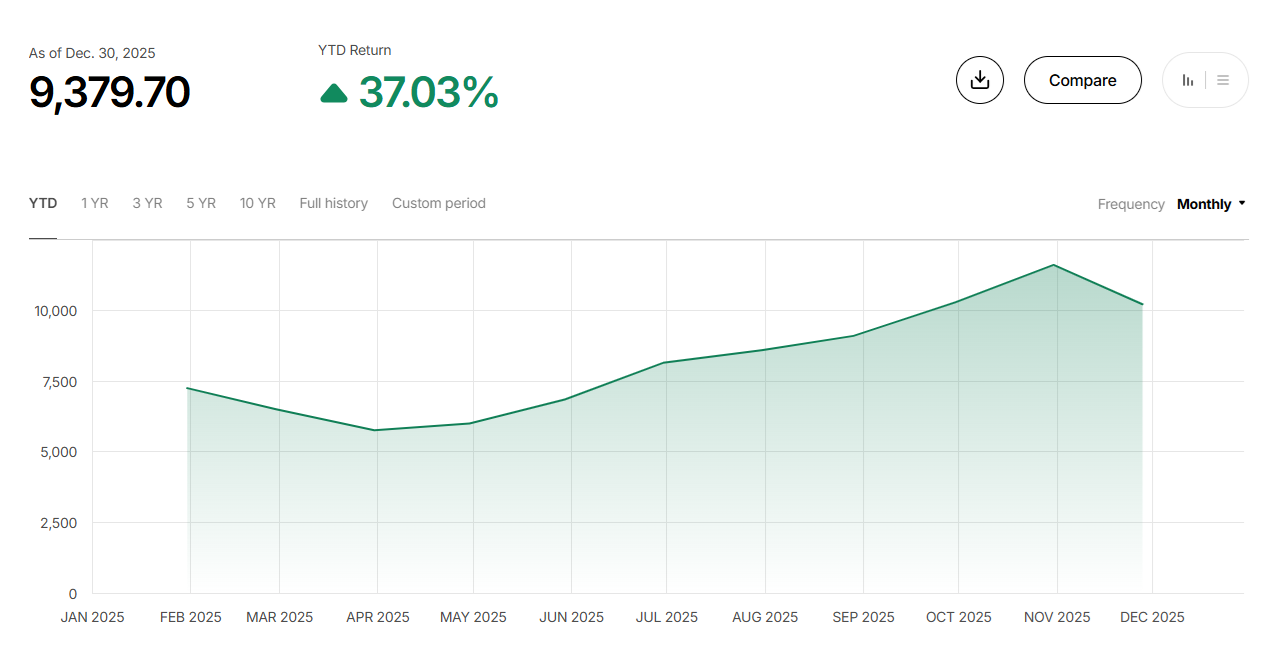

The whole cryptocurrency market ended 2025 with a web loss, with its valuation falling from $3.5 trillion to $3 trillion. The MSCI Blockchain Financial Index has outperformed, rising over 37% previously 12 months.

In 2025, the MSCI Blockchain Financial Index rose a web 37.03%, outperforming most narratives and main cash. The index is predicated on tech shares and displays features throughout the sector.

MSCI Blockchain Financial Index rose over 37% in 2025, boosted by the efficiency of NVDA, IREN, HOOD and stability of different elements. |Supply: MSCI Index.

The MSCI Blockchain Economic system Index contains legacy shares from the period of lively mining. Consequently, the index displays not solely NVDA’s income, but in addition its just lately recovered inventory worth. Airen.

Consequently, the Blockchain Index leverages the most recent traits in know-how and the overall economic system, avoiding underperformance of belongings focused at crypto insiders. The index improved on its efficiency in 2024, when web revenue for the inventory basket elevated by about 34%.

Blockchain financial index MSCI World IndexIn 2025, it achieved a web revenue of 21.9%. The index additionally improved additional in 2024, with web revenue rising by 18.67%.

MSCI delivers its finest efficiency previously two years

MSCI Blockchain Economic system displays the migration of mining corporations to knowledge facilities and captured the rise of NVDA. Consequently, index investing didn’t mirror a 12 months wherein cryptocurrencies had been comparatively weak.

The index posted its finest efficiency since 2023, rising 98.88%. MSCI mirrored the crypto winter with losses of over 46% in 2022.

The 2025 efficiency additionally displays a shift towards international funding in U.S. shares, the index’s largest element. furthermore, AI corporations It pushed up some index shares.

MSCI’s monetary element lags in comparison with tech shares

The MSCI index has a 39% monetary inventory element. VISA inventory ended the 12 months with little web change, buying and selling above $353. Mastercard MA inventory additionally maintained a spread of $577.

Robinhood (HOOD) boosted the index’s ultimate efficiency with a 200% web achieve in 2025, offsetting PayPal’s 30% loss. Coinbase World (COIN) fell roughly 9.3% over the identical interval. The inventory’s comparatively excessive liquidity continued to push the index increased.

Monetary shares additionally mirror the shift in direction of conventional funds and using blockchain elements and stablecoins as a part of common fee methods.

Compared, the S&P index of large-cap cryptocurrencies fell. 14.49% By the top of the 12 months, reflecting weakening sentiment in direction of direct funding in cash and tokens. Blockchain as an infrastructure has seen widespread adoption amongst mainstream corporations, however the AI narrative has deserted native buying and selling and hypothesis over the previous 12 months.

The S&P Broad Digital Asset Index carried out even worse, wiping out 16.22% over the previous 12 months, with a lot of the important losses concentrated within the third quarter.