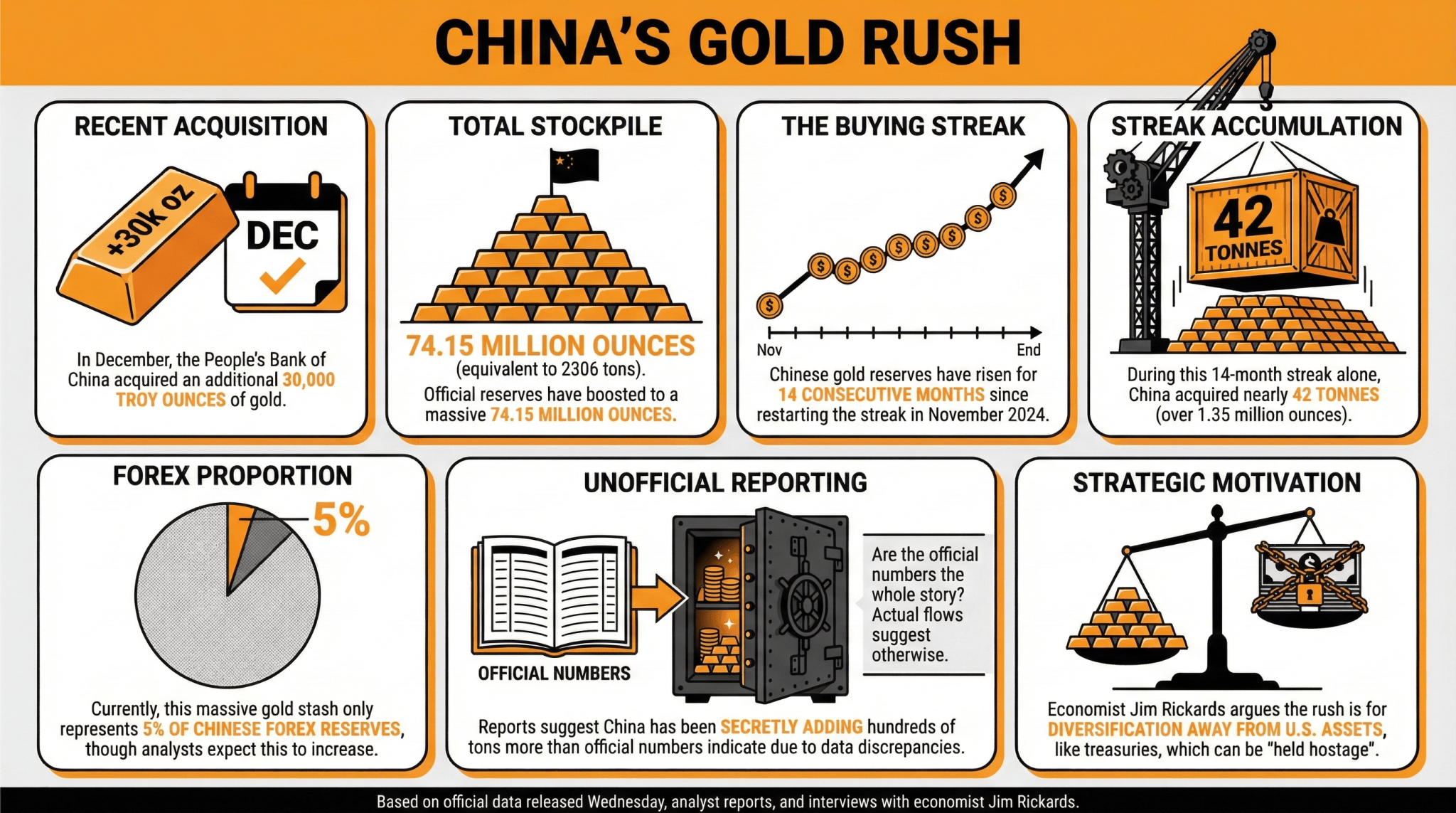

The Individuals’s Financial institution of China acquired 30,000 troy ounces of gold in December, extending its gold purchases for 14 consecutive months, in accordance with official figures. China has one of many largest gold reserves, formally holding over 74 million troy ounces of the valuable metallic.

China strengthens gold purchases, continues buying for 14 consecutive months

China continues its gold rush, buying much more gold in December.

The Individuals’s Financial institution of China acquired 30,000 troy ounces of gold in December, rising reserves to 74.15 million ounces (2,306 tonnes), in accordance with official information launched on Wednesday. That is the 14th month that China’s gold reserves have elevated, a development for the central financial institution.

China’s gold reserves have been constantly rising since November 2024, when China resumed shopping for after a brief interval. Throughout this streak, China acquired roughly 42 tonnes (over 1.35 million ounces) of gold.

Nonetheless, gold held by China solely accounts for five% of China’s international change reserves, and analysts argue that this proportion may enhance additional because the nation seeks to hedge a number of elements.

Nonetheless, there are discrepancies between these numbers and precise flows, with experiences suggesting that China is secretly including tons of of tonnes greater than official numbers.

Legendary economist Jim Rickards stated in a latest interview that one of many primary causes for the central financial institution gold rush and the general worth enhance within the gold and silver market is the necessity for diversification from U.S.-related property resembling authorities bonds that could possibly be held hostage by the U.S. authorities.

That is according to latest efforts to divest from US debt and internationalize the renminbi, together with a digital model on this equation.

The present state of affairs in Venezuela may speed up this course of, as geopolitical tensions strengthen using gold as a hedge towards geopolitical dangers, monetary instability, and the weaponization of the US greenback.

learn extra: Jim Rickards’ Explosive Prediction: Gold to $10,000, Silver to $200 in 2026

FAQ

- How a lot gold did China purchase in December?

Acquired by Individuals’s Financial institution of China in December 30,000 troy ounces of goldenhance reserves 74.15 million ounces (2,306 tons). - How a lot does China proceed to extend its gold reserves?

China’s gold reserves are rising 14 consecutive monthsresumes the buying streak that started in November 2024. - What share of China’s gold reserves account for its international change reserves?

China’s gold reserves are roughly 5% of international change reservesAnalysts anticipate this quantity to extend because the nation diversifies. - In response to consultants, what are the elements driving China’s gold rush?

Economists cite the necessity for diversification. US associated property And geopolitical tensions are the primary motive for the push to gold as a hedge.