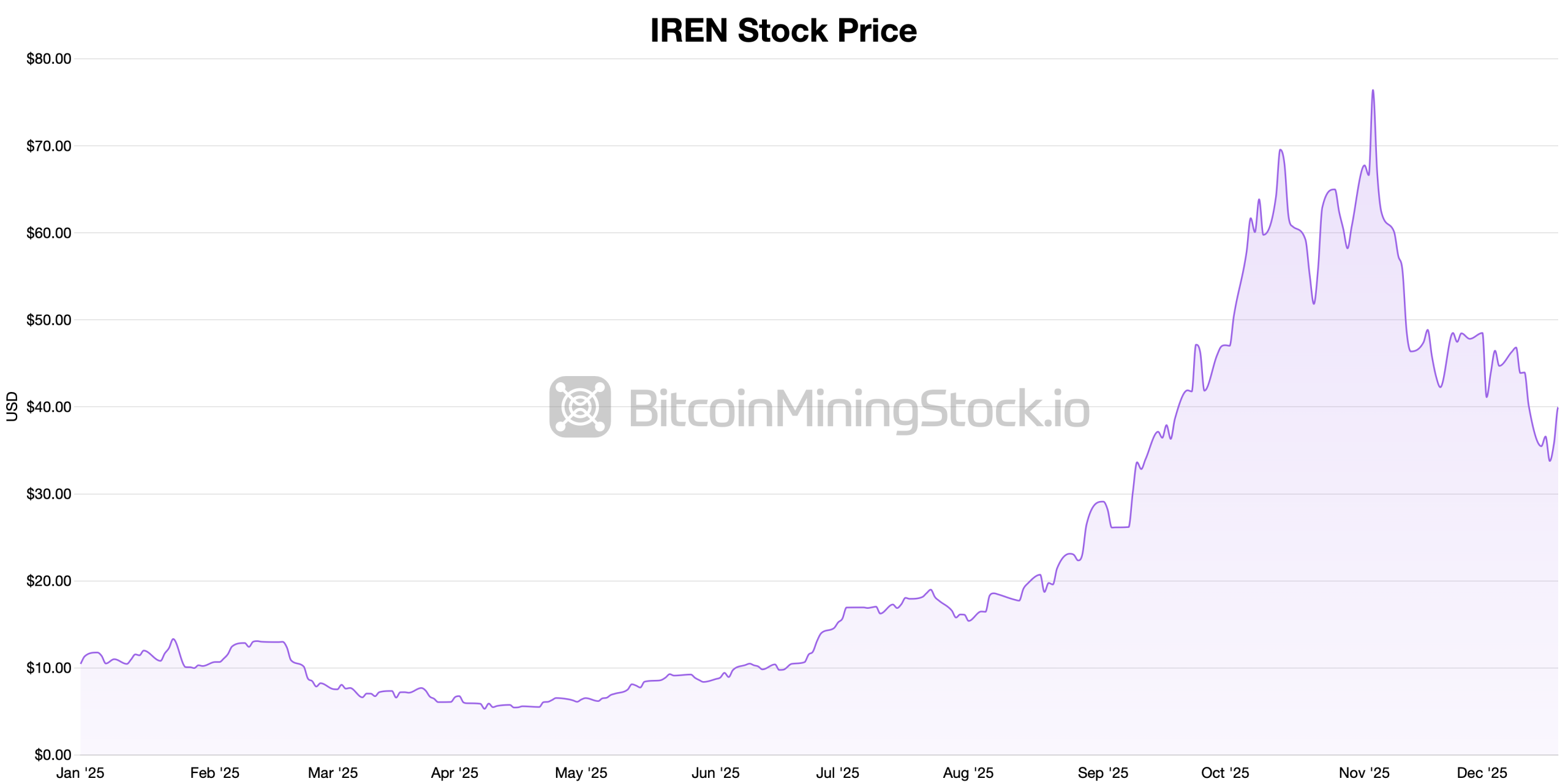

Bitcoin miners traded on U.S. exchanges had been strong on Friday, holding tempo with main U.S. inventory indexes. IREN Restricted, the most important publicly traded Bitcoin miner with a market capitalization of $11.31 billion, rose 11.50% on the day to shut at $39.92. Though the inventory value has fallen by 0.52% prior to now 5 enterprise days, the general image continues to be attracting consideration, with the inventory value rising 306.51% year-to-date (year-to-date).

Utilized Digital rose 16.52% on Friday to shut at $27.85. Nonetheless, the inventory value remained largely unchanged over the five-day interval, down simply 0.03%. Zooming out, APLD continues to be having an incredible 12 months, up 264.52% year-to-date, giving it a market cap of round $7.8 billion. Slightly below APLD, Cipher Mining closed at $16.21 on Friday, marking a 6.99% acquire on the day.

IREN YTD statistics as of December 20, 2025.

This improve hasn’t utterly erased the current impression, with the inventory nonetheless down 4.92% over the previous 5 classes. Nonetheless, CIFR has loads to be happy with over the long run, with its inventory value up 249.35% year-to-date and its market cap hovering round $6.4 billion. Riot Platforms closed Friday’s buying and selling up 8.37% at $14.50. Nonetheless, in 5 days, the inventory value fell by 5.22%. On a year-to-date foundation, RIOT nonetheless leads by 42.01%, with a valuation hovering round $5.39 Billion.

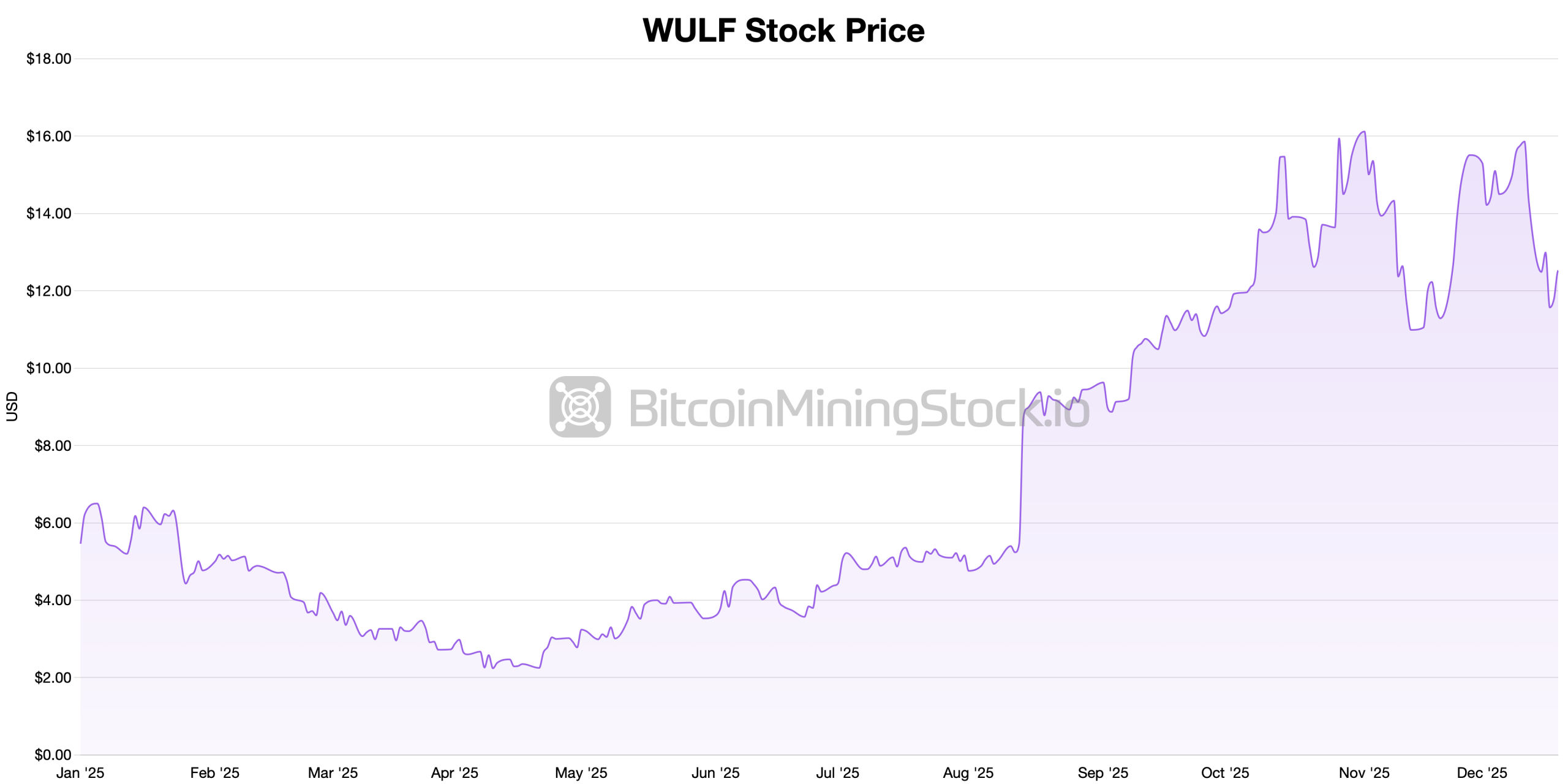

WULF YTD statistics as of December 20, 2025.

TerraWolf Inc. closed the week at $12.52, up 6.19% on Friday. Quick-term buying and selling has been robust, with the inventory value down 12.63% over the previous 5 days. Even after this decline, WULF continues to be up 121.20% year-to-date, with a market capitalization of roughly $4.89 billion as we method the final week of December.

Additionally learn: Bitcoin futures and choices positioning indicators a cautious reset forward

Rounding out the highest 10, Core Scientific ended the week at $15.60, up 7.14% on the day, rising its year-to-date acquire to 11.03% and giving it a market cap of roughly $4.84 billion. Hut 8 Corp. surged 14.33% to shut at $44.12, giving it a year-to-date return of 115.32% and valuing the miner at roughly $4.77 billion.

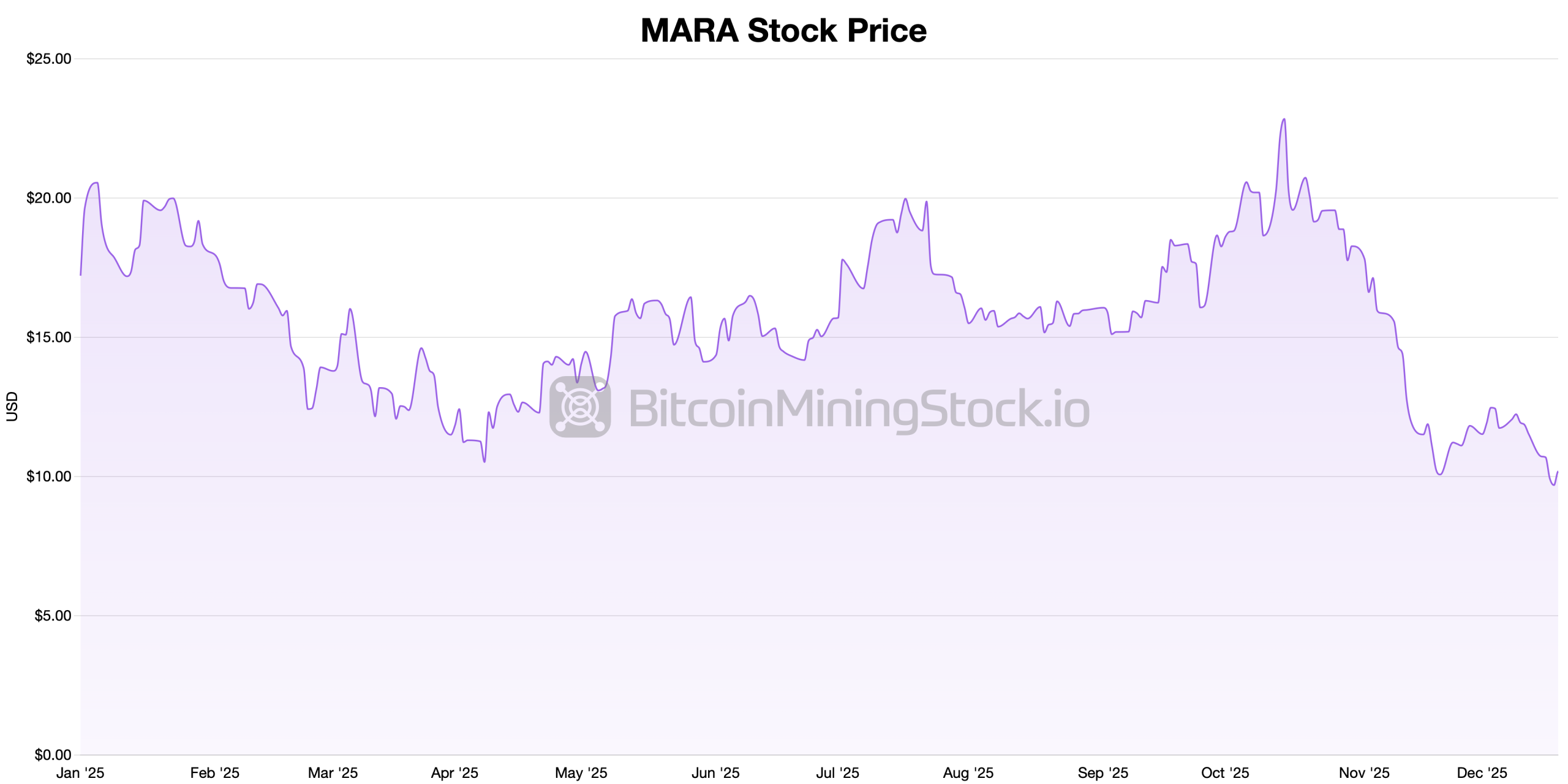

MARA year-to-date statistics as of December 20, 2025.

MARA Holdings rose 5.05% on the day to shut at $10.18, however was nonetheless down 39.29% since January 1st, giving it a market cap of practically $3.85 billion. Cleanspark Inc. rose 7.41% to finish the 12 months at $12.03, up 30.61% year-to-date. In the meantime, Bitdeer Applied sciences Group closed at $11.01, up 9.99% for the day however down 49.19% for the 12 months, giving it a market valuation of roughly $2.3 billion.

Friday’s across-the-board rally ended the 12 months neatly for publicly traded Bitcoin miners, and regardless of some short-term stumbles, most corporations enter the ultimate days of 2025 on strong footing. The distinction between unstable weekly buying and selling and crowd pleasing year-to-date outcomes exhibits that traders proceed to concentrate on scale, execution, and stability sheet self-discipline because the calendar turns, even when not all miners make it to the end line unscathed.

The ultimate week of December is anticipated to stay constructive, however unstable, as traders hold their books on monitor and safe income, whereas skinny vacation buying and selling might be exaggerated. As 2026 begins, consideration will flip to stability sheets, growth plans, and Bitcoin value developments, which ought to set the tone for which miners preserve momentum and which face a reset.

Steadily requested questions ⛏️

- Why did Bitcoin mining shares rise on Friday?Most miners rose together with U.S. inventory indexes as traders bid up shares forward of year-end positioning.

- Which Bitcoin Mining Shares Led the Rise?Massive miners equivalent to IREN Restricted, Utilized Digital, and Hut 8 posted the strongest single-day beneficial properties.

- What ought to traders be looking forward to within the last week of December?If vacation liquidity is skinny and settlement exercise will increase, general value fluctuations in mining shares might improve.

- What are crucial components for Bitcoin miners heading into 2026?Stability sheets, growth plans, and Bitcoin value developments are prone to decide efficiency early within the new 12 months.