Former Binance CEO Qiao Changpeng (CZ) lately stated that the UAE generates surplus electrical energy to fulfill “three days” of excessive demand annually, making Bitcoin the final purchaser of vitality that will go unused.

Stripping away the main points, the logic holds that mining turns curtailed or pent-up energy into income when different off-takers don’t desire it.

The query in 2026 is just not whether or not the excess may be mined, however whether or not that surplus is structural sufficient to shrink, and whether or not miners can preserve their place as AI and high-performance computing drive up the clearing value of agency provide.

Economics is easy. In response to the Cambridge Digital Mining Business Report, electrical energy accounts for greater than 80% of miners’ money working bills.

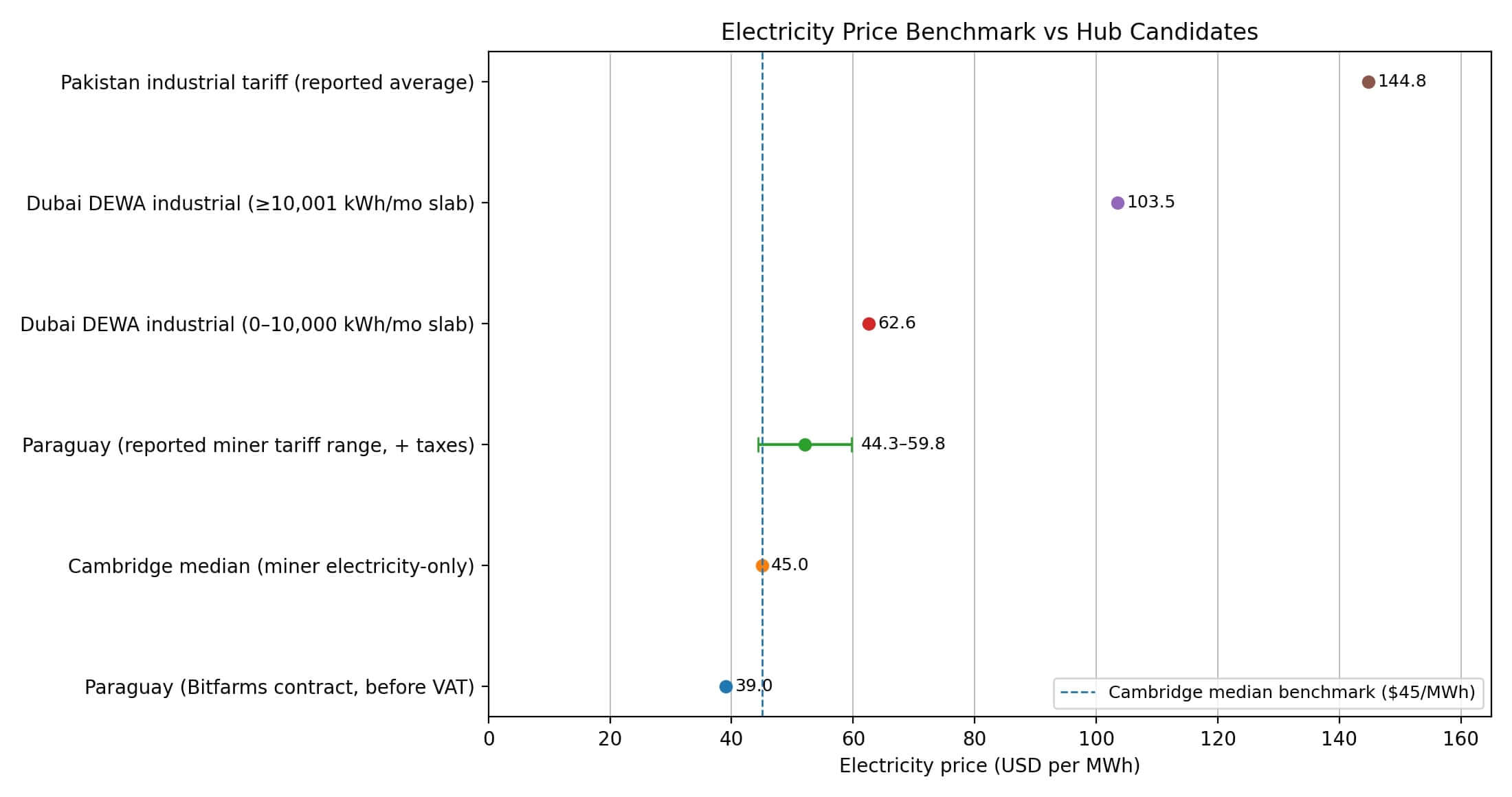

The report notes that the median electricity-only value is about $45 per megawatt-hour, and notes that surveyed miners shed 888 gigawatt-hours of load in 2023, which equates to about 101 megawatts of common pendency capability.

This discount determine helps the versatile load principle. Meaning miners can flip off energy if the grid wants reduction or costs spike, serving to energy corporations handle intermittency and congestion.

Geography tells the remainder. Although an imperfect methodology, Cambridge’s Bitcoin Energy Consumption Index Mining Map tracks the place hashrate is concentrated, however there are caveats to the information, together with a one- to three-month lag in predictions and the potential for VPNs and proxy routing to drive up the share of nations reminiscent of Germany and Eire.

Nation attribution will depend on the geolocation of the IP deal with. This can be a methodology that’s delicate to routing conduct and topic to different inference limitations.

Inside these constraints, this map exhibits mining distributed throughout jurisdictions, however with one factor in widespread: It is entry to low-cost energy, stranded energy, or each.

Pakistan turns extra capability into coverage

Pakistan made the obvious guess. The federal government has introduced plans to allocate 2,000 megawatts within the first part of a nationwide initiative to be break up into Bitcoin mining and AI information facilities, and CZ has been appointed as strategic advisor to the Pakistan Crypto Council.

The Treasury framed this as a option to monetize surplus technology in energy-surplus areas and switch underutilized capability into tradable belongings.

Steady operation of two,000 megawatts produces 17.52 terawatt-hours of electrical energy per 12 months. Trendy mining fleets function at 15 to 25 joules per terahash, and their energy can theoretically assist hashrates of 80 to 133 exahashes per second earlier than contemplating reductions, energy utilization effectivity, or downtime.

Measurement is just not as essential as construction.

What kind of contracts will miners signal, interruptible baseload or fastened baseload? Which areas will probably be chosen and the way lengthy will the coverage final if tariffs rise or IMF strain will increase?

Pakistan’s imaginative and prescient means that “surplus electrons” may turn out to be a nationwide export, however whether or not the two,000 megawatts materializes as a hub or only a headline will depend on execution.

Surplus by design, not by probability

The UAE’s alternatives will not be eternally in surplus, however they’re in surplus by design.

Dubai’s peak demand reached 10.76 GW in 2024, a rise of three.4% year-on-year, concentrated in the summertime months when cooling accounts for a lot of the load.

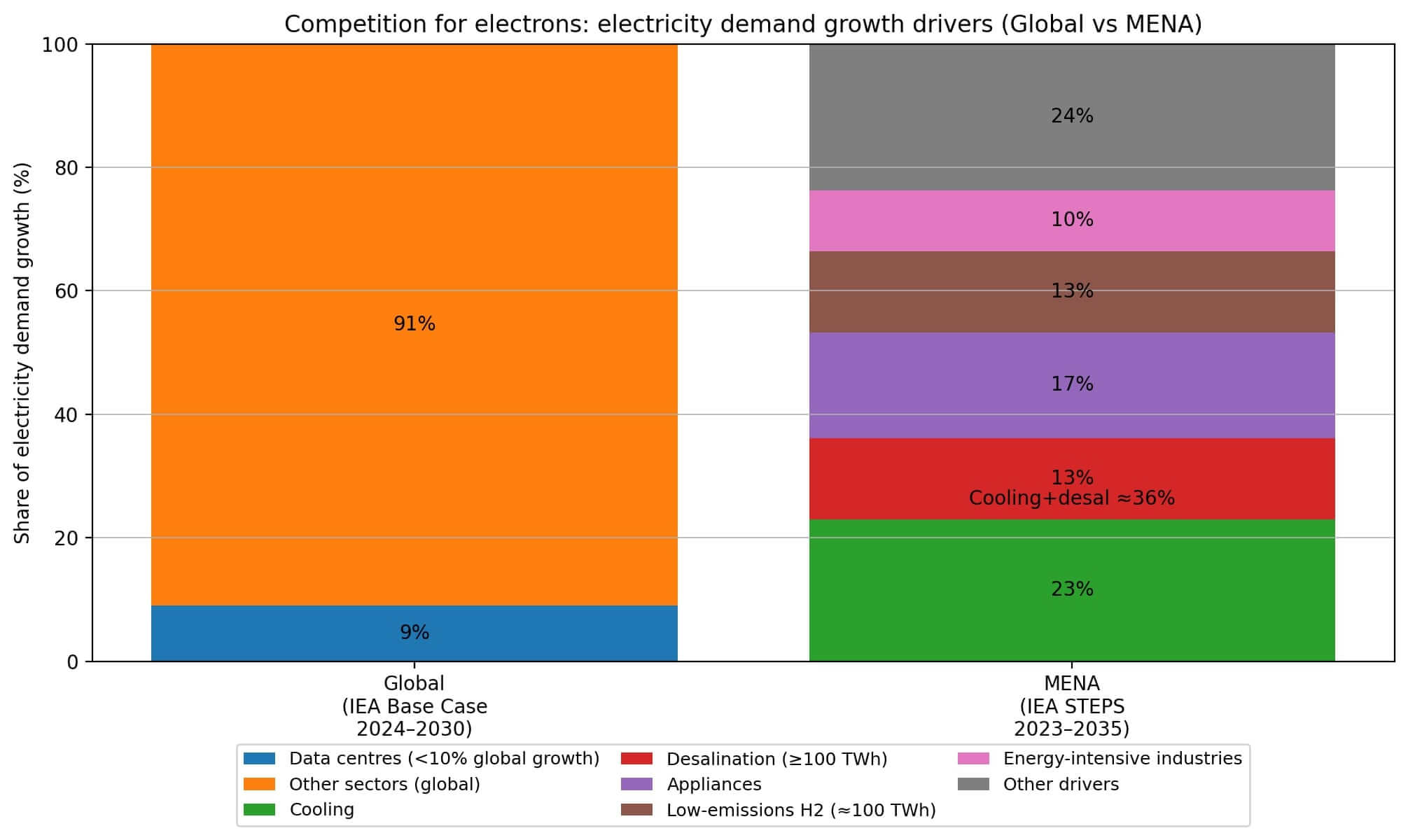

The Worldwide Power Company (IEA) predicts that cooling and desalination will account for practically 40% of electrical energy demand development within the Center East and North Africa by 2035, explicitly naming information facilities as one other rising supply of load.

This creates particular alternatives for miners. Utilities are constructing techniques to deal with summer season peaks, however require year-round monetization, normalization, and off-peak grid stability.

Miners win after they can provide extra flexibility than AI and HPC consumers, reminiscent of curtailment-aware hundreds that soak up energy that others can’t settle for as a result of location, congestion, or dispatch constraints.

Whereas Bitcoin miners may be switched off immediately, information facilities require steady operation, making discount and grid administration way more troublesome.

The area’s ramp-up tendencies favor baseload capability above seasonal demand, however the IEA’s identical outlook marking information facilities as demand drivers means miners face direct competitors for the electrons they want.

The case for hubs will depend upon whether or not there’s sufficient worth for utilities to cost dispatchable hundreds at a lovely value, or whether or not a agency offtake settlement with an AI purchaser will shut out mining altogether.

If a battle for surplus happens

Paraguay exhibits what occurs when surplus electrical energy attracts miners, inflicting a backlash.

The nation’s hydropower capability attracted operators on the lookout for low-cost electrical energy, however charge modifications have come at a price. Miners are actually reportedly paying between $44.34 and $59.76 per megawatt hour in taxes, and native business sources say 35 corporations have ceased operations after the value hike.

Regulation No. 7300 strengthened penalties for energy theft associated to unlawful cryptocurrency mining, growing the utmost penalty to 10 years and authorizing the confiscation of kit.

Regardless of this, actual capital continues to circulate. HIVE has accomplished Section 1 infrastructure of a 100-megawatt facility backed by a completely powered 200-megawatt substation, demonstrating that some operators are contemplating sturdy economics even after repricing.

The strain within the relationship is evident. Hydropower surpluses generate preliminary buyer attraction, however as mining corporations scale up and notice that they’re intensive, taxable off-takers, or when native grid constraints or noise externalities improve political strain, states reprice electrical energy.

Paraguay’s trajectory exhibits how hubs flip when their social license expires, making coverage sturdiness the first variable within the website choice mannequin.

What really makes the hub

Mining hub viability in 2026 will come all the way down to the formulation: supply value per megawatt hour x contract flexibility x coverage sturdiness, measured towards what AI and HPC consumers are keen to pay, grid deficiencies, and overseas alternate and import frictions.

Three situations are developed relating to these variables.

The primary is that the oversupply brought on by restraint will persist. Meaning renewable vitality is added sooner than the grid can soak up it, curtailment will increase, and miners revenue from versatile demand. Hubs are probably to be jurisdictions with weak transmission, hydropower or seasonal surpluses, reminiscent of Paraguay, or nations that explicitly monetize extra capability, reminiscent of Pakistan.

Within the second, AI competes for energy with firms over miners. Information facilities require long-term, secure provide, leaving miners liable to interruptions, congestion, and stranded conditions. Hubs will emerge the place miners can entry interruptible pricing and “non-exportable” vitality, slightly than the capabilities of main corporations.

Within the third, political retribution and backlash change the sport. As miners increase in dimension or create shortages or noise at residence, governments elevate charges. Paraguay is the template. The hub is turned the other way up when the economics that attracted the miners are recalibrated by the identical state that constructed them.

The IEA framework is essential right here. International electrical energy demand is predicted to develop at roughly 4% yearly till 2027, pushed by industrial manufacturing, air con, electrification, and information facilities.

Renewable vitality capability additions are accelerating, however grid integration has been gradual. This delay creates throttling and congestion that miners can monetize, however it additionally implies that surplus is a shifting goal.

The hubs that survive till 2026 is not going to solely be in jurisdictions the place energy is affordable, but in addition the place energy cuts and congestion are prone to persist, the place rules permit mining as a dispatchable load, and the place miners can compete with or complement AI and HPC for electrons.

guidelines

Six variables decide whether or not a jurisdiction turns into a mining hub or only a headliner.

The excess kind is the primary. Is it hydro seasonality, stranded fuel, flaring mitigation, or off-peak nuclear baseload? Every has totally different persistence and shrinkage.

Supply value and contract construction comply with because the second variables. What’s the whole value per megawatt hour? Additionally, is the contract breakable? Who bears the congestion threat and is there any compensation for congestion?

Subsequent, ASIC import and logistics are essential, reminiscent of customs duties, transportation lanes, spare elements availability, and capital administration, all of which impression speed-to-market and operational threat.

Coverage sturdiness is the fourth variable. Price revision threat, licensing necessities, shock bans, and theft crackdowns will decide whether or not a hub stays a hub.

Local weather, cooling and water additionally play a task. Air cooling limitations, immersion feasibility, and warmth and noise externalities restrict the place large-scale operations may be carried out with out frightening native opposition.

The ultimate variable is offtake competitors. Development in demand for AI and HPC is now clearly mirrored in energy demand forecasts. Hubs have to anticipate competitors not just for low-cost electrons but in addition for “good electrons.”

Pakistan’s 2,000 MW plan is the clearest indication that the federal government sees surplus electrical energy as an exportable asset class and mining as one technique of monetizing it.

Whether or not that path results in the subsequent main hub in 2026 will depend upon execution, together with contract phrases, website choice, and whether or not political agreements maintain as miners start consuming gigawatt hours at scale.

CZ’s principle about Bitcoin as the client of final resort is right in precept. The observe is much more troubling, counting on energy grids that may’t soak up renewable vitality quick sufficient, states that permit versatile hundreds, and miners that may stay aggressive as information facilities drive up the value of secure energy.

The websites that emerge will probably be those who have had these situations in place lengthy sufficient to construct infrastructure and enter into contracts that can survive the primary charge modifications and the primary summer season energy outages.