Cryptocurrencies have maintained regular upward momentum in latest weeks. Institutional demand and short-term liquidation-related inflows contributed to the latest consolidation above $90,000. Analysts be aware that rising lows and constant ETF inflows help a cautiously bullish framework for Bitcoin’s near-term outlook.

BTC stays agency close to main resistances

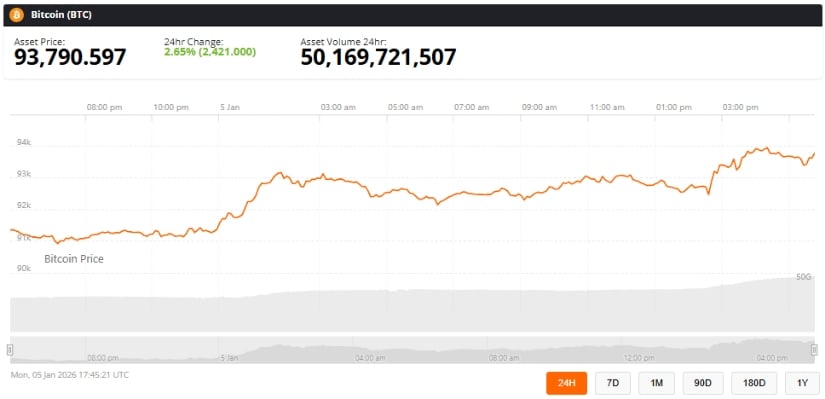

Bitcoin is up 2.65% up to now 24 hours, buying and selling close to $93,790 and coming into a key resistance space close to $94,000. Analyst Ted (@TedPillows) emphasised that “a day by day shut above the $94,000 degree will increase the chance of a transfer in direction of $100,000,” whereas warning {that a} rejection at this degree might end in a return to the $90,000 help.

BTC exams main resistance. An in depth above $94,000 might push Bitcoin in direction of $100,000, and if rejected, it might re-attempt the $90,000 help. Supply: @TedPillows by way of X

Traditionally, short-term consolidation on this vary, particularly after ETF inflows or a currency-driven brief squeeze, has generally led to multi-week rallies, however remoted short-covering occasions can create non permanent spikes that rapidly dissipate. Due to this fact, merchants monitoring Bitcoin should distinguish between structural demand and non permanent reflex flows.

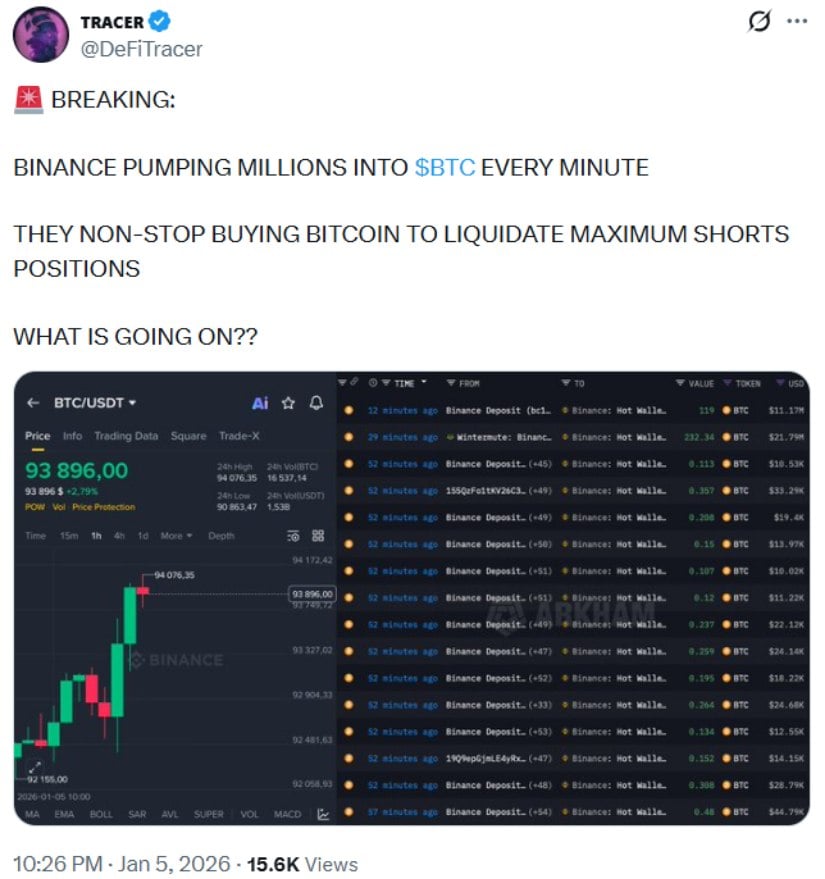

Binance flows and clearing actions

Latest information from Arkham Intelligence reveals a number of high-value BTC transfers to Binance scorching wallets, together with 119 BTC ($11.17 million) and 232 BTC ($21.79 million). These actions could replicate clearing-related exercise reasonably than voluntary purchases by the change itself.

Binance expects a big inflow of BTC as short-term liquidation purchases drive market momentum. Supply: @DeFiTracer by way of X

Whereas these inflows might speed up upward momentum, comparable inflows up to now have additionally created short-term volatility reasonably than sustained upside. Due to this fact, observers ought to interpret these trades as contributing to market dynamics reasonably than as specific bullish alerts.

Technical evaluation helps conditional upside

In accordance with TradingView analyst DeGRAM, BTC/USD just lately broke above descending resistance after an prolonged interval of symmetrical triangular consolidation. “The breakout above the descending resistance confirms the bullish momentum, and the upper lows are holding according to the supporting upward development line,” de Gramm mentioned.

BTC has damaged out of the symmetrical triangle, supported by institutional demand and ETF inflows, with help at $95,000-$98,000 and a goal of $90,000-$92,000. Supply: DeGRAM TradingView

- Goal vary: $95,000-$98,000

- Main help: $90,000 to $92,000

Nevertheless, technical validation requires affirmation. If the amount continues and the value closes above $94,000 for the day, our bullish view will strengthen. Conversely, a big breakdown beneath $90,000 might override the present configuration and set off a deeper integration section.

closing ideas

The near-term outlook for Bitcoin stays cautiously bullish, supported by structural demand from ETFs and institutional traders, in addition to technical proof of rising help ranges. Merchants must be looking out for affirmation alerts resembling a day by day shut above $94,000 with above-average quantity, in addition to key threat ranges resembling help close to $90,000-$92,000 and resistance close to $94,000.

On the time of writing, Bitcoin was buying and selling round 93,790, up 2.65% up to now 24 hours. Supply: Bitcoin worth by way of Courageous New Coin

Understanding the affect of ETF inflows, structural and reflex flows, and macroeconomic indicators such because the US ISM Manufacturing report is crucial in decoding short-term worth traits.

Whereas the $100,000 goal is noteworthy beneath present situations, a possible draw back continues to be conceivable if breakout situations fail or macroeconomic pressures weigh on threat belongings. Monitoring flows, worth construction, and buying and selling habits can be essential in assessing Bitcoin’s trajectory within the coming weeks, serving to traders distinguish between sustained momentum and non permanent volatility.