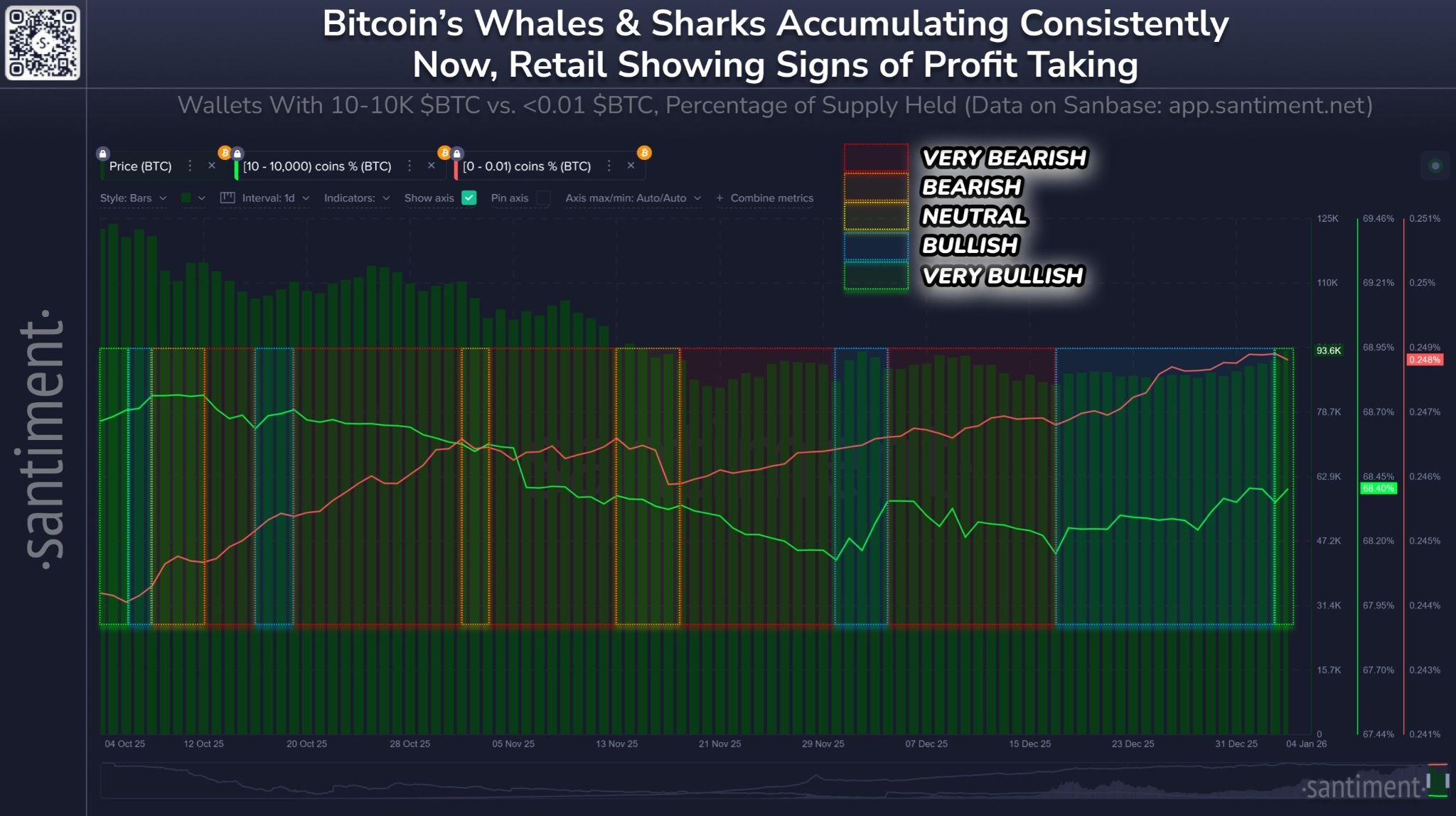

Santiment mentioned Bitcoin accumulation by whales and up to date profit-taking by retail merchants may very well be seen as bullish and will result in additional upward momentum available in the market.

On-chain analytics platform Santiment mentioned on Monday that crypto markets “usually comply with the trail of main stakeholders in whales and sharks, and in the wrong way of small retail wallets.”

Whales and sharks are outlined as teams holding between 10 and 10,000 BTC, whereas retail merchants’ wallets maintain lower than 0.01 BTC.

Since mid-December, Whales and Sharks have collectively amassed a further 56,227 BTC, Santiment mentioned.

“This marked a neighborhood backside for the cryptocurrency. And even when the market stays comparatively flat, a bullish departure from accumulation ought to no less than create a small breakout,” he added.

“Issues have gotten even higher” previously 24 hours, he mentioned, including that retail merchants at the moment are taking income from “the expectation that we’re in a bull lure/a rally of fools.”

Santiment concluded that these dynamics “make it extra probably than typical that the general market capitalization of cryptocurrencies will proceed to extend.”

Whale accumulation and retail gross sales are bullish. sauce: Saintly

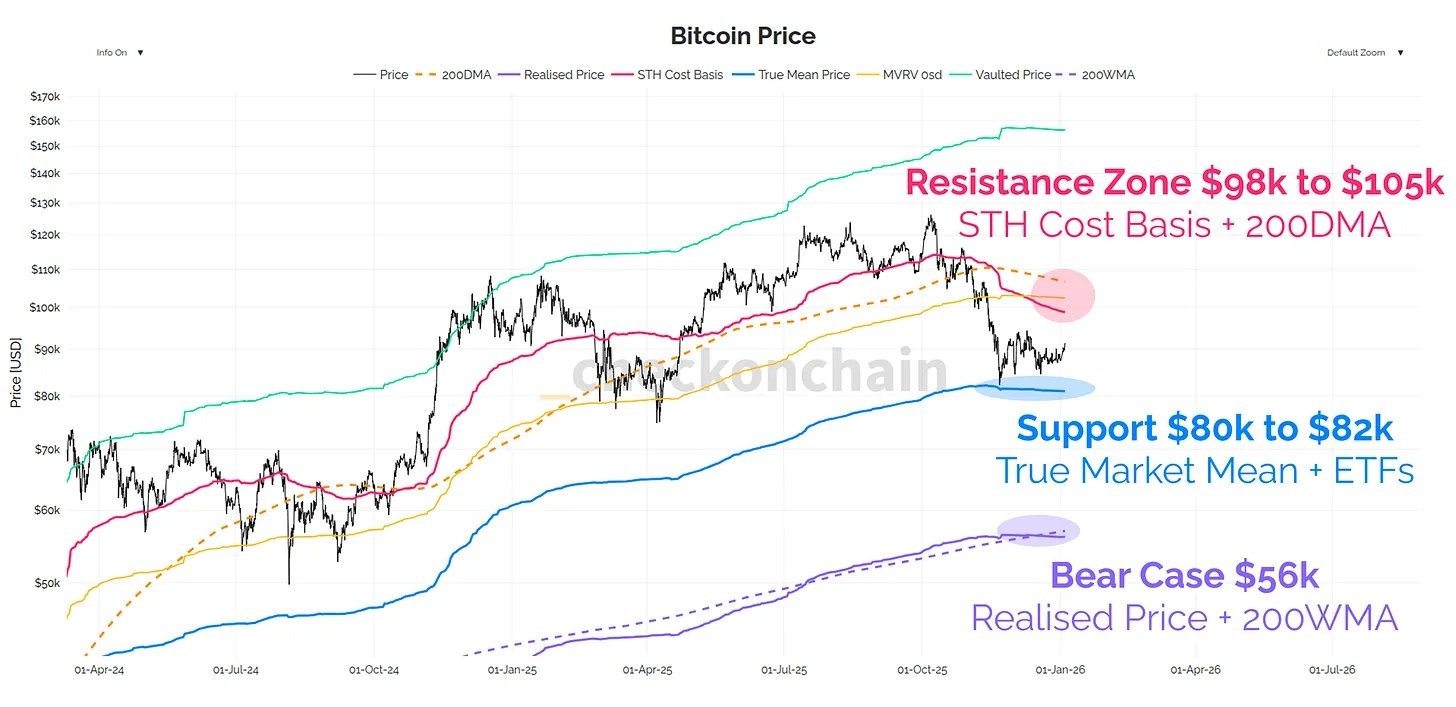

Bitcoin breakout could also be imminent

Bitcoin (BTC) has traded largely sideways for six weeks since mid-to-late November, hovering inside a variety of roughly $87,000 to $94,000.

It’s presently on the higher finish of this vary, hitting a seven-week excessive of $94,800 on Coinbase in late buying and selling on Monday, in accordance with TradingView.

Associated: Can BTC keep away from the bull lure at $93,000? 5 issues to learn about Bitcoin this week

Analyst James Test mentioned on Tuesday that Bitcoin will open 2026 with a rally to $94,000, “however the actual story is that there’s a huge reallocation of provide happening behind the scenes.”

He famous that whereas “top-heavy provide” has rebalanced from 67% to 47%, profit-taking has “fallen off a cliff” and there’s a brief squeeze within the futures market, general market leverage stays low.

Bitcoin is transferring away from help and in direction of long-term resistance. sauce: james examine

bullish consolidation section

“Bitcoin remains to be in a bullish consolidation section,” Andri Fauzan Azima, head of analysis at Bitru Cryptocurrency Change, instructed Cointelegraph.

“Key upside resistance lies between $95,000 and $100,000, with name choice curiosity weighted across the $100,000 strike worth expiring in January. Speedy help lies between $88,000 and $90,000, under which a break may set off a deeper correction,” he added.

journal: Kane Warwick loses $50,000 ETH wager on Bitmine’s ‘1000x’ share plan: Hodler’s Digest