Ethereum (ETH) value exercise in December confirmed a spread contraction across the $3,000 degree and seems to have a breakout potential, whereas on-chain information is recording uncommon indicators.

What are these indicators and have they got a constructive or detrimental influence on ETH value?

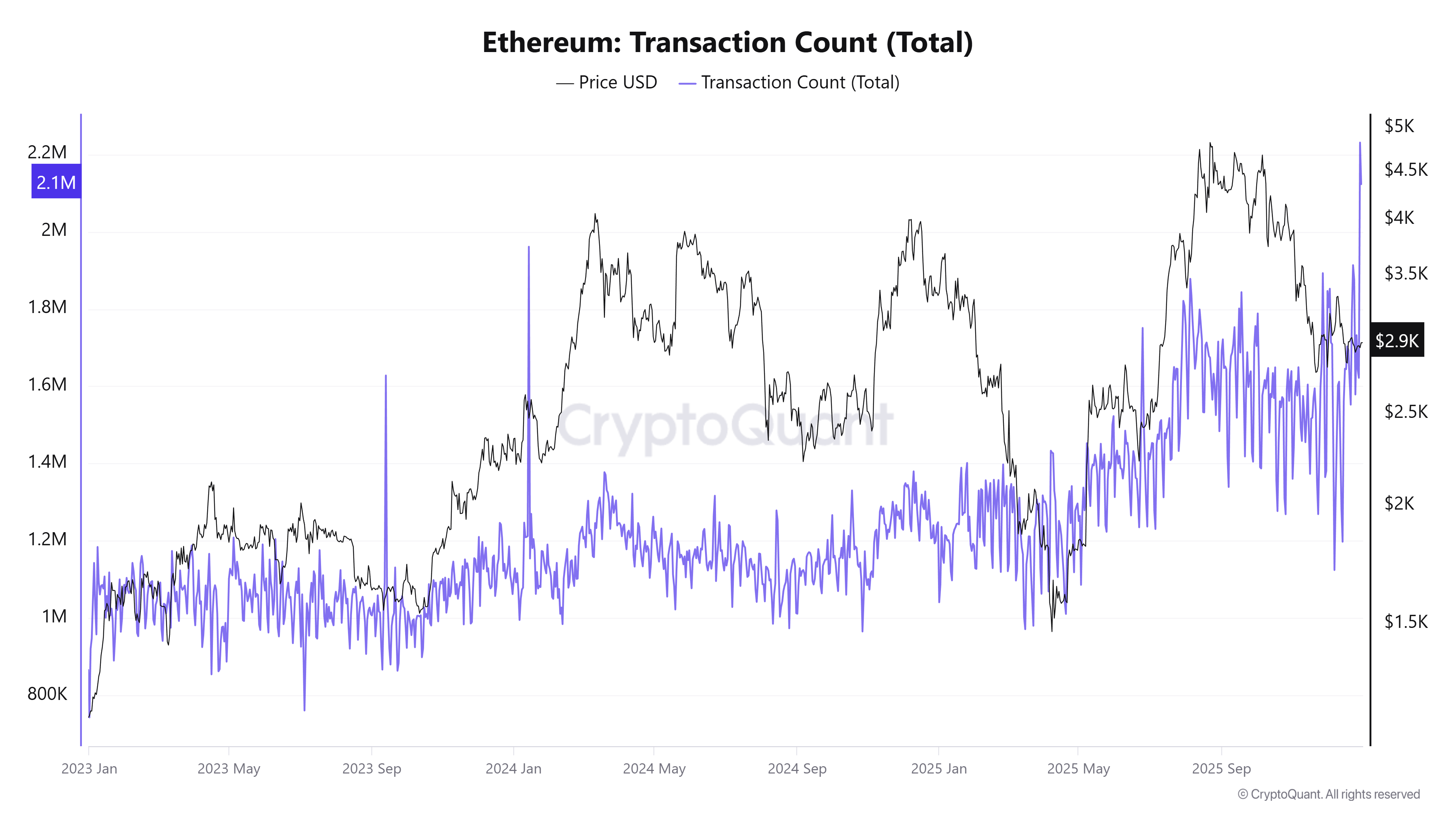

Ethereum transaction numbers surge in December

In response to information from CryptoQuant, the variety of transactions on the Ethereum community spiked on the finish of December. The variety of transactions per day exceeded 2.1 million. This was the very best degree since 2023.

That is additionally a file quantity for the previous 10 years, based on EtherScan information.

Variety of Ethereum transactions (complete). Supply: CryptoQuant

Notably, this surge occurred regardless of a major correction in ETH above $4,500 to round $2,900. This information highlights a transparent disconnect between value actions and on-chain utilization.

This spike may additionally replicate large-scale ETH circulation. This implies that holders might have a selected technique in place.

“Ethereum processed 2,230,801 transactions in in the future, the very best in its 10-year historical past. Charges have been lower than $0.01. Finality was secure. No congestion, no drama. After years of scaling efforts, utilization is returning to L1. Efficiency is bringing customers house,” commented investor BMNR Bullz.

Evaluation by CryptoQuant authors means that such spikes are an indication of panic promoting after they seem throughout a downtrend. Nevertheless, they replicate ETH’s development potential if supported by constructive fundamentals.

Even when the sign is impartial, it might nonetheless tilt positively. Two extra indicators assist this view.

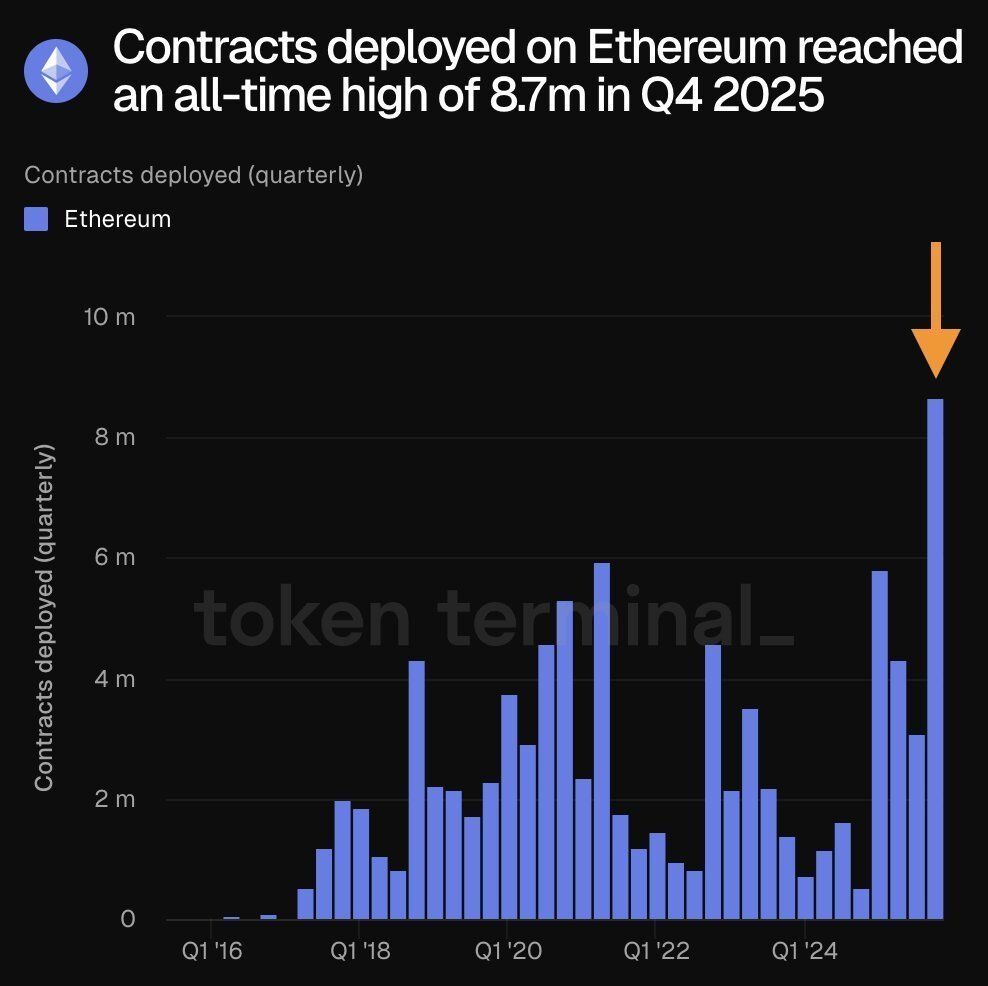

First, the variety of sensible contracts deployed on Ethereum has reached an all-time excessive. In This autumn 2025, greater than 8.7 million new contracts have been deployed. This was the very best degree ever recorded.

The contract will likely be deployed to Ethereum in This autumn 2025. Supply: Token Terminal

This quantity is considerably greater than final quarter and exhibits robust growth of the ecosystem. This additionally helps clarify the rising demand for ETH transfers.

Builders are more and more utilizing Ethereum as a fee layer. Progress will likely be pushed by real-world asset tokenization (RWA), stablecoin exercise, and core infrastructure growth.

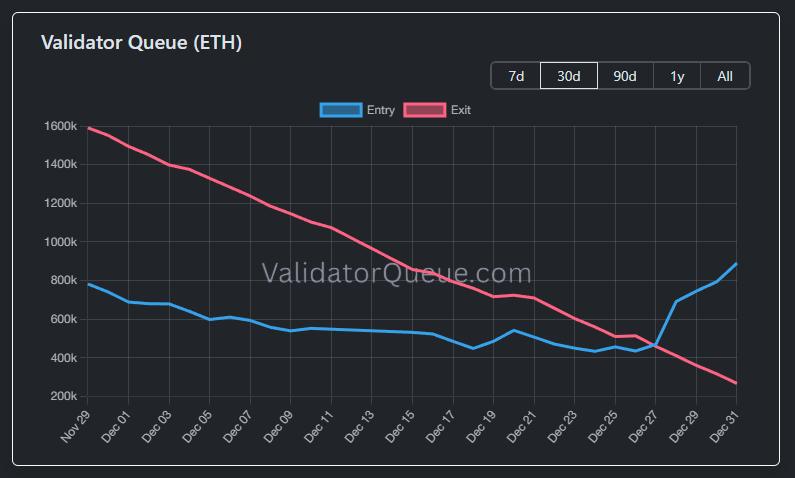

The second issue is the rise in ETH within the staking queue. On the final day of December, the validator entry queue continued to develop, with a complete of 890,000 ETH within the queue. Bitmine’s ETH staking exercise might have accelerated this surge.

Validator Queue (ETH). Supply: Validator Queue

The rise in ETH getting into the staking queue coincided with an irregular improve in community switch quantity. This timing additional explains the noticed surge.

Regardless of these constructive on-chain indicators, ETH value continues to be caught close to the $3,000 degree. BeInCrypto’s latest evaluation means that ETH is forming a bearish setup, coupled with promoting stress from US-based traders.

The put up An uncommon spike in Ethereum community exercise – What does it imply for ETH value? appeared first on BeInCrypto.