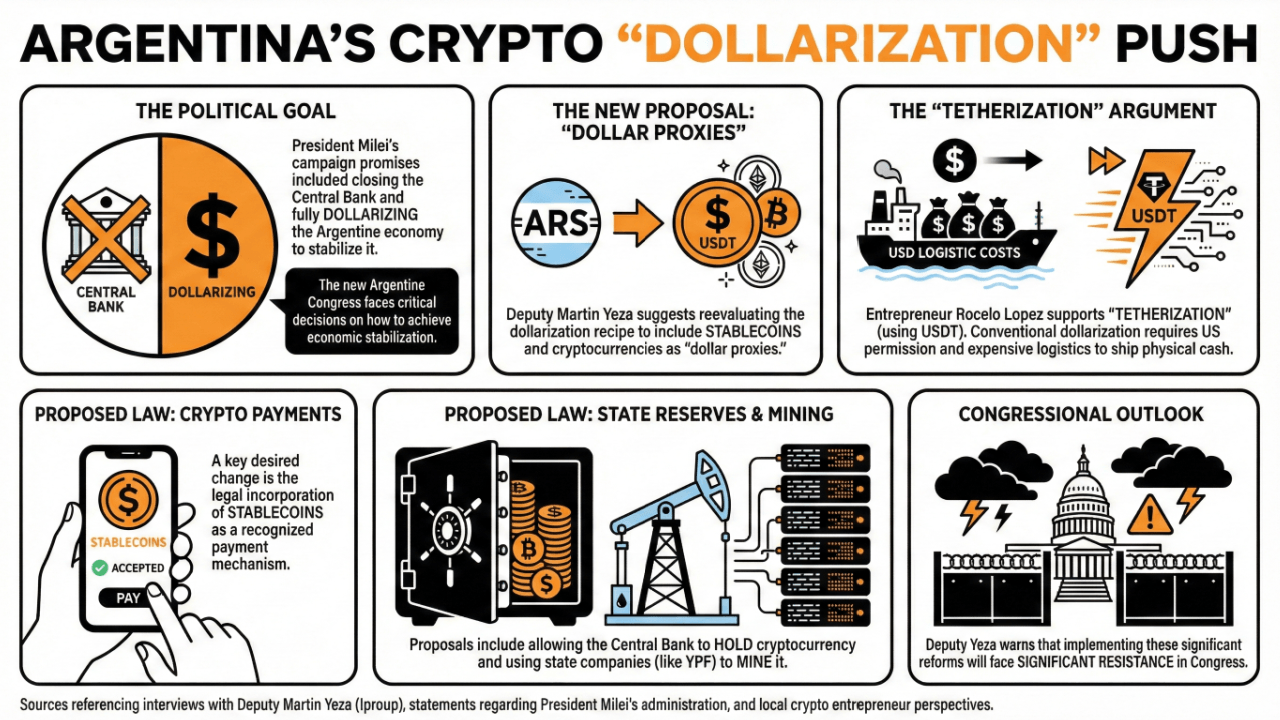

Martin Ezza, a deputy within the new parliament, stated stablecoins might play a brand new and pivotal position within the nation’s funds construction. He believes it could be constructive for central banks to personal cryptocurrencies and permit state-owned enterprises to mine them. Native analysts additionally supported the so-called “tetherization” of the financial system.

Argentina’s new parliament might give new energy to cryptocurrencies in 2026

The brand new Argentine parliament might want to deal with a number of vital crypto and stablecoin-related points within the new yr.

Based on Deputy Minister Martin Eza, the federal government will reevaluate the dollarization recipe this yr to stabilize the financial system and embrace stablecoins and cryptocurrencies as alternate options to the greenback.

In a dialog with Iproup, he stated:

If a sequence of reforms have been to be carried out, they might face important resistance, and such a gathering would definitely not be welcomed in parliament.

However one change he wish to see is the inclusion of stablecoins as a cost mechanism. He’s additionally contemplating permitting central banks to carry cryptocurrencies and mine them by state-owned enterprises resembling YPF, even when governments don’t benefit from these prospects instantly.

One in all President Milais’ main marketing campaign guarantees was to shut the central financial institution and dollarize the financial system to scale back inflation.

Native cryptocurrency entrepreneur Rosselló López supported the “tetherization” of the Argentine financial system, referring to Tether, the issuer of USDT, the most important stablecoin by market capitalization.

A conventional dollarization of the Argentine financial system must be given the inexperienced mild by the USA, which might even have to contemplate the transportation and logistics prices of bringing American money into Argentina.

“Tetherization” would provide benefits in comparison with the common dollarization course of, which doesn’t contain the US authorities. Lopez emphasised that the operations will likely be traceable and will likely be a low-cost transaction.

Latest experiences have revealed that Argentine banks are prepared to supply crypto providers to their prospects and that the central financial institution is drafting particular measures to open the crypto market to personal banks.

learn extra: Argentina’s central financial institution considers banks providing cryptocurrency providers

FAQ

What vital points concerning cryptocurrencies will likely be addressed within the new Argentine Congress?

Congress plans to reevaluate the usage of. Stablecoins and cryptocurrencies As a substitute for the greenback for financial stabilization in 2026.What sort of reforms does Deputy Martin Eza suggest for the introduction of digital currencies?

Yeza is a stablecoin cost mechanism and permit central banks to carry and mine cryptocurrencies by state-owned enterprises.How does Rosselló López see the concept of “tetherization” for Argentina?

Lopez advocates “tetherization” as a versatile various to conventional dollarization, providing advantages resembling traceability and low-cost transactions with out the necessity for U.S. permission.What developments are occurring with cryptocurrencies in Argentine banks?

Studies say Argentine banks are getting ready provides encryption service He additionally revealed that the central financial institution is engaged on measures to open up the cryptocurrency market to personal banks.